2009-2010 Bulletin â PDF - SEAS Bulletin - Columbia University

2009-2010 Bulletin â PDF - SEAS Bulletin - Columbia University

2009-2010 Bulletin â PDF - SEAS Bulletin - Columbia University

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

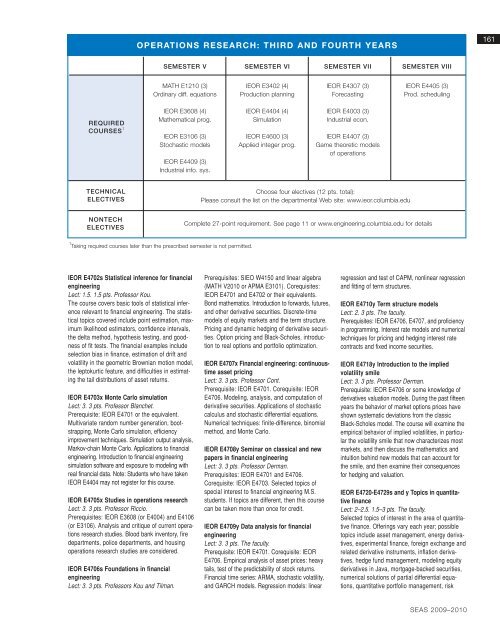

OPERATIONS RESEARCH: THIRD AND FOURTH YEARS<br />

161<br />

SEMESTER V SEMESTER VI SEMESTER VII SEMESTER VIII<br />

MATH E1210 (3) IEOR E3402 (4) IEOR E4307 (3) IEOR E4405 (3)<br />

Ordinary diff. equations Production planning Forecasting Prod. scheduling<br />

REQUIRED<br />

COURSES 1<br />

IEOR E3608 (4) IEOR E4404 (4) IEOR E4003 (3)<br />

Mathematical prog. Simulation Industrial econ.<br />

IEOR E3106 (3) IEOR E4600 (3) IEOR E4407 (3)<br />

Stochastic models Applied integer prog. Game theoretic models<br />

of operations<br />

IEOR E4409 (3)<br />

Industrial info. sys.<br />

TECHNICAL<br />

ELECTIVES<br />

Choose four electives (12 pts. total):<br />

Please consult the list on the departmental Web site: www.ieor.columbia.edu<br />

NONTECH<br />

ELECTIVES<br />

Complete 27-point requirement. See page 11 or www.engineering.columbia.edu for details<br />

1 Taking required courses later than the prescribed semester is not permitted.<br />

IEOR E4702s Statistical inference for financial<br />

engineering<br />

Lect: 1.5. 1.5 pts. Professor Kou.<br />

The course covers basic tools of statistical inference<br />

relevant to financial engineering. The statistical<br />

topics covered include point estimation, maximum<br />

likelihood estimators, confidence intervals,<br />

the delta method, hypothesis testing, and goodness<br />

of fit tests. The financial examples include<br />

selection bias in finance, estimation of drift and<br />

volatility in the geometric Brownian motion model,<br />

the leptokurtic feature, and difficulties in estimating<br />

the tail distributions of asset returns.<br />

IEOR E4703x Monte Carlo simulation<br />

Lect: 3. 3 pts. Professor Blanchet.<br />

Prerequisite: IEOR E4701 or the equivalent.<br />

Multivariate random number generation, bootstrapping,<br />

Monte Carlo simulation, efficiency<br />

improvement techniques. Simulation output analysis,<br />

Markov-chain Monte Carlo. Applications to financial<br />

engineering. Introduction to financial engineering<br />

simulation software and exposure to modeling with<br />

real financial data. Note: Students who have taken<br />

IEOR E4404 may not register for this course.<br />

IEOR E4705x Studies in operations research<br />

Lect: 3. 3 pts. Professor Riccio.<br />

Prerequisites: IEOR E3608 (or E4004) and E4106<br />

(or E3106). Analysis and critique of current operations<br />

research studies. Blood bank inventory, fire<br />

departments, police departments, and housing<br />

operations research studies are considered.<br />

IEOR E4706s Foundations in financial<br />

engineering<br />

Lect: 3. 3 pts. Professors Kou and Tilman.<br />

Prerequisites: SIEO W4150 and linear algebra<br />

(MATH V<strong>2010</strong> or APMA E3101). Corequisites:<br />

IEOR E4701 and E4702 or their equivalents.<br />

Bond mathematics. Introduction to forwards, futures,<br />

and other derivative securities. Discrete-time<br />

models of equity markets and the term structure.<br />

Pricing and dynamic hedging of derivative securities.<br />

Option pricing and Black-Scholes, introduction<br />

to real options and portfolio optimization.<br />

IEOR E4707x Financial engineering: continuoustime<br />

asset pricing<br />

Lect: 3. 3 pts. Professor Cont.<br />

Prerequisite: IEOR E4701. Corequisite: IEOR<br />

E4706. Modeling, analysis, and computation of<br />

derivative securities. Applications of stochastic<br />

calculus and stochastic differential equations.<br />

Numerical techniques: finite-difference, binomial<br />

method, and Monte Carlo.<br />

IEOR E4708y Seminar on classical and new<br />

papers in financial engineering<br />

Lect: 3. 3 pts. Professor Derman.<br />

Prerequisites: IEOR E4701 and E4706.<br />

Corequisite: IEOR E4703. Selected topics of<br />

special interest to financial engineering M.S.<br />

students. If topics are different, then this course<br />

can be taken more than once for credit.<br />

IEOR E4709y Data analysis for financial<br />

engineering<br />

Lect: 3. 3 pts. The faculty.<br />

Prerequisite: IEOR E4701. Corequisite: IEOR<br />

E4706. Empirical analysis of asset prices: heavy<br />

tails, test of the predictability of stock returns.<br />

Financial time series: ARMA, stochastic volatility,<br />

and GARCH models. Regression models: linear<br />

regression and test of CAPM, nonlinear regression<br />

and fitting of term structures.<br />

IEOR E4710y Term structure models<br />

Lect: 2. 3 pts. The faculty.<br />

Prerequisites: IEOR E4706, E4707, and proficiency<br />

in programming. Interest rate models and numerical<br />

techniques for pricing and hedging interest rate<br />

contracts and fixed income securities.<br />

IEOR E4718y Introduction to the implied<br />

volatility smile<br />

Lect: 3. 3 pts. Professor Derman.<br />

Prerequisite: IEOR E4706 or some knowledge of<br />

derivatives valuation models. During the past fifteen<br />

years the behavior of market options prices have<br />

shown systematic deviations from the classic<br />

Black-Scholes model. The course will examine the<br />

empirical behavior of implied volatilities, in particular<br />

the volatility smile that now characterizes most<br />

markets, and then discuss the mathematics and<br />

intuition behind new models that can account for<br />

the smile, and then examine their consequences<br />

for hedging and valuation.<br />

IEOR E4720-E4729s and y Topics in quantitative<br />

finance<br />

Lect: 2–2.5. 1.5–3 pts. The faculty.<br />

Selected topics of interest in the area of quantitative<br />

finance. Offerings vary each year; possible<br />

topics include asset management, energy derivatives,<br />

experimental finance, foreign exchange and<br />

related derivative instruments, inflation derivatives,<br />

hedge fund management, modeling equity<br />

derivatives in Java, mortgage-backed securities,<br />

numerical solutions of partial differential equations,<br />

quantitative portfolio management, risk<br />

<strong>SEAS</strong> <strong>2009</strong>–<strong>2010</strong>