National Horticultural Research Network - Horticulture Industry ...

National Horticultural Research Network - Horticulture Industry ...

National Horticultural Research Network - Horticulture Industry ...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

<strong>National</strong> <strong>Horticultural</strong> <strong>Research</strong> <strong>Network</strong><br />

Vegetable Sector RD&E Framework September 2010<br />

_____________________________________________________________________________________________________<br />

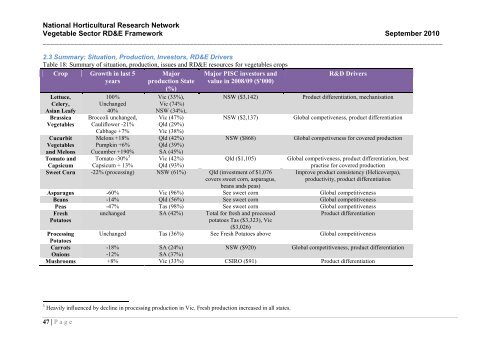

2.3 Summary: Situation, Production, Investors, RD&E Drivers<br />

Table 18: Summary of situation, production, issues and RD&E resources for vegetables crops<br />

Crop Growth in last 5<br />

years<br />

Major<br />

production State<br />

(%)<br />

Major PISC investors and<br />

value in 2008/09 ($’000)<br />

Lettuce,<br />

Celery,<br />

Asian Leafy<br />

Brassica<br />

Vegetables<br />

Cucurbit<br />

Vegetables<br />

and Melons<br />

Tomato and<br />

100%<br />

Unchanged<br />

40%<br />

Broccoli unchanged,<br />

Cauliflower -21%<br />

Cabbage +7%<br />

Melons +18%<br />

Pumpkin +6%<br />

Cucumber +190%<br />

Tomato -30% 3<br />

Vic (33%),<br />

Vic (74%)<br />

NSW (34%),<br />

Vic (47%)<br />

Qld (29%)<br />

Vic (38%)<br />

Qld (42%)<br />

Qld (39%)<br />

SA (45%)<br />

Vic (42%)<br />

NSW ($3,142)<br />

NSW ($2,137)<br />

NSW ($868)<br />

Qld ($1,105)<br />

Capsicum Capsicum + 13% Qld (93%)<br />

Sweet Corn -22% (processing) NSW (61%) Qld (investment of $1,076<br />

covers sweet corn, asparagus,<br />

beans ands peas)<br />

R&D Drivers<br />

Product differentiation, mechanisation<br />

Global competiveness, product differentiation<br />

Global competiveness for covered production<br />

Global competiveness, product differentiation, best<br />

practise for covered production<br />

Improve product consistency (Helicoverpa),<br />

productivity, product differentiation<br />

Asparagus -60% Vic (96%) See sweet corn Global competitiveness<br />

Beans -14% Qld (56%) See sweet corn Global competitiveness<br />

Peas -47% Tas (98%) See sweet corn Global competitiveness<br />

Fresh<br />

Potatoes<br />

unchanged SA (42%) Total for fresh and processed<br />

potatoes Tas ($3,323), Vic<br />

($3,026)<br />

Product differentiation<br />

Processing Unchanged Tas (36%) See Fresh Potatoes above Global competitiveness<br />

Potatoes<br />

Carrots<br />

-18%<br />

SA (24%)<br />

NSW ($920)<br />

Global competitiveness, product differentiation<br />

Onions<br />

-12%<br />

SA (37%)<br />

Mushrooms +8% Vic (33%) CSIRO ($91) Product differentiation<br />

3 Heavily influenced by decline in processing production in Vic. Fresh production increased in all states.<br />

47 | P a g e