Albrecht 19.pdf - Marriott School

Albrecht 19.pdf - Marriott School

Albrecht 19.pdf - Marriott School

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

76154_23_ch19_p942-1006.qxd 3/1/07 3:35 PM Page 972<br />

972 Part 6 Control in a Management Accounting System | EM<br />

Compute and<br />

interpret fixed<br />

overhead cost<br />

variances. 6<br />

Fixed Manufacturing Overhead<br />

Variances in Cost Centers<br />

The final product cost to control is fixed manufacturing overhead. Fixed manufacturing<br />

overhead includes such costs as rent, insurance, depreciation, staff and<br />

supervisor salaries, and property taxes. This cost is unique among the product<br />

costs. Because direct materials and direct labor are generally characterized as<br />

variable costs similar to variable manufacturing overhead, the process of “controlling”<br />

fixed manufacturing overhead is different from the other costs we’ve<br />

studied in this chapter. Nevertheless, fixed manufacturing overhead is a very significant<br />

cost in most organizations. 10<br />

Measuring and Controlling Fixed Manufacturing<br />

Overhead Costs<br />

Reporting on how well fixed manufacturing overhead costs are controlled is actually a<br />

fairly straightforward process. Because these costs are fixed in total, measuring variances<br />

around these costs is simply a matter of comparing the original budget with the total fixed<br />

overhead costs that were actually spent. To demonstrate, let’s return once more to our<br />

Sunbird Boat Company example. Similar to the variable manufacturing overhead budget<br />

established at the beginning of the year, Sunbird’s management team and accountants also<br />

created a fixed manufacturing overhead budget. Then, in order to subsequently allocate<br />

these costs to boats as they are produced during the year, Sunbird created standard fixed<br />

manufacturing overhead rates using an approach similar to that used to create standard<br />

variable manufacturing overhead rates. This process is shown below.<br />

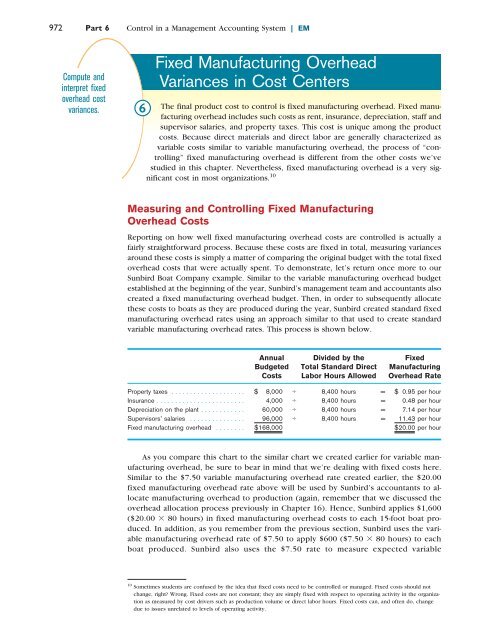

Annual Divided by the Fixed<br />

Budgeted Total Standard Direct Manufacturing<br />

Costs Labor Hours Allowed Overhead Rate<br />

Property taxes . . . . . . . . . . . . . . . . . . . . $ 8,000 8,400 hours = $ 0.95 per hour<br />

Insurance . . . . . . . . . . . . . . . . . . . . . . . . 4,000 8,400 hours = 0.48 per hour<br />

Depreciation on the plant . . . . . . . . . . . . 60,000 8,400 hours = 7.14 per hour<br />

Supervisors’ salaries . . . . . . . . . . . . . . . 96,000 8,400 hours = 11.43 per hour<br />

Fixed manufacturing overhead . . . . . . . . $168,000 $20.00 per hour<br />

As you compare this chart to the similar chart we created earlier for variable manufacturing<br />

overhead, be sure to bear in mind that we’re dealing with fixed costs here.<br />

Similar to the $7.50 variable manufacturing overhead rate created earlier, the $20.00<br />

fixed manufacturing overhead rate above will be used by Sunbird’s accountants to allocate<br />

manufacturing overhead to production (again, remember that we discussed the<br />

overhead allocation process previously in Chapter 16). Hence, Sunbird applies $1,600<br />

($20.00 80 hours) in fixed manufacturing overhead costs to each 15-foot boat produced.<br />

In addition, as you remember from the previous section, Sunbird uses the variable<br />

manufacturing overhead rate of $7.50 to apply $600 ($7.50 80 hours) to each<br />

boat produced. Sunbird also uses the $7.50 rate to measure expected variable<br />

10 Sometimes students are confused by the idea that fixed costs need to be controlled or managed. Fixed costs should not<br />

change, right Wrong. Fixed costs are not constant; they are simply fixed with respect to operating activity in the organization<br />

as measured by cost drivers such as production volume or direct labor hours. Fixed costs can, and often do, change<br />

due to issues unrelated to levels of operating activity.