National Horticultural Research Network - Horticulture Industry ...

National Horticultural Research Network - Horticulture Industry ...

National Horticultural Research Network - Horticulture Industry ...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

<strong>National</strong> <strong>Horticultural</strong> <strong>Research</strong> <strong>Network</strong><br />

Lifestyle Sector RD&E Framework September 2010<br />

_______________________________________________________________________________________________________<br />

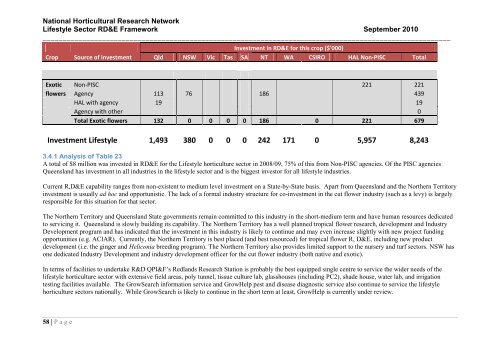

Investment in RD&E for this crop ($'000)<br />

Crop Source of investment Qld NSW Vic Tas SA NT WA CSIRO HAL Non-PISC Total<br />

Exotic Non-PISC 221 221<br />

flowers Agency 113 76 186 439<br />

HAL with agency 19 19<br />

Agency with other 0<br />

Total Exotic flowers 132 0 0 0 0 186 0 221 679<br />

Investment Lifestyle 1,493 380 0 0 0 242 171 0 5,957 8,243<br />

3.4.1 Analysis of Table 23<br />

A total of $8 million was invested in RD&E for the Lifestyle horticulture sector in 2008/09, 75% of this from Non-PISC agencies. Of the PISC agencies<br />

Queensland has investment in all industries in the lifestyle sector and is the biggest investor for all lifestyle industries.<br />

Current R,D&E capability ranges from non-existent to medium level investment on a State-by-State basis. Apart from Queensland and the Northern Territory<br />

investment is usually ad hoc and opportunistic. The lack of a formal industry structure for co-investment in the cut flower industry (such as a levy) is largely<br />

responsible for this situation for that sector.<br />

The Northern Territory and Queensland State governments remain committed to this industry in the short-medium term and have human resources dedicated<br />

to servicing it. Queensland is slowly building its capability. The Northern Territory has a well planned tropical flower research, development and <strong>Industry</strong><br />

Development program and has indicated that the investment in this industry is likely to continue and may even increase slightly with new project funding<br />

opportunities (e.g. ACIAR). Currently, the Northern Territory is best placed (and best resourced) for tropical flower R, D&E, including new product<br />

development (i.e. the ginger and Heliconia breeding program). The Northern Territory also provides limited support to the nursery and turf sectors. NSW has<br />

one dedicated <strong>Industry</strong> Development and industry development officer for the cut flower industry (both native and exotic).<br />

In terms of facilities to undertake R&D QPI&F‟s Redlands <strong>Research</strong> Station is probably the best equipped single centre to service the wider needs of the<br />

lifestyle horticulture sector with extensive field areas, poly tunnel, tissue culture lab, glasshouses (including PC2), shade house, water lab, and irrigation<br />

testing facilities available. The GrowSearch information service and GrowHelp pest and disease diagnostic service also continue to service the lifestyle<br />

horticulture sectors nationally. While GrowSearch is likely to continue in the short term at least, GrowHelp is currently under review.<br />

58 | P a g e