Albrecht 19.pdf - Marriott School

Albrecht 19.pdf - Marriott School

Albrecht 19.pdf - Marriott School

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

76154_23_ch19_p942-1006.qxd 3/1/07 3:35 PM Page 999<br />

EOC | Controlling Cost, Profit, and Investment Centers Chapter 19 999<br />

P 19-61<br />

LO4<br />

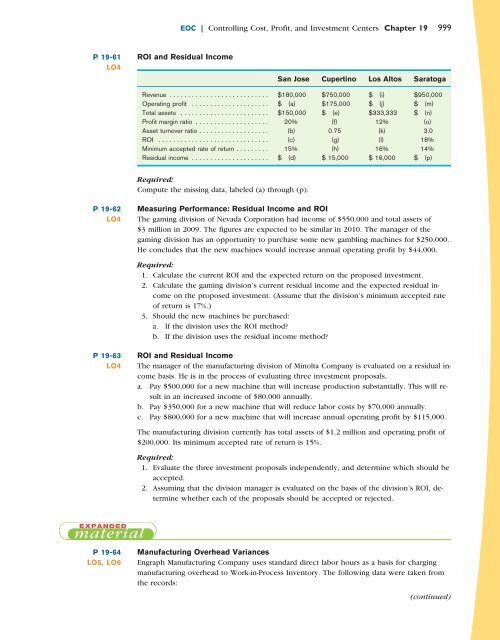

ROI and Residual Income<br />

San Jose Cupertino Los Altos Saratoga<br />

Revenue . . . . . . . . . . . . . . . . . . . . . . . . . . . $180,000 $750,000 $ (i) $950,000<br />

Operating profit . . . . . . . . . . . . . . . . . . . . . $ (a) $175,000 $ (j) $ (m)<br />

Total assets . . . . . . . . . . . . . . . . . . . . . . . . $150,000 $ (e) $333,333 $ (n)<br />

Profit margin ratio . . . . . . . . . . . . . . . . . . . . 20% (f) 12% (o)<br />

Asset turnover ratio . . . . . . . . . . . . . . . . . . . (b) 0.75 (k) 3.0<br />

ROI . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (c) (g) (l) 18%<br />

Minimum accepted rate of return . . . . . . . . . 15% (h) 16% 14%<br />

Residual income . . . . . . . . . . . . . . . . . . . . . $ (d) $ 15,000 $ 16,000 $ (p)<br />

Required:<br />

Compute the missing data, labeled (a) through (p).<br />

P 19-62<br />

LO4<br />

Measuring Performance: Residual Income and ROI<br />

The gaming division of Nevada Corporation had income of $550,000 and total assets of<br />

$3 million in 2009. The figures are expected to be similar in 2010. The manager of the<br />

gaming division has an opportunity to purchase some new gambling machines for $250,000.<br />

He concludes that the new machines would increase annual operating profit by $44,000.<br />

Required:<br />

1. Calculate the current ROI and the expected return on the proposed investment.<br />

2. Calculate the gaming division’s current residual income and the expected residual income<br />

on the proposed investment. (Assume that the division’s minimum accepted rate<br />

of return is 17%.)<br />

3. Should the new machines be purchased:<br />

a. If the division uses the ROI method<br />

b. If the division uses the residual income method<br />

P 19-63<br />

LO4<br />

ROI and Residual Income<br />

The manager of the manufacturing division of Minolta Company is evaluated on a residual income<br />

basis. He is in the process of evaluating three investment proposals.<br />

a. Pay $500,000 for a new machine that will increase production substantially. This will result<br />

in an increased income of $80,000 annually.<br />

b. Pay $350,000 for a new machine that will reduce labor costs by $70,000 annually.<br />

c. Pay $800,000 for a new machine that will increase annual operating profit by $115,000.<br />

The manufacturing division currently has total assets of $1.2 million and operating profit of<br />

$200,000. Its minimum accepted rate of return is 15%.<br />

Required:<br />

1. Evaluate the three investment proposals independently, and determine which should be<br />

accepted.<br />

2. Assuming that the division manager is evaluated on the basis of the division’s ROI, determine<br />

whether each of the proposals should be accepted or rejected.<br />

EXPANDED<br />

material<br />

P 19-64<br />

LO5, LO6<br />

Manufacturing Overhead Variances<br />

Engraph Manufacturing Company uses standard direct labor hours as a basis for charging<br />

manufacturing overhead to Work-in-Process Inventory. The following data were taken from<br />

the records:<br />

(continued)