Reply SpA

Reply SpA

Reply SpA

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Income statement<br />

Statement of comprehensive income<br />

Statement of financial position<br />

Statement of changes in equity<br />

Statement of cash flows<br />

Notes to the financial statements<br />

Annexed tables<br />

<br />

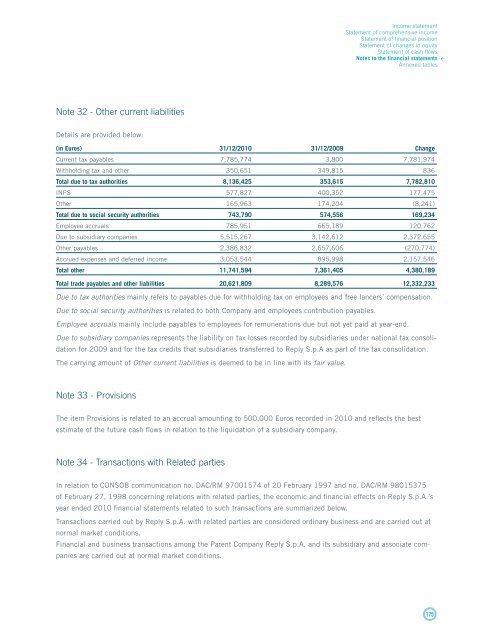

Note 32 - Other current liabilities<br />

Details are provided below:<br />

(in Euros) 31/12/2010 31/12/2009 Change<br />

Current tax payables 7,785,774 3,800 7,781,974<br />

Withholding tax and other 350,651 349,815 836<br />

Total due to tax authorities 8,136,425 353,615 7,782,810<br />

INPS 577,827 400,352 177,475<br />

Other 165,963 174,204 (8,241)<br />

Total due to social security authorities 743,790 574,556 169,234<br />

Employee accruals 785,951 665,189 120,762<br />

Due to subsidiary companies 5,515,267 3,142,612 2,372,655<br />

Other payables 2,386,832 2,657,606 (270,774)<br />

Accrued expenses and deferred income 3,053,544 895,998 2,157,546<br />

Total other 11,741,594 7,361,405 4,380,189<br />

Total trade payables and other liabilities 20,621,809 8,289,576 12,332,233<br />

Due to tax authorities mainly refers to payables due for withholding tax on employees and free lancers’ compensation.<br />

Due to social security authorities is related to both Company and employees contribution payables.<br />

Employee accruals mainly include payables to employees for remunerations due but not yet paid at year-end.<br />

Due to subsidiary companies represents the liability on tax losses recorded by subsidiaries under national tax consolidation<br />

for 2009 and for the tax credits that subsidiaries transferred to <strong>Reply</strong> S.p.A as part of the tax consolidation.<br />

The carrying amount of Other current liabilities is deemed to be in line with its fair value.<br />

Note 33 - Provisions<br />

The item Provisions is related to an accrual amounting to 500,000 Euros recorded in 2010 and reflects the best<br />

estimate of the future cash flows in relation to the liquidation of a subsidiary company.<br />

Note 34 - Transactions with Related parties<br />

In relation to CONSOB communication no. DAC/RM 97001574 of 20 February 1997 and no. DAC/RM 98015375<br />

of February 27, 1998 concerning relations with related parties, the economic and financial effects on <strong>Reply</strong> S.p.A.’s<br />

year ended 2010 financial statements related to such transactions are summarized below.<br />

Transactions carried out by <strong>Reply</strong> S.p.A. with related parties are considered ordinary business and are carried out at<br />

normal market conditions.<br />

Financial and business transactions among the Parent Company <strong>Reply</strong> S.p.A. and its subsidiary and associate companies<br />

are carried out at normal market conditions.<br />

175