Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

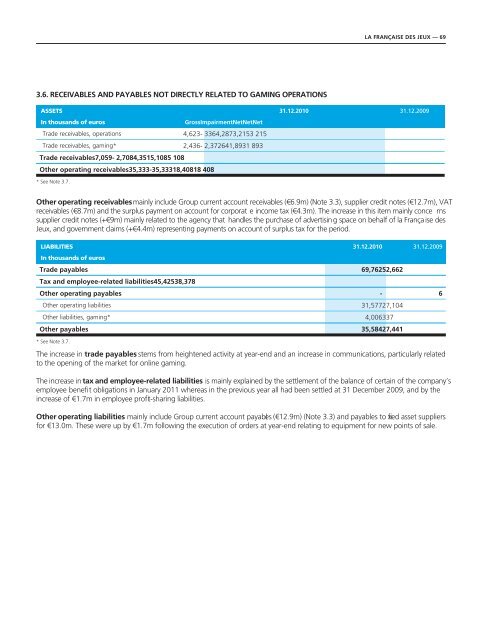

3.6. RECEIVABLES AND PAYABLES NOT DIRECTLY RELATED TO GAMING OPERATIONS<br />

LA FRANÇAISE DES JEUX — 69<br />

ASSETS 31.12.2010 31.12.2009<br />

In thousands of euros GrossImpairmentNetNetNet<br />

Trade receivables, operations 4,623- 3364,2873,2153 215<br />

Trade receivables, gaming* 2,436- 2,372641,8931 893<br />

Trade receivables7,059- 2,7084,3515,1085 108<br />

Other operating receivables35,333-35,33318,40818 408<br />

* See Note 3.7.<br />

Other operating receivables mainly include Group current account receivables (€6.9m) (Note 3.3), supplier credit notes (€12.7m), VAT<br />

receivables (€8.7m) and the surplus payment on account for corporat e income tax (€4.3m). The increase in this item mainly conce rns<br />

supplier credit notes (+€9m) mainly related to the agency that handles the purchase of advertising space on behalf of la França ise <strong>des</strong><br />

<strong>Jeux</strong>, and government claims (+€4.4m) representing payments on account of surplus tax for the period.<br />

LIABILITIES<br />

In thousands of euros<br />

31.12.2010 31.12.2009<br />

Trade payables<br />

Tax and employee-related liabilities45,42538,378<br />

69,76252,662<br />

Other operating payables - 6<br />

Other operating liabilities 31,57727,104<br />

Other liabilities, gaming* 4,006337<br />

Other payables 35,58427,441<br />

* See Note 3.7.<br />

The increase in trade payables stems from heightened activity at year-end and an increase in communications, particularly related<br />

to the opening of the market for online gaming.<br />

The increase in tax and employee-related liabilities is mainly explained by the settlement of the balance of certain of the company’s<br />

employee benefi t obligations in January 2011 whereas in the previous year all had been settled at 31 December 2009, and by the<br />

increase of €1.7m in employee profi t-sharing liabilities.<br />

Other operating liabilities mainly include Group current account payables (€12.9m) (Note 3.3) and payables to fixed<br />

asset suppliers<br />

for €13.0m. These were up by €1.7m following the execution of orders at year-end relating to equipment for new points of sale.