Global Economic Outlook and Strategy - Kadin Indonesia

Global Economic Outlook and Strategy - Kadin Indonesia

Global Economic Outlook and Strategy - Kadin Indonesia

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

February 28, 2008<br />

<strong>Global</strong> <strong>Economic</strong> <strong>Outlook</strong> <strong>and</strong> <strong>Strategy</strong><br />

Michael Saunders<br />

(44-20) 7986-3299<br />

michael.saunders<br />

@citi.com<br />

United Kingdom<br />

The U.K. economy continues to show signs of economic slowdown, <strong>and</strong> further marked<br />

weakness is likely in coming months as the credit crunch <strong>and</strong> last year’s rate hikes bite.<br />

We expect GDP growth this year to be about 1¾%, with consumption growth the weakest<br />

since 1992. The MPC has already made two 25-basis-point cuts, <strong>and</strong> we expect the MPC<br />

to cut by an additional 100 basis points over the course of the year. The gradual pace of<br />

easing is recognition that, with rising near-term inflation <strong>and</strong> a sharp recent pickup in<br />

inflation expectations, the MPC wants to allow a disinflationary cushion of economic<br />

weakness to build up. Easing aims to limit the extent of the slowdown, not prevent it from<br />

happening. In turn, this lack of aggressive early stimulus raises the likelihood that growth<br />

remains subdued <strong>and</strong> interest rates stay low in 2009.<br />

The United Kingdom is especially sensitive to the crisis in money <strong>and</strong> credit markets<br />

because of the interplay between high private debt, low private savings, the massively<br />

overstretched housing market, <strong>and</strong> the big role played by wholesale lenders in the<br />

mortgage market. Housing dem<strong>and</strong> is dropping amid tightening lending st<strong>and</strong>ards <strong>and</strong><br />

widening mortgage spreads. Commercial property values also are plunging, with the<br />

sharpest drop since data began more than 20 years ago. In turn, consumer spending is now<br />

starting to slow as savings begin to rise <strong>and</strong> surveys of retailers show marked weakness.<br />

Given that sales usually lag housing by about six months, retail sales growth is likely to<br />

slow a lot more in coming months. The labor market remains quite strong so far but<br />

usually lags the economy by a quarter or two. Hence, employment will probably start to<br />

weaken around midyear.<br />

The MPC faces a tricky job in balancing downside risks to growth against upside inflation<br />

risks. Recent surveys suggest that firms are very confident in their ability to raise selling<br />

prices, <strong>and</strong> food <strong>and</strong> energy price increases are likely to lift CPI inflation to about 3.0%<br />

this year. Inflation expectations already are elevated, <strong>and</strong> there is a risk that rapid easing,<br />

amid rising inflation, could destabilize inflation expectations further <strong>and</strong> worsen the<br />

growth-inflation tradeoff. Balancing these risks suggests that easing will be gradual.<br />

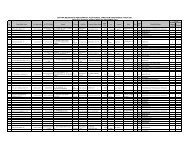

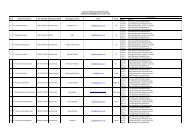

Figure 30. United Kingdom — <strong>Economic</strong> Forecast, 2007-09F<br />

2007 2008<br />

2007F 2008F 2009F 2Q 3QF 4QF 1QF 2QF 3QF 4QF<br />

Real GDP YoY 3.1% 1.7% 1.9% 3.2% 3.2% 3.0% 2.5% 1.9% 1.3% 1.2%<br />

SAAR 3.3 2.9 2.5 1.3 0.8 0.6 2.1<br />

Domestic Dem<strong>and</strong> YoY 3.8 1.6 1.4 3.4 4.0 3.9 3.0 2.3 0.7 0.4<br />

(Incl. Inventories) SAAR 2.6 6.2 2.8 0.4 -0.1 -0.4 1.7<br />

Consumption YoY 3.1 0.9 1.4 2.7 3.6 3.0 2.1 1.3 0.3 0.0<br />

SAAR 2.9 4.5 1.5 -0.3 -0.5 0.6 0.3<br />

Investment YoY 6.6 4.6 1.5 6.4 6.0 4.9 4.8 6.7 4.3 2.5<br />

SAAR -3.0 9.8 9.1 3.9 4.3 0.1 1.9<br />

Exports YoY -4.6 4.0 6.9 -11.7 2.1 2.4 3.7 4.3 3.4 4.7<br />

SAAR 1.0 8.1 1.6 4.4 3.3 4.3 7.0<br />

Imports YoY -2.3 3.4 4.7 -10.3 4.3 5.3 5.2 5.7 1.1 1.6<br />

SAAR -1.9 20.0 3.3 0.8 0.1 0.5 5.3<br />

Unemployment Rate % 5.4 5.5 5.8 5.4 5.4 5.4 5.4 5.4 5.5 5.6<br />

CPI Inflation YoY 2.3 2.5 2.0 2.6 1.8 2.1 2.4 2.3 2.7 2.4<br />

Merch. Trade £bn -86.2 -90.1 -81.0 -19.3 -22.4 -24.7 -25.2 -22.4 -21.4 -21.1<br />

% of GDP -6.2 -6.2 -5.3 -5.6 -6.4 -7.0 -7.0 -6.2 -5.8 -5.7<br />

Current Account £bn -72.1 -66.2 -51.0 -13.7 -20.0 -21.8 -21.0 -16.1 -14.8 -14.3<br />

% of GDP -5.2 -4.5 -3.3 -4.0 -5.7 -6.1 -5.9 -4.4 -4.0 -3.8<br />

PSNB £bn FY -42.9 -48.8 -54.6<br />

% of GDP -3.0 -3.3 -3.5<br />

General Govt. Balance % of GDP -3.0 -3.4 -3.6<br />

Public Debt % of GDP 42.9 44.2 45.8<br />

Gross Nonoil Trading Profits YoY 13.2 5.9 5.8<br />

F Citi forecast. SAAR Seasonally adjusted annual rate. YoY Year-to-year growth rate. Investment excludes inventories. Source: Citi.<br />

25