Here - ETDP Seta

Here - ETDP Seta

Here - ETDP Seta

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

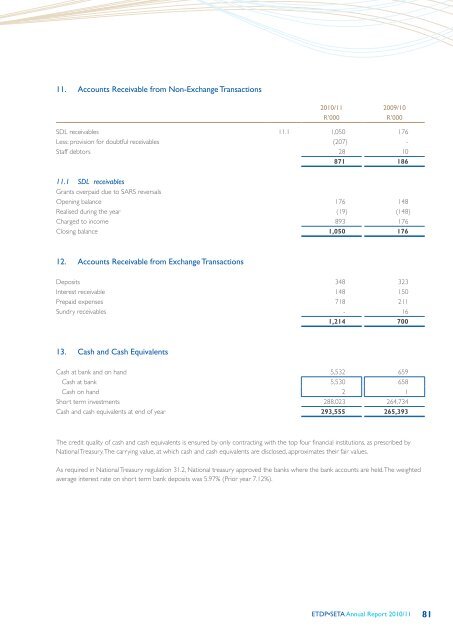

11. Accounts Receivable from Non-Exchange Transactions<br />

2010/11 2009/10<br />

R’000 R’000<br />

SDL receivables 11.1 1,050 176<br />

Less: provision for doubtful receivables (207) -<br />

Staff debtors 28 10<br />

871 186<br />

11.1 SDL receivables<br />

Grants overpaid due to SARS reversals<br />

Opening balance 176 148<br />

Realised during the year (19) (148)<br />

Charged to income 893 176<br />

Closing balance 1,050 176<br />

12. Accounts Receivable from Exchange Transactions<br />

Deposits 348 323<br />

Interest receivable 148 150<br />

Prepaid expenses 718 211<br />

Sundry receivables - 16<br />

1,214 700<br />

13. Cash and Cash Equivalents<br />

Cash at bank and on hand 5,532 659<br />

Cash at bank 5,530 658<br />

Cash on hand 2 1<br />

Short term investments 288,023 264,734<br />

Cash and cash equivalents at end of year 293,555 265,393<br />

The credit quality of cash and cash equivalents is ensured by only contracting with the top four financial institutions, as prescribed by<br />

National Treasury. The carrying value, at which cash and cash equivalents are disclosed, approximates their fair values.<br />

As required in National Treasury regulation 31.2, National treasury approved the banks where the bank accounts are held. The weighted<br />

average interest rate on short term bank deposits was 5.97% (Prior year 7.12%).<br />

<strong>ETDP</strong>•SETA Annual Report 2010/11<br />

81