Albrecht 19.pdf - Marriott School

Albrecht 19.pdf - Marriott School

Albrecht 19.pdf - Marriott School

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

76154_23_ch19_p942-1006.qxd 3/1/07 3:35 PM Page 989<br />

EOC | Controlling Cost, Profit, and Investment Centers Chapter 19 989<br />

E 19-34<br />

LO3<br />

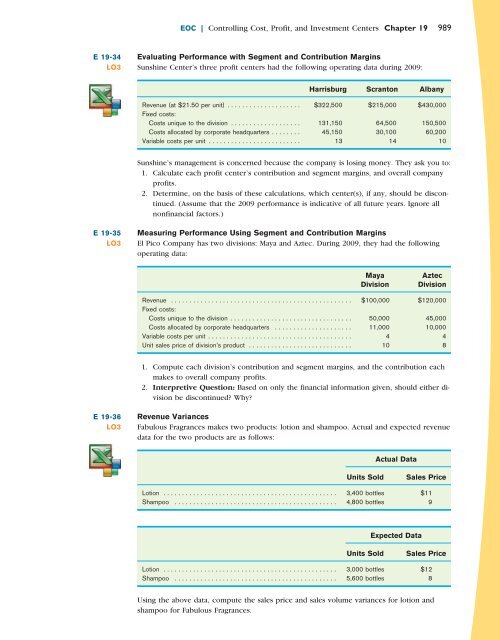

Evaluating Performance with Segment and Contribution Margins<br />

Sunshine Center’s three profit centers had the following operating data during 2009:<br />

Harrisburg Scranton Albany<br />

Revenue (at $21.50 per unit) . . . . . . . . . . . . . . . . . . . . $322,500 $215,000 $430,000<br />

Fixed costs:<br />

Costs unique to the division . . . . . . . . . . . . . . . . . . . 131,150 64,500 150,500<br />

Costs allocated by corporate headquarters . . . . . . . . 45,150 30,100 60,200<br />

Variable costs per unit . . . . . . . . . . . . . . . . . . . . . . . . . 13 14 10<br />

Sunshine’s management is concerned because the company is losing money. They ask you to:<br />

1. Calculate each profit center’s contribution and segment margins, and overall company<br />

profits.<br />

2. Determine, on the basis of these calculations, which center(s), if any, should be discontinued.<br />

(Assume that the 2009 performance is indicative of all future years. Ignore all<br />

nonfinancial factors.)<br />

E 19-35<br />

LO3<br />

Measuring Performance Using Segment and Contribution Margins<br />

El Pico Company has two divisions: Maya and Aztec. During 2009, they had the following<br />

operating data:<br />

Maya<br />

Division<br />

Aztec<br />

Division<br />

Revenue . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $100,000 $120,000<br />

Fixed costs:<br />

Costs unique to the division . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 50,000 45,000<br />

Costs allocated by corporate headquarters . . . . . . . . . . . . . . . . . . . . . 11,000 10,000<br />

Variable costs per unit . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 4 4<br />

Unit sales price of division’s product . . . . . . . . . . . . . . . . . . . . . . . . . . . . 10 8<br />

1. Compute each division’s contribution and segment margins, and the contribution each<br />

makes to overall company profits.<br />

2. Interpretive Question: Based on only the financial information given, should either division<br />

be discontinued Why<br />

E 19-36<br />

LO3<br />

Revenue Variances<br />

Fabulous Fragrances makes two products: lotion and shampoo. Actual and expected revenue<br />

data for the two products are as follows:<br />

Actual Data<br />

Units Sold<br />

Sales Price<br />

Lotion . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3,400 bottles $11<br />

Shampoo . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 4,800 bottles 9<br />

Expected Data<br />

Units Sold<br />

Sales Price<br />

Lotion . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3,000 bottles $12<br />

Shampoo . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 5,600 bottles 8<br />

Using the above data, compute the sales price and sales volume variances for lotion and<br />

shampoo for Fabulous Fragrances.