Global Economic Outlook and Strategy - Kadin Indonesia

Global Economic Outlook and Strategy - Kadin Indonesia

Global Economic Outlook and Strategy - Kadin Indonesia

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

February 28, 2008<br />

<strong>Global</strong> <strong>Economic</strong> <strong>Outlook</strong> <strong>and</strong> <strong>Strategy</strong><br />

Jürgen Michels<br />

(44-20) 7986-3294<br />

juergen.michels<br />

@citi.com<br />

Jürgen Michels<br />

(44-20) 7986-3294<br />

juergen.michels<br />

@citi.com<br />

Michael Saunders<br />

(44-20) 7986-3299<br />

michael.saunders<br />

@citi.com<br />

Euro Area<br />

Germany<br />

While German consumption disappointed again at the end of 2007, recent activity <strong>and</strong><br />

confidence data suggest solid growth in the manufacturing sector. With ongoing job<br />

creation <strong>and</strong> rising wages, we continue to forecast a modest recovery in private<br />

consumption in 2008. However, we do not expect excessive wage gains that would be a<br />

threat to price stability. The recently negotiated 5% wage gain in the steel sector probably<br />

will not be the pattern for other sectors, although there is a chance that public sector trade<br />

unions will get a big increase from their 8% wage claim. With the shift to the left in the<br />

recent state elections, the gr<strong>and</strong> coalition probably will ease fiscal policy somewhat <strong>and</strong> is<br />

unlikely to implement structural reforms before the 2009 general election.<br />

France<br />

The moderation in French GDP growth at the end of 2007 was in line with expectations, but<br />

final domestic dem<strong>and</strong> surprised to the upside due to a pickup in capital spending growth.<br />

Buoyant construction activity is likely to boost investment growth at the beginning of 2008,<br />

but tighter financing conditions probably will lead to moderation in the rest of the year.<br />

However, the plunge in consumer confidence suggests that private consumption growth is<br />

likely to moderate further in early 2008. Furthermore, sluggish export growth probably will<br />

cap GDP growth in 2008. As the French government is unlikely to find support for<br />

undermining the value of the euro, President Nicolas Sarkozy’s administration probably will<br />

have to ease fiscal policy to keep growth from moderating, which could lead to further<br />

deterioration of the government’s public support.<br />

Italy<br />

Italian GDP growth probably sank into negative territory in the fourth quarter, prompting<br />

us to lower our 2008 forecast to well below trend. The expansion continues to<br />

underperform that of the euro area, reflecting worsening export performance <strong>and</strong> weak<br />

consumption. Political uncertainty — the government had to call snap elections after<br />

losing a confidence vote — is also making a dent in business <strong>and</strong> consumer confidence,<br />

<strong>and</strong> has virtually eliminated the chances of new reforms in the near term. The 2008 budget<br />

proposal was less ambitious than that of 2007. The implementation of the welfare accord is<br />

postponed, fiscal consolidation is diluted, <strong>and</strong> spending cuts are delayed. On a positive<br />

note, unemployment reached a record low in 2007.<br />

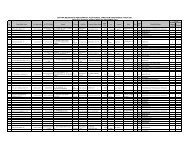

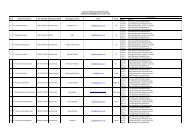

Figure 28. Germany, France, <strong>and</strong> Italy — <strong>Economic</strong> Forecast, 2007-09F<br />

Germany France Italy<br />

2007F 2008F 2009F 2007F 2008F 2009F 2007F 2008F 2009F<br />

Real GDP YoY 2.6% 1.6% 1.9% 1.9% 1.6% 1.6% 1.6% 0.8% 1.4%<br />

Final Domestic Dem<strong>and</strong> YoY 1.2 1.0 1.4 2.3 1.8 2.0 1.7 1.2 1.3<br />

Private Consumption YoY -0.5 1.0 1.2 2.0 1.6 1.9 1.8 0.8 1.4<br />

Fixed Investment YoY 5.3 1.1 2.6 3.9 3.0 3.1 2.9 2.3 2.2<br />

Exports YoY 8.0 5.2 6.0 2.7 1.1 2.8 2.1 0.6 3.2<br />

Imports YoY 5.0 4.0 5.9 3.6 2.1 3.7 2.3 1.5 2.9<br />

CPI YoY 2.1 1.8 1.6 1.5 2.2 1.4 2.2 2.5 1.8<br />

Unemployment Rate % 8.4 7.8 7.6 8.1 8.0 8.0 6.0 6.1 6.1<br />

Current Account bn 160.8 170.8 174.3 -23.5 -28.3 -30.3 -30.5 -25.0 -25.0<br />

% of GDP 6.6 6.8 6.8 -1.5 -1.7 -1.6 -2.0 -1.5 -1.5<br />

General Govt. Balance bn 0.4 -12.7 -17.6 -48.2 -55.8 -55.5 -35.7 -43.5 -48.0<br />

% of GDP 0.0 -0.5 -0.7 -2.6 -2.9 -2.8 -2.3 -2.7 -2.9<br />

General Govt. Debt % of GDP 62.7 61.3 60.6 66.8 67.6 68.1 104.5 103.0 102.4<br />

Gross Trading Profits YoY 6.9 3.5 6.5 4.1 2.6 3.8 5.0 3.5 3.6<br />

F Citi forecast. YoY Year-to-year growth rate. Note: The German annual figures are derived from quarterly Bundesbank data, <strong>and</strong> thus, adjusted for working days. The forecasts for GDP <strong>and</strong> its<br />

components are calendar adjusted. Sources: Deutsche Bundesbank, Statistisches Bundesamt, <strong>and</strong> Citi.<br />

23