Reply SpA

Reply SpA

Reply SpA

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Income statement<br />

Statement of comprehensive income<br />

Statement of financial position<br />

Statement of changes in equity<br />

Statement of cash flows<br />

Notes to the financial statements<br />

Annexed tables<br />

<br />

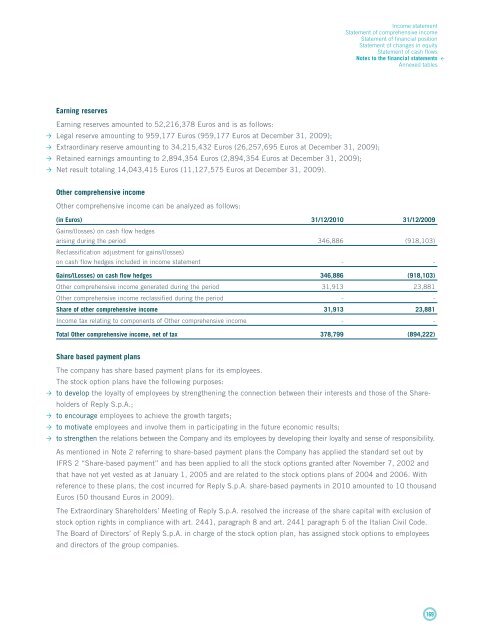

Earning reserves<br />

Earning reserves amounted to 52,216,378 Euros and is as follows:<br />

Legal reserve amounting to 959,177 Euros (959,177 Euros at December 31, 2009);<br />

Extraordinary reserve amounting to 34,215,432 Euros (26,257,695 Euros at December 31, 2009);<br />

Retained earnings amounting to 2,894,354 Euros (2,894,354 Euros at December 31, 2009);<br />

Net result totaling 14,043,415 Euros (11,127,575 Euros at December 31, 2009).<br />

Other comprehensive income<br />

Other comprehensive income can be analyzed as follows:<br />

(in Euros) 31/12/2010 31/12/2009<br />

Gains/(losses) on cash flow hedges<br />

arising during the period 346,886 (918,103)<br />

Reclassification adjustment for gains/(losses)<br />

on cash flow hedges included in income statement - -<br />

Gains/(Losses) on cash flow hedges 346,886 (918,103)<br />

Other comprehensive income generated during the period 31,913 23,881<br />

Other comprehensive income reclassified during the period - -<br />

Share of other comprehensive income 31,913 23,881<br />

Income tax relating to components of Other comprehensive income - -<br />

Total Other comprehensive income, net of tax 378,799 (894,222)<br />

Share based payment plans<br />

The company has share based payment plans for its employees.<br />

The stock option plans have the following purposes:<br />

to develop the loyalty of employees by strengthening the connection between their interests and those of the Shareholders<br />

of <strong>Reply</strong> S.p.A.;<br />

to encourage employees to achieve the growth targets;<br />

to motivate employees and involve them in participating in the future economic results;<br />

to strengthen the relations between the Company and its employees by developing their loyalty and sense of responsibility.<br />

As mentioned in Note 2 referring to share-based payment plans the Company has applied the standard set out by<br />

IFRS 2 “Share-based payment” and has been applied to all the stock options granted after November 7, 2002 and<br />

that have not yet vested as at January 1, 2005 and are related to the stock options plans of 2004 and 2006. With<br />

reference to these plans, the cost incurred for <strong>Reply</strong> S.p.A. share-based payments in 2010 amounted to 10 thousand<br />

Euros (50 thousand Euros in 2009).<br />

The Extraordinary Shareholders’ Meeting of <strong>Reply</strong> S.p.A. resolved the increase of the share capital with exclusion of<br />

stock option rights in compliance with art. 2441, paragraph 8 and art. 2441 paragraph 5 of the Italian Civil Code.<br />

The Board of Directors’ of <strong>Reply</strong> S.p.A. in charge of the stock option plan, has assigned stock options to employees<br />

and directors of the group companies.<br />

169