Annual Report 2010-2011 - Colombo Stock Exchange

Annual Report 2010-2011 - Colombo Stock Exchange

Annual Report 2010-2011 - Colombo Stock Exchange

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Financial Review<br />

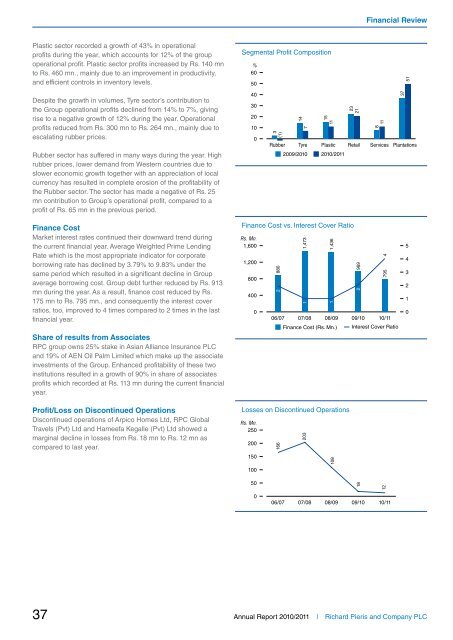

Plastic sector recorded a growth of 43% in operational<br />

profits during the year, which accounts for 12% of the group<br />

operational profit. Plastic sector profits increased by Rs. 140 mn<br />

to Rs. 460 mn., mainly due to an improvement in productivity,<br />

and efficient controls in inventory levels.<br />

Segmental Profit Composition<br />

%<br />

60<br />

50<br />

51<br />

Despite the growth in volumes, Tyre sector’s contribution to<br />

the Group operational profits declined from 14% to 7%, giving<br />

rise to a negative growth of 12% during the year. Operational<br />

profits reduced from Rs. 300 mn to Rs. 264 mn., mainly due to<br />

escalating rubber prices.<br />

Rubber sector has suffered in many ways during the year. High<br />

rubber prices, lower demand from Western countries due to<br />

slower economic growth together with an appreciation of local<br />

currency has resulted in complete erosion of the profitability of<br />

the Rubber sector. The sector has made a negative of Rs. 25<br />

mn contribution to Group’s operational profit, compared to a<br />

profit of Rs. 65 mn in the previous period.<br />

40<br />

30<br />

20<br />

10<br />

0<br />

3<br />

(1)<br />

14<br />

7<br />

15<br />

11<br />

23<br />

21<br />

Rubber Tyre Plastic Retail Services Plantations<br />

2009/<strong>2010</strong> <strong>2010</strong>/<strong>2011</strong><br />

8<br />

11<br />

37<br />

Finance Cost<br />

Market interest rates continued their downward trend during<br />

the current financial year. Average Weighted Prime Lending<br />

Rate which is the most appropriate indicator for corporate<br />

borrowing rate has declined by 3.79% to 9.83% under the<br />

same period which resulted in a significant decline in Group<br />

average borrowing cost. Group debt further reduced by Rs. 913<br />

mn during the year. As a result, finance cost reduced by Rs.<br />

175 mn to Rs. 795 mn., and consequently the interest cover<br />

ratios, too, improved to 4 times compared to 2 times in the last<br />

financial year.<br />

Share of results from Associates<br />

RPC group owns 25% stake in Asian Alliance Insurance PLC<br />

and 19% of AEN Oil Palm Limited which make up the associate<br />

investments of the Group. Enhanced profitability of these two<br />

institutions resulted in a growth of 90% in share of associates<br />

profits which recorded at Rs. 113 mn during the current financial<br />

year.<br />

Profit/Loss on Discontinued Operations<br />

Discontinued operations of Arpico Homes Ltd, RPC Global<br />

Travels (Pvt) Ltd and Hameefa Kegalle (Pvt) Ltd showed a<br />

marginal decline in losses from Rs. 18 mn to Rs. 12 mn as<br />

compared to last year.<br />

Finance Cost vs. Interest Cover Ratio<br />

Rs. Mn.<br />

1,600<br />

1,200<br />

800<br />

400<br />

0<br />

2 880<br />

1,473<br />

1,436<br />

2 969<br />

795 4<br />

1<br />

1<br />

06/07 07/08 08/09 09/10 10/11<br />

Finance Cost (Rs. Mn.) Interest Cover Ratio<br />

Losses on Discontinued Operations<br />

Rs. Mn.<br />

250<br />

200<br />

150<br />

100<br />

166<br />

203<br />

108<br />

5<br />

4<br />

3<br />

2<br />

1<br />

0<br />

50<br />

18<br />

12<br />

0<br />

06/07 07/08 08/09 09/10 10/11<br />

37<br />

<strong>Annual</strong> <strong>Report</strong> <strong>2010</strong>/<strong>2011</strong> | Richard Pieris and Company PLC