Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

44 — 2010 <strong>FINANCIAL</strong> <strong>REPORT</strong><br />

5.11.2. Reserves<br />

The Group’s business of organising and operating betting games involves specifi c risks and commitments of particular signifi cance<br />

which must be anticipated through appropriate coverage. Some of these risks and commitments are covered by the statutory reserve<br />

of €257m, created by la <strong>Française</strong> <strong>des</strong> <strong>Jeux</strong>.<br />

These risks are:<br />

– operating risks that may arise at any time during the life cycle of the games (<strong>des</strong>ign, game equipment production, logistics, marketing,<br />

etc.). They are measured, post-tax, at 0.3% of stakes, or €30m at the end of 2010, based on the 2009 fi nancial statements.<br />

– rare and extreme-case counterparty risks transcending current risks for which models are available; they are covered by counterparty<br />

funds and the permanent fund (Note 11.2). These risks are measured as and when a major change occurs in the gaming offer and<br />

in players’ behaviour. At the end of 2009, they were covered to €100m by the statutory reserve;<br />

– risks corresponding to the contractual liquidity commitment to the network of sale agents. These risks were measured, using a<br />

contractual formula, at a post-tax amount of €126.7m at 31 December 2010.<br />

5.12. PROVISIONS<br />

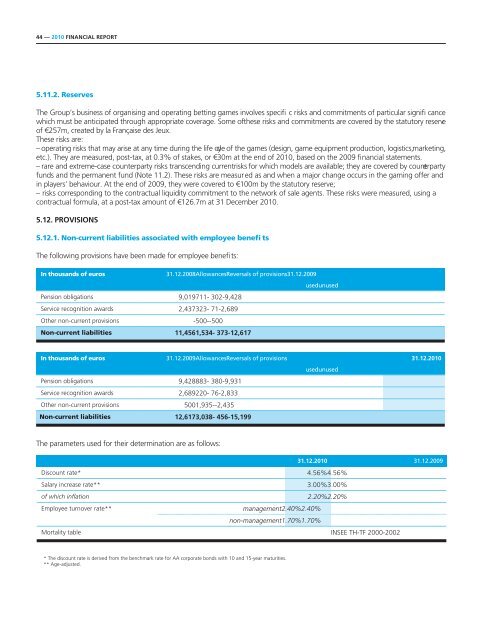

5.12.1. Non-current liabilities associated with employee benefi ts<br />

The following provisions have been made for employee benefi ts:<br />

In thousands of euros 31.12.2008AllowancesReversals of provisions31.12.2009<br />

usedunused<br />

Pension obligations 9,019711- 302-9,428<br />

Service recognition awards 2,437323- 71-2,689<br />

Other non-current provisions -500--500<br />

Non-current liabilities 11,4561,534- 373-12,617<br />

In thousands of euros 31.12.2009AllowancesReversals of provisions 31.12.2010<br />

usedunused<br />

Pension obligations 9,428883- 380-9,931<br />

Service recognition awards 2,689220- 76-2,833<br />

Other non-current provisions 5001,935--2,435<br />

Non-current liabilities 12,6173,038- 456-15,199<br />

The parameters used for their determination are as follows:<br />

31.12.2010 31.12.2009<br />

Discount rate* 4.56%4.56%<br />

Salary increase rate** 3.00%3.00%<br />

of which infl ation 2.20%2.20%<br />

Employee turnover rate** management2.40%2.40%<br />

non-management1.70%1.70%<br />

Mortality table INSEE TH-TF 2000-2002<br />

* The discount rate is derived from the benchmark rate for AA corporate bonds with 10 and 15-year maturities.<br />

** Age-adjusted.