Reply SpA

Reply SpA

Reply SpA

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Income statement<br />

Statement of comprehensive income<br />

Statement of financial position<br />

Statement of changes in equity<br />

Statement of cash flows<br />

Notes to the financial statements<br />

Annexed tables<br />

<br />

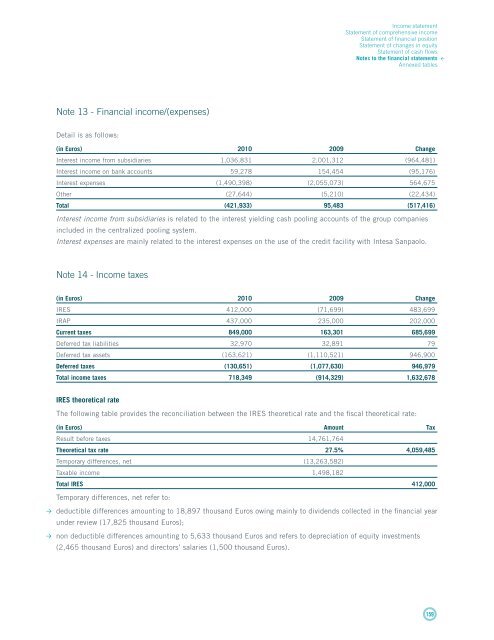

Note 13 - Financial income/(expenses)<br />

Detail is as follows:<br />

(in Euros) 2010 2009 Change<br />

Interest income from subsidiaries 1,036,831 2,001,312 (964,481)<br />

Interest income on bank accounts 59,278 154,454 (95,176)<br />

Interest expenses (1,490,398) (2,055,073) 564,675<br />

Other (27,644) (5,210) (22,434)<br />

Total (421,933) 95,483 (517,416)<br />

Interest income from subsidiaries is related to the interest yielding cash pooling accounts of the group companies<br />

included in the centralized pooling system.<br />

Interest expenses are mainly related to the interest expenses on the use of the credit facility with Intesa Sanpaolo.<br />

Note 14 - Income taxes<br />

(in Euros) 2010 2009 Change<br />

IRES 412,000 (71,699) 483,699<br />

IRAP 437,000 235,000 202,000<br />

Current taxes 849,000 163,301 685,699<br />

Deferred tax liabilities 32,970 32,891 79<br />

Deferred tax assets (163,621) (1,110,521) 946,900<br />

Deferred taxes (130,651) (1,077,630) 946,979<br />

Total income taxes 718,349 (914,329) 1,632,678<br />

IRES theoretical rate<br />

The following table provides the reconciliation between the IRES theoretical rate and the fiscal theoretical rate:<br />

(in Euros) Amount Tax<br />

Result before taxes 14,761,764<br />

Theoretical tax rate 27.5% 4,059,485<br />

Temporary differences, net (13,263,582)<br />

Taxable income 1,498,182<br />

Total IRES 412,000<br />

Temporary differences, net refer to:<br />

deductible differences amounting to 18,897 thousand Euros owing mainly to dividends collected in the financial year<br />

under review (17,825 thousand Euros);<br />

non deductible differences amounting to 5,633 thousand Euros and refers to depreciation of equity investments<br />

(2,465 thousand Euros) and directors’ salaries (1,500 thousand Euros).<br />

159