Global Economic Outlook and Strategy - Kadin Indonesia

Global Economic Outlook and Strategy - Kadin Indonesia

Global Economic Outlook and Strategy - Kadin Indonesia

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

February 28, 2008<br />

<strong>Global</strong> <strong>Economic</strong> <strong>Outlook</strong> <strong>and</strong> <strong>Strategy</strong><br />

Yiping Huang<br />

(852) 2501-2735<br />

yiping.huang@citi.com<br />

Minggao Shen<br />

86 (10) 6510-2933<br />

ext. 71068<br />

minggao.shen@citi.com<br />

China: Renewed Inflation Challenge<br />

After a temporary dip in December, January consumer inflation rose to 7.1%, another 11-<br />

year high. The elevated inflation rate is probably the result of several factors — a slow<br />

supply response to rising dem<strong>and</strong>, inclement weather, <strong>and</strong> the Chinese New Year holiday.<br />

February CPI could rise even further. High inflation complicates macroeconomic<br />

policymaking in China, especially with increasing weakness in the global economy, <strong>and</strong><br />

could result in a combination of tight monetary policy <strong>and</strong> expansionary fiscal policy.<br />

As long as inflation remains high, the central bank will likely retain its tightening<br />

language. High inflation could create political as well as economic instability, as evidenced<br />

by the Tiananmen Incident in 1989. But we expect the year-to-year inflation rate to<br />

moderate starting in March, as snowstorms <strong>and</strong> the holiday effects recede <strong>and</strong> a higher base<br />

lowers year-to-year comparisons. Slowing exports also could ease inflation pressures by<br />

softening aggregate dem<strong>and</strong>. During the past ten years, export growth slumped twice, first<br />

in 1998 <strong>and</strong> then in 2001. Both instances were followed by deflation.<br />

The relatively resilient Chinese trade data for January alongside weak U.S. retail sales in<br />

December led some investors to believe that “de-coupling” might be at work. January<br />

export <strong>and</strong> import data, however, were likely distorted, as traders rushed to have their<br />

products delivered ahead of the lunar holiday. More importantly, U.S. consumption<br />

remained relatively strong until December. Weak U.S. consumption probably translates<br />

into slowing Chinese exports with a lag of a couple of months.<br />

We expect the government to move decisively once economic momentum slows. As in<br />

earlier economic slowdowns, the authorities could boost domestic dem<strong>and</strong> by increasing<br />

direct spending, encouraging state sector investment, <strong>and</strong> relaxing some existing controls.<br />

While distribution of additional funds may take some time, the authorities could accelerate<br />

the spending process once the annual budgets are allocated after the National People’s<br />

Congress meeting in early March.<br />

China’s GDP growth should remain strong this year, but its structure could shift<br />

significantly. Investment could again serve as an important countercyclical force, while<br />

consumption is likely to soften alongside weakening exports. Dem<strong>and</strong> for nontraded goods<br />

should outperform that of traded goods, especially if cautious yuan appreciation continues,<br />

which we expect.<br />

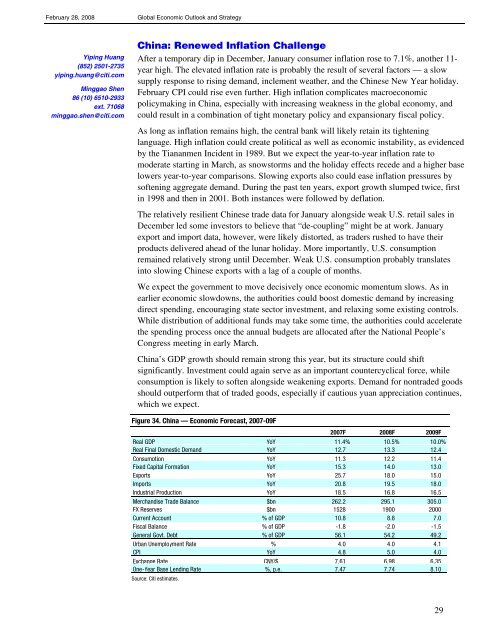

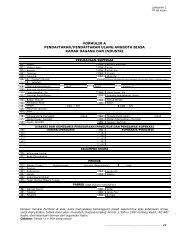

Figure 34. China — <strong>Economic</strong> Forecast, 2007-09F<br />

2007F 2008F 2009F<br />

Real GDP YoY 11.4% 10.5% 10.0%<br />

Real Final Domestic Dem<strong>and</strong> YoY 12.7 13.3 12.4<br />

Consumption YoY 11.3 12.2 11.4<br />

Fixed Capital Formation YoY 15.3 14.0 13.0<br />

Exports YoY 25.7 18.0 15.0<br />

Imports YoY 20.8 19.5 18.0<br />

Industrial Production YoY 18.5 16.8 16.5<br />

Merch<strong>and</strong>ise Trade Balance $bn 262.2 295.1 305.0<br />

FX Reserves $bn 1528 1900 2000<br />

Current Account % of GDP 10.8 8.8 7.0<br />

Fiscal Balance % of GDP -1.8 -2.0 -1.5<br />

General Govt. Debt % of GDP 56.1 54.2 49.2<br />

Urban Unemployment Rate % 4.0 4.0 4.1<br />

CPI YoY 4.8 5.0 4.0<br />

Exchange Rate CNY/$ 7.61 6.98 6.35<br />

One-Year Base Lending Rate %, p.e. 7.47 7.74 8.10<br />

Source: Citi estimates.<br />

29