Global Economic Outlook and Strategy - Kadin Indonesia

Global Economic Outlook and Strategy - Kadin Indonesia

Global Economic Outlook and Strategy - Kadin Indonesia

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

February 28, 2008<br />

<strong>Global</strong> <strong>Economic</strong> <strong>Outlook</strong> <strong>and</strong> <strong>Strategy</strong><br />

Rising global food<br />

prices...<br />

...complicate monetary<br />

policy.<br />

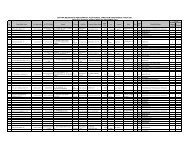

Food inflation has become a key challenge in a number of economies, including China,<br />

Hong Kong, Singapore, Taiwan, <strong>and</strong> Vietnam. This has led to tightening monetary<br />

policies, including faster appreciation of Asian currencies, especially the Taiwanese<br />

dollar <strong>and</strong> Vietnamese dong. In other economies where inflation is less of a challenge,<br />

monetary policy easing is likely to continue following the Fed actions, especially in<br />

Thail<strong>and</strong>, the Philippines, <strong>and</strong> Korea. While inflation complicates macroeconomic<br />

policymaking, we think the chances of stagflation remain remote, as slowing activities<br />

should help ease inflation rates, especially core rates. But food prices could stay high in<br />

coming months, suggesting that tightening biases may continue in a number of<br />

economies.<br />

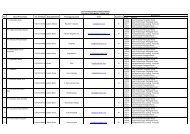

Given the high share of food in the typical CPI basket in Latin America, inflation<br />

pressures should remain a concern for most regional central bankers in the coming<br />

month. Interest rate markets reflect a lower risk of rate hikes in Brazil, <strong>and</strong> they are now<br />

pricing in cuts in Mexico. But the central banks of Chile, Colombia, <strong>and</strong> Peru remain<br />

under pressure to tighten further, as inflation rates continue to print well above their<br />

targets. Our current forecasts show the region shifting into a current account deficit of<br />

0.2% of GDP in 2008 on the back of rapidly growing imports. However, we believe<br />

that sky-high commodity prices place our forecast at risk, <strong>and</strong> may lead to higher-thanexpected<br />

reserves accumulation again this year.<br />

9