Global Economic Outlook and Strategy - Kadin Indonesia

Global Economic Outlook and Strategy - Kadin Indonesia

Global Economic Outlook and Strategy - Kadin Indonesia

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

February 28, 2008<br />

<strong>Global</strong> <strong>Economic</strong> <strong>Outlook</strong> <strong>and</strong> <strong>Strategy</strong><br />

Dana M. Peterson<br />

(1-212) 816-3549<br />

dana.peterson<br />

@citi.com<br />

Canada<br />

Anemic U.S. final dem<strong>and</strong> growth, last year’s rapid appreciation of the Canadian dollar<br />

(CAD), <strong>and</strong> ongoing financial market strains will continue to weigh on the Canadian<br />

economy over the medium term. Flagging output <strong>and</strong> moderating inflation likely will<br />

prompt an additional 100 basis points of easing by June.<br />

Tighter credit conditions, a considerable net exports drag, <strong>and</strong> slower domestic dem<strong>and</strong><br />

growth probably will result in significantly subpar growth in 2008. Accommodative policy,<br />

against a backdrop of hearty global growth, an improved U.S. outlook, healthy Canadian<br />

balance sheets, <strong>and</strong> elevated commodity prices should help place the expansion back on<br />

track by late 2009.<br />

The disinflationary effects of last year’s rapid currency appreciation <strong>and</strong> the 1% cut in the<br />

Goods <strong>and</strong> Services Tax will keep both overall <strong>and</strong> core inflation in the lower bound of the<br />

Bank of Canada’s (BoC) operational guide in 2008. Headline CPI should move back to the<br />

2.0% target in 2009, but the core measure likely will settle just below 2.0%.<br />

Key downside risks to the inflation outlook include a protracted period of net exports drag<br />

amid a U.S. recession, the dampening effects of past <strong>and</strong> recent CAD appreciation, <strong>and</strong> a<br />

disorderly resolution to global imbalances. Furthermore, possible moderation in global<br />

growth or curbed investment by top Asian trading partners present an uncertain outlook for<br />

commodity prices — a key driver of the Canadian expansion in recent years. Meanwhile,<br />

excess consumer dem<strong>and</strong> remains the main upside risk. As downside risks are likely to<br />

dominate near term, we expect the BoC to lower its policy rate to 3% before the summer.<br />

The stronger CAD <strong>and</strong> stricter lending st<strong>and</strong>ards are squeezing corporate profits in certain<br />

key sectors, limiting investment <strong>and</strong> hiring intentions. A peak in the housing boom this year<br />

should diminish construction spending <strong>and</strong> quell excess dem<strong>and</strong> for housing-related<br />

products. But slower dem<strong>and</strong> overall should alleviate capacity pressures, limiting outsized<br />

employment gains <strong>and</strong> wage inflation. In addition, we anticipate that a cooler economy will<br />

likely trigger a modest retreat in the CAD versus the USD.<br />

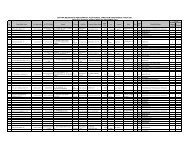

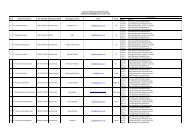

Figure 32. Canada — <strong>Economic</strong> Forecast, 2007-09F<br />

2007 2008<br />

2007F 2008F 2009F 2Q 3Q 4QF 1QF 2QF 3QF 4QF<br />

Real GDP YoY 2.5% 1.0% 1.5% 2.5% 2.9% 2.7% 1.8% 1.0% 0.6% 0.6%<br />

SAAR 3.8 2.9 0.7 0.1 0.4 1.0 0.9<br />

Final Domestic Dem<strong>and</strong> YoY 3.9 2.9 2.1 3.8 4.0 4.2 4.0 3.3 2.6 1.9<br />

SAAR 4.9 4.6 4.4 2.2 2.1 1.6 1.7<br />

Private Consumption YoY 4.2 3.3 2.6 4.5 4.0 4.1 4.0 3.3 3.1 2.7<br />

SAAR 5.9 3.0 4.2 3.0 2.8 2.5 2.4<br />

Government Spending YoY 2.9 2.7 2.4 2.3 3.4 3.4 3.5 3.2 2.3 2.0<br />

SAAR 2.9 5.9 3.2 2.0 2.0 2.0 2.0<br />

Private Fixed Investment YoY 4.1 1.9 0.2 3.7 4.6 4.7 4.2 3.1 0.9 -0.4<br />

SAAR 4.4 7.6 4.7 0.1 0.2 -1.1 -0.8<br />

Exports YoY 1.4 -0.3 3.1 2.3 2.2 0.1 -0.4 -1.2 -0.7 1.3<br />

SAAR 3.1 2.3 -5.4 -1.5 0.1 4.0 2.7<br />

Imports YoY 5.2 6.8 4.6 3.2 6.1 7.8 9.0 8.3 5.0 4.9<br />

SAAR 7.7 18.6 5.5 4.9 4.9 4.9 4.9<br />

CPI YoY 2.1 1.4 2.0 2.2 2.1 2.4 1.7 1.1 1.3 1.4<br />

Core CPI YoY 2.1 1.1 1.9 2.4 2.2 1.6 1.2 0.9 0.9 1.4<br />

Unemployment Rate % 6.0 6.3 6.4 6.1 6.0 5.9 6.1 6.3 6.4 6.4<br />

Current Account Balance, SA C$bn 13.6 -2.5 -12.4 25.4 4.2 -0.5 -0.2 -5.0 -2.3 -2.6<br />

% of GDP 0.9 -0.2 -0.8 1.7 0.3 0.0 0.0 -0.3 -0.1 -0.2<br />

Net Exports (Pct. Contrib.) -1.7 -3.1 -0.9 -1.4 -4.9 -4.5 -2.7 -2.1 -0.7 -1.2<br />

Inventories (Pct. Contrib.) 0.0 1.0 0.2 0.5 2.9 1.7 0.6 0.4 0.0 0.4<br />

Budget Balance % of GDP 0.2 0.1 0.1<br />

F Citi forecast. YoY Year-to-year percent change. SAAR Seasonally adjusted annual rate. Sources: Statistics Canada <strong>and</strong> Citi.<br />

27