You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

74 — 2010 <strong>FINANCIAL</strong> <strong>REPORT</strong><br />

4.1. OPERATING PROFIT<br />

4.1.1. Operating income<br />

4<br />

NOTES TO THE INCOME STATEMENT<br />

This mainly consists of gaming revenue (€1,170.4m) which corresponds to the share of player stake allocated to la <strong>Française</strong> <strong>des</strong> <strong>Jeux</strong>,<br />

based on the rates set by current legislation.<br />

Revenue from other activities (€25.4m) consists mainly of products invoiced to retailers, sale agents and subsidiaries.<br />

Other operating income (€45.3m) consists of scratch card winnings that have not been claimed by players and which have lapsed.<br />

4.1.2. Other external purchases and expenses<br />

The costs of the distribution network of la <strong>Française</strong> <strong>des</strong> <strong>Jeux</strong>, in addition to repair and maintenance costs, general sub-contra cting<br />

costs, advertising and promotion expenditure, represent 89% of the total for this item.<br />

4.1.3. Personnel expenses and headcount<br />

The increase in personnel expenses was due mainly to the rise in the weighted headcount, which rose from 985 in 2009 to 1,040 in 2010.<br />

4.2. <strong>FINANCIAL</strong> RESULT<br />

Financial income amounted to €20.1m and notably inclu<strong>des</strong> income from transferable securities totalling €28.2m, or €24.9m of<br />

revenues and €3.3m of net proceeds from disposals, up €6.4m, mainly due to the maturing of two lines of investment. Moreover,<br />

given the volatility of rates, very few FRA and FLOOR contracts we re concluded in 2010 whilst the hedges put in place in 2009 had<br />

generated interest of more than €5.7m. Finally, fi nancial expenses include impairment lo sses on securities and current accounts.<br />

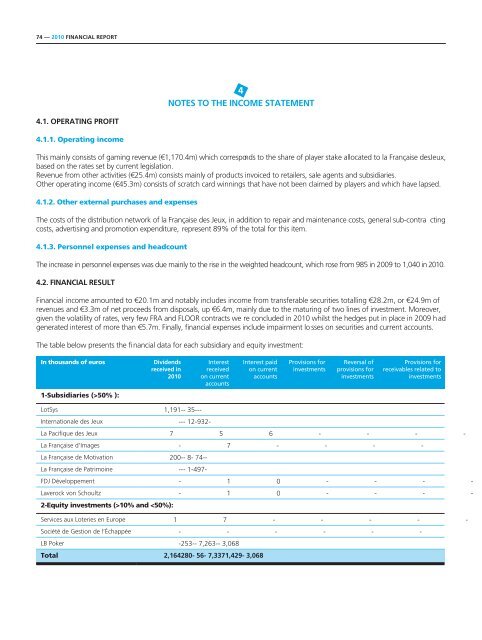

The table below presents the fi nancial data for each subsidiary and equity investment:<br />

In thousands of euros Dividends<br />

received in<br />

2010<br />

1-Subsidiaries (>50% ):<br />

LotSys 1,191-- 35---<br />

Internationale <strong>des</strong> <strong>Jeux</strong> --- 12-932-<br />

Interest<br />

received<br />

on current<br />

accounts<br />

Interest paid<br />

on current<br />

accounts<br />

Provisions for<br />

investments<br />

Reversal of<br />

provisions for<br />

investments<br />

Provisions for<br />

receivables related to<br />

investments<br />

La Pacifi que <strong>des</strong> <strong>Jeux</strong> 7 5 6 - - - -<br />

La <strong>Française</strong> d’Images - 7 - - - -<br />

La <strong>Française</strong> de Motivation 200-- 8- 74--<br />

La <strong>Française</strong> de Patrimoine --- 1-497-<br />

FDJ Développement - 1 0 - - - -<br />

Laverock von Schoultz - 1 0 - - - -<br />

2-Equity investments (>10% and