Albrecht 19.pdf - Marriott School

Albrecht 19.pdf - Marriott School

Albrecht 19.pdf - Marriott School

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

76154_23_ch19_p942-1006.qxd 3/1/07 3:35 PM Page 961<br />

Controlling Cost, Profit, and Investment Centers Chapter 19 961<br />

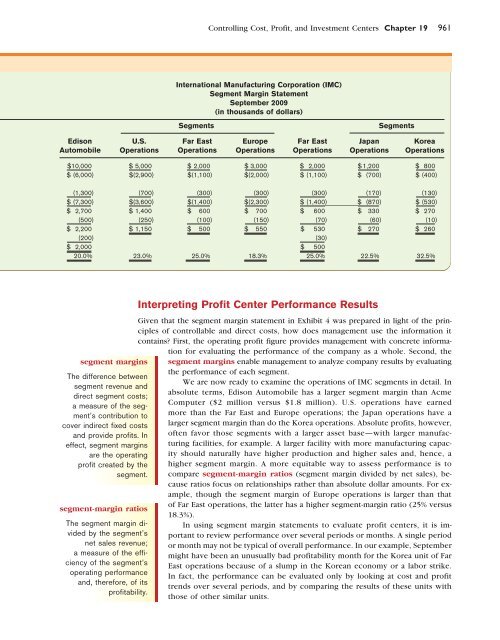

International Manufacturing Corporation (IMC)<br />

Segment Margin Statement<br />

September 2009<br />

(in thousands of dollars)<br />

Segments<br />

Segments<br />

Edison U.S. Far East Europe Far East Japan Korea<br />

Automobile Operations Operations Operations Operations Operations Operations<br />

$10,000 $ 5,000 $ 2,000 $ 3,000 $ 2,000 $ 1,200 $ 800<br />

$ (6,000) $(2,900) $(1,100) $(2,000) $ (1,100) $ (700) $ (400)<br />

(1,300) (700) (300) (300) (300) (170) (130)<br />

$ (7,300) $(3,600) $(1,400) $(2,300) $ (1,400) $ (870) $ (530)<br />

$ 2,700 $ 1,400 $ 600 $ 700 $ 600 $ 330 $ 270<br />

(500) (250) (100) (150) (70) (60) (10)<br />

$ 2,200 $ 1,150 $ 500 $ 550 $ 530 $ 270 $ 260<br />

(200) (30)<br />

$ 2,000 $ 500<br />

20.0% 23.0% 25.0% 18.3% 25.0% 22.5% 32.5%<br />

segment margins<br />

The difference between<br />

segment revenue and<br />

direct segment costs;<br />

a measure of the segment’s<br />

contribution to<br />

cover indirect fixed costs<br />

and provide profits. In<br />

effect, segment margins<br />

are the operating<br />

profit created by the<br />

segment.<br />

segment-margin ratios<br />

The segment margin divided<br />

by the segment’s<br />

net sales revenue;<br />

a measure of the efficiency<br />

of the segment’s<br />

operating performance<br />

and, therefore, of its<br />

profitability.<br />

Interpreting Profit Center Performance Results<br />

Given that the segment margin statement in Exhibit 4 was prepared in light of the principles<br />

of controllable and direct costs, how does management use the information it<br />

contains First, the operating profit figure provides management with concrete information<br />

for evaluating the performance of the company as a whole. Second, the<br />

segment margins enable management to analyze company results by evaluating<br />

the performance of each segment.<br />

We are now ready to examine the operations of IMC segments in detail. In<br />

absolute terms, Edison Automobile has a larger segment margin than Acme<br />

Computer ($2 million versus $1.8 million). U.S. operations have earned<br />

more than the Far East and Europe operations; the Japan operations have a<br />

larger segment margin than do the Korea operations. Absolute profits, however,<br />

often favor those segments with a larger asset base—with larger manufacturing<br />

facilities, for example. A larger facility with more manufacturing capacity<br />

should naturally have higher production and higher sales and, hence, a<br />

higher segment margin. A more equitable way to assess performance is to<br />

compare segment-margin ratios (segment margin divided by net sales), because<br />

ratios focus on relationships rather than absolute dollar amounts. For example,<br />

though the segment margin of Europe operations is larger than that<br />

of Far East operations, the latter has a higher segment-margin ratio (25% versus<br />

18.3%).<br />

In using segment margin statements to evaluate profit centers, it is important<br />

to review performance over several periods or months. A single period<br />

or month may not be typical of overall performance. In our example, September<br />

might have been an unusually bad profitability month for the Korea unit of Far<br />

East operations because of a slump in the Korean economy or a labor strike.<br />

In fact, the performance can be evaluated only by looking at cost and profit<br />

trends over several periods, and by comparing the results of these units with<br />

those of other similar units.