Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

16 — 2010 <strong>FINANCIAL</strong> <strong>REPORT</strong><br />

These offers also benefi ted from regulatory changes authorising<br />

the increase in the prize payout to players. Finally, the football<br />

World Cup, a major sporting event, was a resounding success.<br />

4.1.2. Distribution of player stake<br />

The €10,551.4m in player stake were distributed between<br />

players, the hedging of counterparty risk, French public fi nance<br />

and la <strong>Française</strong> <strong>des</strong> <strong>Jeux</strong>.<br />

The amount paid out to players was €6,788.9m. This fi gure was<br />

up by 7.6% over 2009, mainly due to the increase in prize payout<br />

to players on sports betting, both in the brick-and-mortar network<br />

as well as online.<br />

Legislative changes authorised the increase in the maximum payout<br />

from an average of 75% to 85% and as a result, the rate of<br />

redistribution to players rose from 63.1% to 64.3%.<br />

Allocation to counterparty funds, net of counterparty spreads,<br />

totalled €76.1m and represented 0.7% of player stake in 2010<br />

compared to 0.4% in 2009. These funds are intended to hedge<br />

the counterparty risk of certain games, i.e. the risk that the total<br />

prize amount actually distributed to winners is higher than the share<br />

of player stake set aside for this purpose, in accordance with the<br />

requirements of the Budget Minister’s decree. The increase in net<br />

provisions is linked to the rise in player stake and changes in<br />

counterparty spreads.<br />

Government levies on player stake (including VAT on gaming<br />

revenue, tax on winnings and rounding of winnings, excluding the<br />

permanent fund surplus) totalled €2,516.0m, down 0.6% compared<br />

with 2009. These represented 23.8% of player stake, against 25.3%<br />

in 2009, a decline attributed to the increase in prize payouts to<br />

players.<br />

Gaming revenue corresponds to commissions paid to la <strong>Française</strong><br />

<strong>des</strong> <strong>Jeux</strong> and its distribution network, which totalled €1,170.4m, or<br />

11.1% of player stake, unchanged compared to 2009.<br />

4.1.3. Other revenue and other operating income<br />

Other revenue, mainly composed of rentals of point-of-sale<br />

(POS) terminals and equipment to retailers, totalled €25.4m, up<br />

3.9% compared to 2009 due to the increase in the number of<br />

real-time points of sale.<br />

Revenue from ordinary activities, composed of gaming<br />

revenue and other revenue, amou nted to €1,195.8m, against<br />

€1,138.4m in 2009.<br />

Other operating income consists primarily of unclaimed prizes<br />

on scratch games (+ €7.2m) and capitalised production (+ €2.8m).<br />

Operating income amounted to €1,256.1m, up 5.5% compared<br />

to 2009.<br />

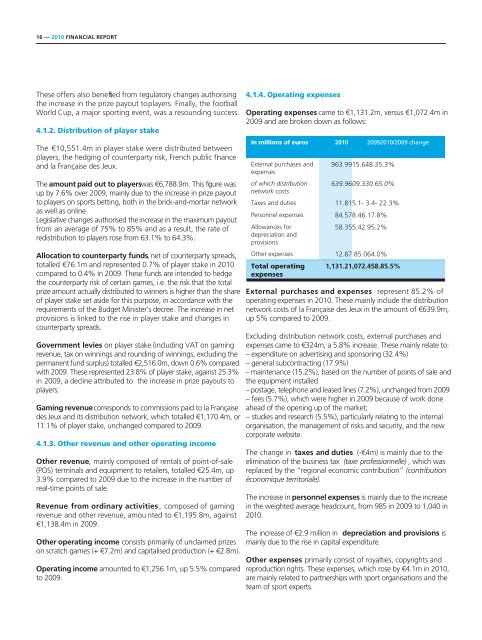

4.1.4. Operating expenses<br />

Operating expenses came to €1,131.2m, versus €1,072.4m in<br />

2009 and are broken down as follows:<br />

In millions of euros 2010 20092010/2009 change<br />

External purchases and<br />

expenses<br />

of which distribution<br />

network costs<br />

963.9915.648.35.3%<br />

639.9609.330.65.0%<br />

Taxes and duties 11.815.1- 3.4- 22.3%<br />

Personnel expenses 84.578.46.17.8%<br />

Allowances for<br />

depreciation and<br />

provisions<br />

58.355.42.95.2%<br />

Other expenses 12.87.85.064.0%<br />

Total operating<br />

expenses<br />

1,131.21,072.458.85.5%<br />

External purchases and expenses represent 85.2% of<br />

operating expenses in 2010. These mainly include the distribution<br />

network costs of la <strong>Française</strong> <strong>des</strong> <strong>Jeux</strong> in the amount of €639.9m,<br />

up 5% compared to 2009.<br />

Excluding distribution network costs, external purchases and<br />

expenses came to €324m, a 5.8% increase. These mainly relate to:<br />

– expenditure on advertising and sponsoring (32.4%)<br />

– general subcontracting (17.9%)<br />

– maintenance (15.2%), based on the number of points of sale and<br />

the equipment installed<br />

– postage, telephone and leased lines (7.2%), unchanged from 2009<br />

– fees (5.7%), which were higher in 2009 because of work done<br />

ahead of the opening up of the market;<br />

– studies and research (5.5%), particularly relating to the internal<br />

organisation, the management of risks and security, and the new<br />

corporate website.<br />

The change in taxes and duties (-€4m) is mainly due to the<br />

elimination of the business tax (taxe professionnelle) , which was<br />

replaced by the “regional economic contribution” (contribution<br />

économique territoriale).<br />

The increase in personnel expenses is mainly due to the increase<br />

in the weighted average headcount, from 985 in 2009 to 1,040 in<br />

2010.<br />

The increase of €2.9 million in depreciation and provisions is<br />

mainly due to the rise in capital expenditure.<br />

Other expenses primarily consist of royalties, copyrights and<br />

reproduction rights. These expenses, which rose by €4.1m in 2010,<br />

are mainly related to partnerships with sport organisations and the<br />

team of sport experts.