Global Economic Outlook and Strategy - Kadin Indonesia

Global Economic Outlook and Strategy - Kadin Indonesia

Global Economic Outlook and Strategy - Kadin Indonesia

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

February 28, 2008<br />

<strong>Global</strong> <strong>Economic</strong> <strong>Outlook</strong> <strong>and</strong> <strong>Strategy</strong><br />

SNB’s 2% target ceiling. Therefore, the SNB will likely keep rates on hold in coming<br />

months, unless the CHF rises more sharply. The outlook for the CHF also should be<br />

reinforced by the currency’s longst<strong>and</strong>ing safe-haven status, with a strong <strong>and</strong> positive<br />

correlation between equity market volatility <strong>and</strong> the trade-weighted CHF.<br />

While the Norges Bank has recently expressed concerns about money market strains<br />

<strong>and</strong> heightened global economic uncertainty, we still expect further monetary policy<br />

tightening to combat inflation risks amid heightened capacity pressures <strong>and</strong><br />

accelerating wages. Oil prices are a double-edged sword for the NOK. Recent high<br />

prices have supported the NOK, but the sharp rise over the past year also raises the<br />

risk of a correction. In Sweden, the Riksbank is expected to keep rates steady near<br />

term, following the surprise rate hike in February. The next move is likely to be a cut<br />

around yearend to offset the negative effects from the credit crisis <strong>and</strong> weakening U.S.<br />

<strong>and</strong> global economic growth. But interest rate spreads remain in the SEK’s favor.<br />

Also, while periods of financial instability normally do not favor the SEK, the SEK<br />

should strengthen again once the dust settles in financial markets.<br />

Currencies across CEEMEA continue to feel the effects of conflicting forces. Amid<br />

ongoing financing concerns, currencies of external deficit countries such as South Africa<br />

<strong>and</strong> Romania remain under pressure relative to the EUR. Inflationary pressures across the<br />

region, however, continue to put upward pressure on domestic interest rates, providing<br />

some support to currencies of countries with better economic prospects, including Pol<strong>and</strong>,<br />

Israel, <strong>and</strong> Slovakia. Slovakia is also experiencing capital inflows in anticipation of a<br />

revaluation of the koruna’s central parity against the EUR next quarter as part of the euroadoption<br />

process. Hungary, by ab<strong>and</strong>oning its b<strong>and</strong>, reversed much of its January selloff.<br />

Latin American currencies have so far shown no vulnerability to deteriorating global<br />

prospects. In fact, with the United States cutting rates <strong>and</strong> commodity prices making<br />

new highs, Latin currencies have continued to appreciate. Inflationary challenges in<br />

Chile, Peru, <strong>and</strong> Colombia will likely keep those central banks vigilant, with a bias<br />

toward maintaining a hawkish discourse, <strong>and</strong> possibly even hiking rates. Rate cuts are<br />

likely in Mexico, but not until September, given the likelihood that yearly inflation will<br />

increase above the top of Banxico’s b<strong>and</strong> during most of the second quarter.<br />

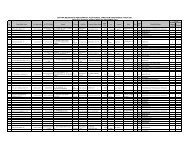

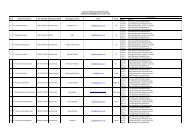

Figure 20. Currency Recommendations, as of Feb 28, 2008<br />

Current<br />

3-Month<br />

Forecast<br />

Annual Return vs<br />

FWD Implied Vol.<br />

12-Month<br />

Forecast<br />

Annual Return vs<br />

FWD Implied Vol.<br />

United States NA NA NA NA NA NA NA<br />

Japan 106 105 1.9 10.7 112 -7.2 9.6<br />

Euro Area 1.51 1.52 4.1 9.1 1.46 -2.1 8.8<br />

Canada 0.98 1.02 -14.4 11.6 1.04 -5.2 10.9<br />

Australia 0.94 0.94 3.5 13.1 0.89 -0.7 12.7<br />

New Zeal<strong>and</strong> 0.81 0.80 -6.3 14.8 0.74 -3.6 14.8<br />

Norway 5.20 4.92 25.3 12.2 4.94 8.2 11.8<br />

Sweden 6.20 6.02 13.0 11.8 6.35 -0.5 11.3<br />

Switzerl<strong>and</strong> 1.06 1.05 4.7 10.0 1.03 2.7 9.0<br />

United Kingdom 1.98 1.96 -1.7 8.6 1.93 -0.4 8.5<br />

China 7.11 7.02 -5.2 3.4 6.62 -2.2 4.9<br />

India 39.9 38.7 12.7 6.0 37.2 7.7 6.4<br />

Korea 938 960 -8.8 5.3 887 6.0 4.9<br />

Pol<strong>and</strong> 2.33 2.39 -7.6 11.0 2.43 -0.7 10.5<br />

Russia 24.1 24.0 3.7 5.9 24.5 1.4 6.7<br />

South Africa 7.56 7.83 -5.5 19.6 8.07 2.2 19.3<br />

Turkey 1.18 1.23 -3.9 14.1 1.31 1.9 16.2<br />

Brazil 1.67 1.80 -23.7 13.6 1.83 -2.6 14.6<br />

Mexico 10.7 10.9 -2.3 5.3 11.0 1.6 6.6<br />

Source: Citi.<br />

15