Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

1.3.2. LVS<br />

1.3.2.1. Acquisition of controlling interest in LVS<br />

To strengthen its technological expertise in online gaming, on<br />

23 March 2010 la <strong>Française</strong> <strong>des</strong> <strong>Jeux</strong> acquired UK software<br />

publisher LVS (Laverock von Schoultz). Based in London and an<br />

expert in Internet technologies, LVS is a European benchmark<br />

as a supplier of betting software platforms. Notably, it worked<br />

with la <strong>Française</strong> <strong>des</strong> <strong>Jeux</strong> to set up its new online sports betting<br />

offer, ParionsWeb, which was launched in November 2009. This<br />

confi rmed the Group’s positioning as an integrated operator in<br />

the fi eld of sports betting. In the retail network as on the<br />

Internet, this acquisition helps to ensure that the offer is highly<br />

responsive to players’ expectations, and to provide them with<br />

the highest level of security.<br />

Historic<br />

value<br />

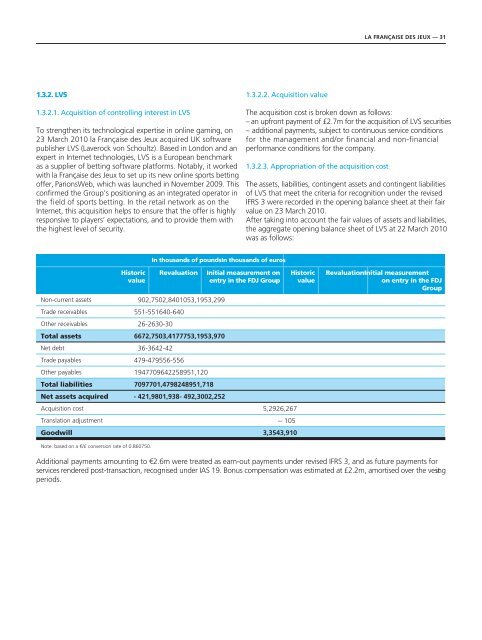

In thousands of poundsIn thousands of euros<br />

Revaluation Initial measurement on<br />

entry in the FDJ Group<br />

Non-current assets 902,7502,8401053,1953,299<br />

Trade receivables 551-551640-640<br />

Other receivables 26-2630-30<br />

Total assets 6672,7503,4177753,1953,970<br />

Net debt 36-3642-42<br />

Trade payables 479-479556-556<br />

Other payables 1947709642258951,120<br />

Total liabilities 7097701,4798248951,718<br />

Net assets acquired - 421,9801,938- 492,3002,252<br />

1.3.2.2. Acquisition value<br />

Acquisition cost 5,2926,267<br />

Translation adjustment -- 105<br />

Goodwill 3,3543,910<br />

Note: based on a €/£ conversion rate of 0.860750.<br />

LA FRANÇAISE DES JEUX — 31<br />

The acquisition cost is broken down as follows:<br />

– an upfront payment of £2.7m for the acquisition of LVS securities<br />

– additional payments, subject to continuous service conditions<br />

for the management and/or financial and non-financial<br />

performance conditions for the company.<br />

1.3.2.3. Appropriation of the acquisition cost<br />

The assets, liabilities, contingent assets and contingent liabilities<br />

of LVS that meet the criteria for recognition under the revised<br />

IFRS 3 were recorded in the opening balance sheet at their fair<br />

value on 23 March 2010.<br />

After taking into account the fair values of assets and liabilities,<br />

the aggregate opening balance sheet of LVS at 22 March 2010<br />

was as follows:<br />

Historic<br />

value<br />

RevaluationInitial measurement<br />

on entry in the FDJ<br />

Group<br />

Additional payments amounting to €2.6m were treated as earn-out payments under revised IFRS 3, and as future payments for<br />

services rendered post-transaction, recognised under IAS 19. Bonus compensation was estimated at £2.2m, amortised over the vest ing<br />

periods.