Albrecht 19.pdf - Marriott School

Albrecht 19.pdf - Marriott School

Albrecht 19.pdf - Marriott School

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

76154_23_ch19_p942-1006.qxd 3/1/07 3:35 PM Page 968<br />

968 Part 6 Control in a Management Accounting System | EM<br />

Compute and<br />

interpret variable<br />

overhead cost<br />

variances. 5<br />

Variable Manufacturing Overhead<br />

Variances in Cost Centers<br />

Manufacturing overhead is the third type of product cost that must be controlled<br />

and accounted for. In this section we will cover variable overhead. Fixed overhead<br />

will be covered in the next section.<br />

Measuring and Controlling Variable Manufacturing<br />

Overhead Costs<br />

Variable manufacturing overhead includes such costs as indirect materials, indirect<br />

labor, utilities, and repairs and maintenance. Like direct materials and direct labor,<br />

variable manufacturing overhead is measured and controlled by establishing standard<br />

costs, measuring actual costs, analyzing variances from standard, and reporting the variances<br />

to managers so they can take necessary corrective action.<br />

Identifying Variable Overhead Elements, Cost Drivers, and Per-Unit Costs<br />

The first step in controlling variable manufacturing overhead is to study the behavior of each<br />

overhead cost to determine whether it is fixed, variable, or mixed. 7 The second step is to<br />

identify a cost driver for each variable manufacturing overhead element that relates the variable<br />

manufacturing overhead cost to specific activities or volume changes. For simplicity in<br />

illustrating variable overhead variances, we will assume that variable manufacturing overhead<br />

costs vary with direct labor hours. However, you should be aware that, where possible,<br />

costs are assigned to activities based on cost drivers that reflect the actual usage of costs<br />

for each activity. Thus, instead of using one cost driver, such as direct labor hours, a company<br />

might identify different cost drivers for each type of variable overhead cost. 8<br />

To illustrate the calculation of variable manufacturing cost variances using direct labor<br />

hours as the cost driver, we will return again to our Sunbird Boat Company example.<br />

Assume for Sunbird that direct labor hours worked fluctuate between 7,000 and 9,000<br />

hours each year. At the beginning of the year, Sunbird’s management team and accountants<br />

analyzed the company’s cost behavior patterns over this relevant range to create an<br />

annual budget. Based on their sales budget, they also established a production budget to<br />

produce 105 15-foot boats. 9 As you recall from its standard costs (Exhibit 3 on page 950),<br />

Sunbird allows 80 standard direct labor hours for each 15-foot boat produced. This means<br />

that 8,400 direct labor hours (105 boats 80 standard hours) were originally forecasted<br />

to be used in the current year. These data were then used to establish standard variable<br />

manufacturing overhead rates as shown below.<br />

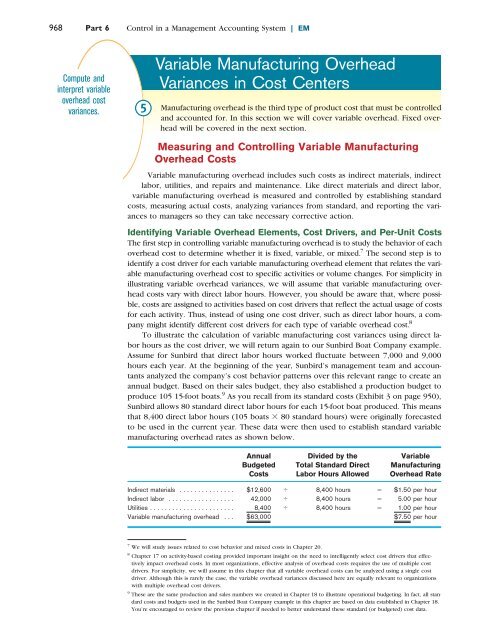

Annual Divided by the Variable<br />

Budgeted Total Standard Direct Manufacturing<br />

Costs Labor Hours Allowed Overhead Rate<br />

Indirect materials . . . . . . . . . . . . . . . $12,600 8,400 hours $1.50 per hour<br />

Indirect labor . . . . . . . . . . . . . . . . . . 42,000 8,400 hours 5.00 per hour<br />

Utilities . . . . . . . . . . . . . . . . . . . . . . . 8,400 8,400 hours 1.00 per hour<br />

Variable manufacturing overhead . . . $63,000 $7.50 per hour<br />

7 We will study issues related to cost behavior and mixed costs in Chapter 20.<br />

8 Chapter 17 on activity-based costing provided important insight on the need to intelligently select cost drivers that effectively<br />

impact overhead costs. In most organizations, effective analysis of overhead costs requires the use of multiple cost<br />

drivers. For simplicity, we will assume in this chapter that all variable overhead costs can be analyzed using a single cost<br />

driver. Although this is rarely the case, the variable overhead variances discussed here are equally relevant to organizations<br />

with multiple overhead cost drivers.<br />

9 These are the same production and sales numbers we created in Chapter 18 to illustrate operational budgeting. In fact, all standard<br />

costs and budgets used in the Sunbird Boat Company example in this chapter are based on data established in Chapter 18.<br />

You’re encouraged to review the previous chapter if needed to better understand these standard (or budgeted) cost data.