Annual Report 2010-2011 - Colombo Stock Exchange

Annual Report 2010-2011 - Colombo Stock Exchange

Annual Report 2010-2011 - Colombo Stock Exchange

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

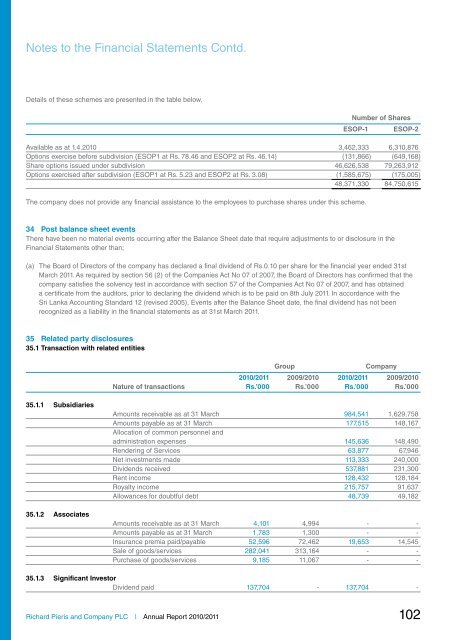

Notes to the Financial Statements Contd.<br />

Details of these schemes are presented in the table below.<br />

Number of Shares<br />

ESOP-1 ESOP-2<br />

Available as at 1.4.<strong>2010</strong> 3,462,333 6,310,876<br />

Options exercise before subdivision (ESOP1 at Rs. 78.46 and ESOP2 at Rs. 46.14) (131,866) (649,168)<br />

Share options issued under subdivision 46,626,538 79,263,912<br />

Options exercised after subdivision (ESOP1 at Rs. 5.23 and ESOP2 at Rs. 3.08) (1,585,675) (175,005)<br />

48,371,330 84,750,615<br />

The company does not provide any financial assistance to the employees to purchase shares under this scheme.<br />

34 Post balance sheet events<br />

There have been no material events occurring after the Balance Sheet date that require adjustments to or disclosure in the<br />

Financial Statements other than;<br />

(a) The Board of Directors of the company has declared a final dividend of Rs.0.10 per share for the financial year ended 31st<br />

March <strong>2011</strong>. As required by section 56 (2) of the Companies Act No 07 of 2007, the Board of Directors has confirmed that the<br />

company satisfies the solvency test in accordance with section 57 of the Companies Act No 07 of 2007, and has obtained<br />

a certificate from the auditors, prior to declaring the dividend which is to be paid on 8th July <strong>2011</strong>. In accordance with the<br />

Sri Lanka Accounting Standard 12 (revised 2005), Events after the Balance Sheet date, the final dividend has not been<br />

recognized as a liability in the financial statements as at 31st March <strong>2011</strong>.<br />

35 Related party disclosures<br />

35.1 Transaction with related entities<br />

Group<br />

Company<br />

<strong>2010</strong>/<strong>2011</strong> 2009/<strong>2010</strong> <strong>2010</strong>/<strong>2011</strong> 2009/<strong>2010</strong><br />

Nature of transactions Rs.’000 Rs.’000 Rs.’000 Rs.’000<br />

35.1.1 Subsidiaries<br />

35.1.2 Associates<br />

Amounts receivable as at 31 March 984,541 1,629,758<br />

Amounts payable as at 31 March 177,515 148,167<br />

Allocation of common personnel and<br />

administration expenses 145,636 148,490<br />

Rendering of Services 63,877 67,946<br />

Net investments made 113,333 240,000<br />

Dividends received 537,881 231,300<br />

Rent income 128,432 128,184<br />

Royalty income 215,757 91,637<br />

Allowances for doubtful debt 48,739 49,182<br />

Amounts receivable as at 31 March 4,101 4,994 - -<br />

Amounts payable as at 31 March 1,783 1,300 - -<br />

Insurance premia paid/payable 52,596 72,462 19,653 14,545<br />

Sale of goods/services 282,041 313,164 - -<br />

Purchase of goods/services 9,185 11,067 - -<br />

35.1.3 Significant Investor<br />

Dividend paid 137,704 - 137,704 -<br />

Richard Pieris and Company PLC | <strong>Annual</strong> <strong>Report</strong> <strong>2010</strong>/<strong>2011</strong> 102