Annual Report 2012 - Fingrid

Annual Report 2012 - Fingrid

Annual Report 2012 - Fingrid

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

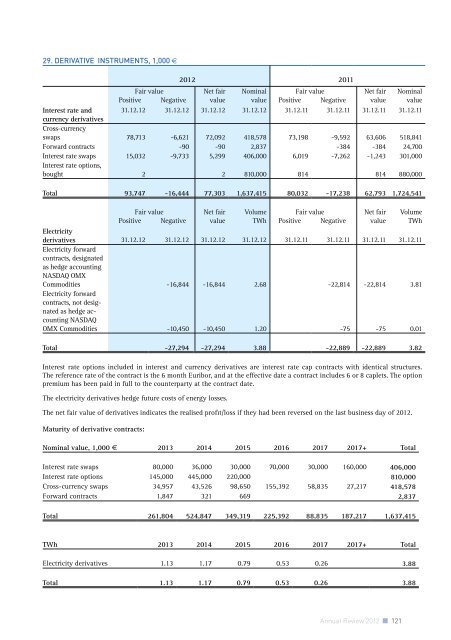

29. DERIVATIVE INSTRUMENTS, 1,000 €<br />

<strong>2012</strong> 2011<br />

Fair value<br />

Net fair Nominal Fair value<br />

Net fair Nominal<br />

Positive Negative value value Positive Negative value value<br />

Interest rate and 31.12.12 31.12.12 31.12.12 31.12.12 31.12.11 31.12.11 31.12.11 31.12.11<br />

currency derivatives<br />

Cross-currency<br />

swaps 78,713 -6,621 72,092 418,578 73,198 -9,592 63,606 518,841<br />

Forward contracts -90 -90 2,837 -384 -384 24,700<br />

Interest rate swaps 15,032 -9,733 5,299 406,000 6,019 -7,262 -1,243 301,000<br />

Interest rate options,<br />

bought 2 2 810,000 814 814 880,000<br />

Total 93,747 -16,444 77,303 1,637,415 80,032 -17,238 62,793 1,724,541<br />

Fair value<br />

Positive Negative<br />

Net fair<br />

value<br />

Volume<br />

TWh<br />

Fair value<br />

Positive Negative<br />

Net fair<br />

value<br />

Volume<br />

TWh<br />

Electricity<br />

derivatives 31.12.12 31.12.12 31.12.12 31.12.12 31.12.11 31.12.11 31.12.11 31.12.11<br />

Electricity forward<br />

contracts, designated<br />

as hedge accounting<br />

NASDAQ OMX<br />

Commodities -16,844 -16,844 2.68 -22,814 -22,814 3.81<br />

Electricity forward<br />

contracts, not designated<br />

as hedge accounting<br />

NASDAQ<br />

OMX Commodities -10,450 -10,450 1.20 -75 -75 0.01<br />

Total -27,294 -27,294 3.88 -22,889 -22,889 3.82<br />

Interest rate options included in interest and currency derivatives are interest rate cap contracts with identical structures.<br />

The reference rate of the contract is the 6 month Euribor, and at the effective date a contract includes 6 or 8 caplets. The option<br />

premium has been paid in full to the counterparty at the contract date.<br />

The electricity derivatives hedge future costs of energy losses.<br />

The net fair value of derivatives indicates the realised profit/loss if they had been reversed on the last business day of <strong>2012</strong>.<br />

Maturity of derivative contracts:<br />

Nominal value, 1,000 € 2013 2014 2015 2016 2017 2017+ Total<br />

Interest rate swaps 80,000 36,000 30,000 70,000 30,000 160,000 406,000<br />

Interest rate options 145,000 445,000 220,000 810,000<br />

Cross-currency swaps 34,957 43,526 98,650 155,392 58,835 27,217 418,578<br />

Forward contracts 1,847 321 669 2,837<br />

Total 261,804 524,847 349,319 225,392 88,835 187,217 1,637,415<br />

TWh 2013 2014 2015 2016 2017 2017+ Total<br />

Electricity derivatives 1.13 1.17 0.79 0.53 0.26 3.88<br />

Total 1.13 1.17 0.79 0.53 0.26 3.88<br />

<strong>Annual</strong> Review <strong>2012</strong> 121