Global Economic Outlook and Strategy - Kadin Indonesia

Global Economic Outlook and Strategy - Kadin Indonesia

Global Economic Outlook and Strategy - Kadin Indonesia

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

February 28, 2008<br />

<strong>Global</strong> <strong>Economic</strong> <strong>Outlook</strong> <strong>and</strong> <strong>Strategy</strong><br />

Kiichi Murashima<br />

(81-3) 5574-4730<br />

kiichi.murashima<br />

@nikkocitigroup.com<br />

Japan<br />

We expect Japan’s economic growth to stabilize near the potential growth rate of the<br />

economy (slightly below 2%) this year after a bumpy ride in 2007. Last year, higher input<br />

costs including energy costs, the resulting deterioration in the profit outlook for small<br />

firms, <strong>and</strong> the enforcement of the revised Building St<strong>and</strong>ard Law temporarily distorted<br />

economic growth. However, real GDP advanced at an annualized 3.7% in the fourth<br />

quarter, reflecting strong export <strong>and</strong> business investment growth.<br />

Major dem<strong>and</strong> components are likely to exp<strong>and</strong>. Private consumption will likely maintain<br />

modest but stable expansion on somewhat higher income growth in 2008. Business<br />

investment likely will increase amid capacity shortages <strong>and</strong> healthy profits at large firms,<br />

but investment at small firms should be soft. The negative impact of the revised Building<br />

St<strong>and</strong>ard Law on housing has already come to an end. Finally, exports are likely to<br />

maintain slower but solid growth because Japan’s exports are now much more diversified<br />

than in the past. For example, exports to oil-producing countries alone are pushing up<br />

overall exports by almost three percentage points. Exports to Asia will likely slow<br />

gradually as the negative impact of the U.S. slowdown dampens growth in the region.<br />

Underlying inflation will likely remain low in 2008. While year-to-year changes in core<br />

CPI are expected to reach the 1% mark in coming months, this is mostly attributable to<br />

surging energy <strong>and</strong> manufactured food prices. Core inflation adjusted for energy <strong>and</strong> food<br />

will likely remain low against the backdrop of near-trend growth <strong>and</strong> persistent declines in<br />

unit labor costs. Core inflation probably will slip again to about 0.3% by the end of 2008.<br />

We expect the next rate hike by the Bank of Japan (BoJ) to be delayed until the end of<br />

2008 or early 2009. Continued uncertainties surrounding the U.S. economy <strong>and</strong> global<br />

financial markets, combined with ambiguity regarding domestic growth prospects, will<br />

likely continue to dissuade the BoJ from raising policy rates until after the release of its<br />

October economic outlook. BoJ Governor Fukui will step down in March, but the basic<br />

thrust of monetary policy (that is, policy normalization) will be maintained.<br />

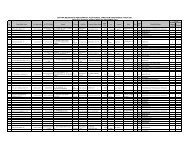

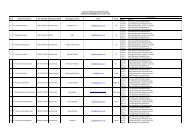

Figure 26. Japan — <strong>Economic</strong> Forecast, 2007-09F<br />

2007 2008<br />

2007F 2008F 2009F 2Q 3Q 4Q 1QF 2QF 3QF 4QF<br />

Real GDP YoY 2.1% 1.9% 1.7% 1.7% 1.9% 1.8% 1.4% 2.2% 2.3% 1.9%<br />

SAAR -1.4 1.3 3.7 2.0 2.0 1.5 2.0<br />

Domestic Dem<strong>and</strong> YoY 1.0 1.2 1.4 0.7 0.8 0.4 0.2 1.2 1.7 1.6<br />

SAAR -1.9 -0.7 2.1 1.5 1.8 1.5 1.7<br />

Private Consumption YoY 1.5 1.0 1.3 1.1 2.0 1.1 0.8 0.9 1.1 1.1<br />

SAAR 0.7 0.5 0.8 1.0 1.3 1.2 1.0<br />

Business Investment YoY 2.5 4.2 2.5 0.4 0.7 2.1 3.0 5.3 5.2 3.1<br />

SAAR -6.0 4.5 12.1 2.1 2.9 4.0 3.4<br />

Housing Investment YoY -9.3 0.4 4.8 -3.0 -11.4 -21.4 -13.5 -5.0 6.1 17.8<br />

Public Investment YoY -2.3 -4.6 -3.3 -1.9 1.0 -1.8 -7.0 -4.7 -3.3 -3.3<br />

Exports YoY 8.7 6.6 4.2 7.9 8.6 10.8 8.5 8.2 5.8 3.9<br />

SAAR 4.6 12.1 12.1 5.5 3.3 2.4 4.3<br />

Imports YoY 1.7 1.9 3.0 1.4 1.5 1.9 1.4 1.5 2.3 2.6<br />

SAAR 2.2 -0.5 1.9 2.0 2.5 2.9 2.9<br />

Core CPI YoY 0.0 0.7 0.3 -0.1 -0.1 0.4 0.9 0.8 0.7 0.5<br />

Nominal GDP YoY 1.3 1.4 1.8 1.2 1.1 0.7 0.3 1.5 1.8 2.0<br />

Current Account ¥ tn 25.0 25.0 27.9 26.1 24.9 26.3 26.1 25.2 23.8 24.8<br />

% of GDP 4.8 4.8 5.2 5.1 4.8 5.1 5.0 4.8 4.5 4.7<br />

Unemployment Rate % 3.9 3.9 3.7 3.8 3.8 3.9 3.9 3.9 3.9 3.8<br />

Industrial Production YoY 2.9 2.3 2.5 2.3 2.7 2.8 3.0 3.4 1.7 1.2<br />

Corporate Profits (Fiscal Year) YoY 6.0 4.0 5.0<br />

General Govt. Balance (Fiscal Year) % of GDP -2.8 -3.0 -3.1<br />

F Citi forecast. SAAR Seasonally adjusted annual rate. YoY Year-on-year percentage change. Corporate profits are TSE-I non-financials consolidated recurring profits. Source: Citi.<br />

21