Albrecht 19.pdf - Marriott School

Albrecht 19.pdf - Marriott School

Albrecht 19.pdf - Marriott School

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

76154_23_ch19_p942-1006.qxd 3/1/07 3:35 PM Page 977<br />

EOC | Controlling Cost, Profit, and Investment Centers Chapter 19 977<br />

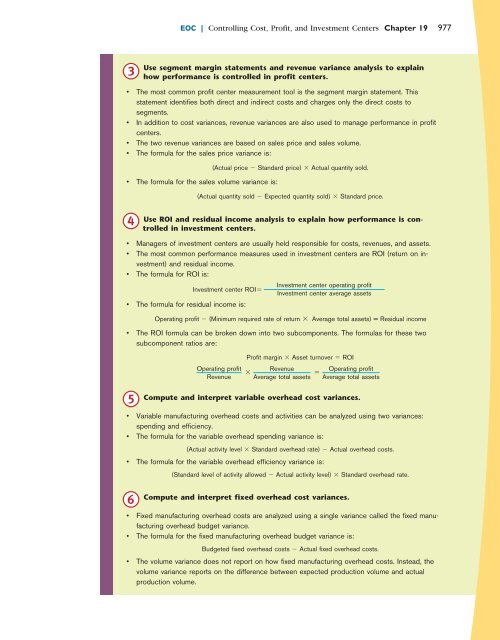

3<br />

Use segment margin statements and revenue variance analysis to explain<br />

how performance is controlled in profit centers.<br />

• The most common profit center measurement tool is the segment margin statement. This<br />

statement identifies both direct and indirect costs and charges only the direct costs to<br />

segments.<br />

• In addition to cost variances, revenue variances are also used to manage performance in profit<br />

centers.<br />

• The two revenue variances are based on sales price and sales volume.<br />

• The formula for the sales price variance is:<br />

• The formula for the sales volume variance is:<br />

4<br />

(Actual price Standard price) Actual quantity sold.<br />

(Actual quantity sold Expected quantity sold) Standard price.<br />

Use ROI and residual income analysis to explain how performance is controlled<br />

in investment centers.<br />

• Managers of investment centers are usually held responsible for costs, revenues, and assets.<br />

• The most common performance measures used in investment centers are ROI (return on investment)<br />

and residual income.<br />

• The formula for ROI is:<br />

Investment center ROI<br />

• The formula for residual income is:<br />

Operating profit (Minimum required rate of return Average total assets) = Residual income<br />

• The ROI formula can be broken down into two subcomponents. The formulas for these two<br />

subcomponent ratios are:<br />

5<br />

Profit margin Asset turnover ROI<br />

<br />

Compute and interpret variable overhead cost variances.<br />

• Variable manufacturing overhead costs and activities can be analyzed using two variances:<br />

spending and efficiency.<br />

• The formula for the variable overhead spending variance is:<br />

(Actual activity level Standard overhead rate) Actual overhead costs.<br />

• The formula for the variable overhead efficiency variance is:<br />

6<br />

Operating profit<br />

Revenue<br />

Investment center operating profit<br />

Investment center average assets<br />

Revenue<br />

Average total assets<br />

(Standard level of activity allowed Actual activity level) Standard overhead rate.<br />

Compute and interpret fixed overhead cost variances.<br />

• Fixed manufacturing overhead costs are analyzed using a single variance called the fixed manufacturing<br />

overhead budget variance.<br />

• The formula for the fixed manufacturing overhead budget variance is:<br />

Budgeted fixed overhead costs Actual fixed overhead costs.<br />

• The volume variance does not report on how fixed manufacturing overhead costs. Instead, the<br />

volume variance reports on the difference between expected production volume and actual<br />

production volume.<br />

<br />

Operating profit<br />

Average total assets