You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

8.2. LIQUIDITY RISK<br />

Liquidity risk is the risk of not being able to raise the funds<br />

necessary to meet future fi nancial obligations. In particular, the<br />

cash necessary to cover counterparty risks on certain games, for<br />

which amounts are potentially high, must be immediately available.<br />

It corresponds to the amounts recognised in the counterparty<br />

funds, the permanent fund (Note 11.2) and for extreme cases, in<br />

the statutory reserve fund. The allocation of investments at la<br />

<strong>Française</strong> <strong>des</strong> <strong>Jeux</strong> provi<strong>des</strong> that more than 45% of assets must<br />

be invested in standard short-term instruments (cash equivalents<br />

or current fi nancial assets). The Group has no debt.<br />

8.3. MARKET RISK<br />

8.3.1. Management of foreign exchange risk<br />

In its normal business activity, the Group is exposed to foreign<br />

exchange risks resulting from supplier invoices denominated in<br />

foreign currencies. The risk is measured in aggregate for each<br />

currency. The general Group policy is to hedge this risk over each<br />

budgetary period. The only currency to which the Group had<br />

signifi cant exposure during the fi scal year ended 31 December<br />

2010 is the US dollar, for a maximum equivalent of €18m.<br />

The fair value of the currency-based derivatives (forward purchase<br />

contracts) was a negative €436k in 2010, against a negative €88k<br />

in 2009.<br />

The fair value of these instruments, based on interest and<br />

exchange rates at the balance sheet date, is the amount the<br />

Group would expect to receive or pay if it were to cancel the<br />

position at that date.<br />

An increase of US$0.10 per €1.00 in the €/USD exchange rate for<br />

these derivatives held for economic hedging but not qualifi ed for<br />

hedge accounting would reduce the Group’s income by €1.0m.<br />

A decrease of US$0.10 would increase income by €1.2m.<br />

8.3.2. Management of interest rate risk<br />

LA FRANÇAISE DES JEUX — 51<br />

The Group’s exposure to changes in interest rates is due primarily<br />

to its forward investments. The Group implements a policy of<br />

dynamic interest rate risk management supervised by the Treasury<br />

Committee. The objective of this policy is to secure a minimum<br />

return, in the context of a maximum three-year investment horizon<br />

and using the three-month Euribor as the benchmark rate, for a<br />

portion of the amounts invested.<br />

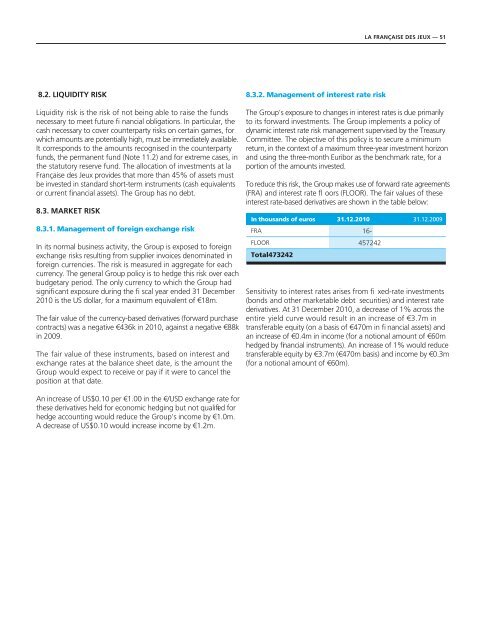

To reduce this risk, the Group makes use of forward rate agreements<br />

(FRA) and interest rate fl oors (FLOOR). The fair values of these<br />

interest rate-based derivatives are shown in the table below:<br />

In thousands of euros 31.12.2010 31.12.2009<br />

FRA 16-<br />

FLOOR 457242<br />

Total473242<br />

Sensitivity to interest rates arises from fi xed-rate investments<br />

(bonds and other marketable debt securities) and interest rate<br />

derivatives. At 31 December 2010, a decrease of 1% across the<br />

entire yield curve would result in an increase of €3.7m in<br />

transferable equity (on a basis of €470m in fi nancial assets) and<br />

an increase of €0.4m in income (for a notional amount of €60m<br />

hedged by fi nancial instruments). An increase of 1% would reduce<br />

transferable equity by €3.7m (€470m basis) and income by €0.3m<br />

(for a notional amount of €60m).