Albrecht 19.pdf - Marriott School

Albrecht 19.pdf - Marriott School

Albrecht 19.pdf - Marriott School

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

76154_23_ch19_p942-1006.qxd 3/1/07 3:35 PM Page 960<br />

960 Part 6 Control in a Management Accounting System<br />

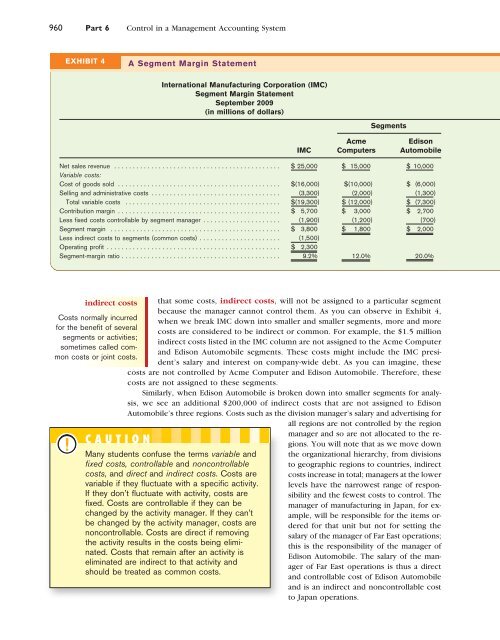

EXHIBIT 4<br />

A Segment Margin Statement<br />

International Manufacturing Corporation (IMC)<br />

Segment Margin Statement<br />

September 2009<br />

(in millions of dollars)<br />

Segments<br />

Acme<br />

Edison<br />

IMC Computers Automobile<br />

Net sales revenue . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 25,000 $ 15,000 $ 10,000<br />

Variable costs:<br />

Cost of goods sold . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $(16,000) $(10,000) $ (6,000)<br />

Selling and administrative costs . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (3,300) (2,000) (1,300)<br />

Total variable costs . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $(19,300) $ (12,000) $ (7,300)<br />

Contribution margin . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 5,700 $ 3,000 $ 2,700<br />

Less fixed costs controllable by segment manager . . . . . . . . . . . . . . . . . . . . . (1,900) (1,200) (700)<br />

Segment margin . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 3,800 $ 1,800 $ 2,000<br />

Less indirect costs to segments (common costs) . . . . . . . . . . . . . . . . . . . . . . (1,500)<br />

Operating profit . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 2,300<br />

Segment-margin ratio . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 9.2% 12.0% 20.0%<br />

indirect costs<br />

Costs normally incurred<br />

for the benefit of several<br />

segments or activities;<br />

sometimes called common<br />

costs or joint costs.<br />

CAUTION<br />

that some costs, indirect costs, will not be assigned to a particular segment<br />

because the manager cannot control them. As you can observe in Exhibit 4,<br />

when we break IMC down into smaller and smaller segments, more and more<br />

costs are considered to be indirect or common. For example, the $1.5 million<br />

indirect costs listed in the IMC column are not assigned to the Acme Computer<br />

and Edison Automobile segments. These costs might include the IMC president’s<br />

salary and interest on company-wide debt. As you can imagine, these<br />

costs are not controlled by Acme Computer and Edison Automobile. Therefore, these<br />

costs are not assigned to these segments.<br />

Similarly, when Edison Automobile is broken down into smaller segments for analysis,<br />

we see an additional $200,000 of indirect costs that are not assigned to Edison<br />

Automobile’s three regions. Costs such as the division manager’s salary and advertising for<br />

all regions are not controlled by the region<br />

Many students confuse the terms variable and<br />

fixed costs, controllable and noncontrollable<br />

costs, and direct and indirect costs. Costs are<br />

variable if they fluctuate with a specific activity.<br />

If they don’t fluctuate with activity, costs are<br />

fixed. Costs are controllable if they can be<br />

changed by the activity manager. If they can’t<br />

be changed by the activity manager, costs are<br />

noncontrollable. Costs are direct if removing<br />

the activity results in the costs being eliminated.<br />

Costs that remain after an activity is<br />

eliminated are indirect to that activity and<br />

should be treated as common costs.<br />

manager and so are not allocated to the regions.<br />

You will note that as we move down<br />

the organizational hierarchy, from divisions<br />

to geographic regions to countries, indirect<br />

costs increase in total; managers at the lower<br />

levels have the narrowest range of responsibility<br />

and the fewest costs to control. The<br />

manager of manufacturing in Japan, for example,<br />

will be responsible for the items ordered<br />

for that unit but not for setting the<br />

salary of the manager of Far East operations;<br />

this is the responsibility of the manager of<br />

Edison Automobile. The salary of the manager<br />

of Far East operations is thus a direct<br />

and controllable cost of Edison Automobile<br />

and is an indirect and noncontrollable cost<br />

to Japan operations.