Market Economics | Interest Rate Strategy - BNP PARIBAS ...

Market Economics | Interest Rate Strategy - BNP PARIBAS ...

Market Economics | Interest Rate Strategy - BNP PARIBAS ...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

flattening in a rally and steepening in a sell-off. That<br />

is not so much the case for 5s10s, as this spread<br />

shows little directionality (Chart 1). This, combined<br />

with other factors, leads us to favor the 10y sector<br />

along the curve (see “Treasury Curve and Fly<br />

Opportunities” in this <strong>Market</strong> Mover for more details).<br />

We express this view through a 5s10s flattener. We<br />

started to scale into this position at 138.5bp.<br />

Next we turn to allocation among various products<br />

within rates.<br />

Mortgages look fair but are likely to continue to<br />

perform well<br />

With the majority of convexity selling done, we turned<br />

overweight on mortgages as convexity hedging in the<br />

sell-off left mortgages cheap. Since then, lower<br />

coupon mortgages have tightened especially on a<br />

nominal basis, while not as much on an OAS basis<br />

since the decline in volatility has kept OASs in check.<br />

While our regression shows mortgages are fair at this<br />

point (Chart 2), we continue to remain overweight as<br />

we expect new origination to be low as the majority<br />

of the refinanceable universe is now out-of-money.<br />

Despite an increase over the past two weeks, the<br />

refinancing index is still about 60% below the highs<br />

of 2010 and is at the lower end of the series over the<br />

past couple years (Chart 3). Lower refinancing<br />

signals slower prepayments, which was confirmed<br />

with December’s prepayment report, in which speeds<br />

were around 5% slower. Over the next couple of<br />

months, we expect speeds to decline by another<br />

50%. Refinancing accounted for around 80% of new<br />

origination in 2010, so lower refinancing activity<br />

should cause a drop in origination, which should in<br />

turn be supportive of the basis.<br />

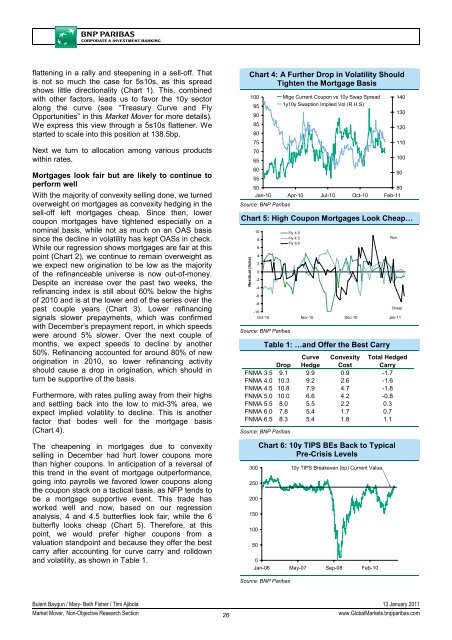

Furthermore, with rates pulling away from their highs<br />

and settling back into the low to mid-3% area, we<br />

expect implied volatility to decline. This is another<br />

factor that bodes well for the mortgage basis<br />

(Chart 4).<br />

The cheapening in mortgages due to convexity<br />

selling in December had hurt lower coupons more<br />

than higher coupons. In anticipation of a reversal of<br />

this trend in the event of mortgage outperformance,<br />

going into payrolls we favored lower coupons along<br />

the coupon stack on a tactical basis, as NFP tends to<br />

be a mortgage supportive event. This trade has<br />

worked well and now, based on our regression<br />

analysis, 4 and 4.5 butterflies look fair, while the 6<br />

butterfly looks cheap (Chart 5). Therefore, at this<br />

point, we would prefer higher coupons from a<br />

valuation standpoint and because they offer the best<br />

carry after accounting for curve carry and rolldown<br />

and volatility, as shown in Table 1.<br />

Chart 4: A Further Drop in Volatility Should<br />

Tighten the Mortgage Basis<br />

100<br />

95<br />

Mtge Current Coupon vs 10y Swap Spread<br />

1y10y Swaption Implied Vol (R.H.S)<br />

140<br />

90<br />

130<br />

85<br />

120<br />

80<br />

75<br />

110<br />

70<br />

65<br />

100<br />

60<br />

90<br />

55<br />

50<br />

80<br />

Jan-10 Apr-10 Jul-10 Oct-10 Feb-11<br />

Source: <strong>BNP</strong> Paribas<br />

Chart 5: High Coupon Mortgages Look Cheap…<br />

Residual (ticks)<br />

10<br />

8<br />

6<br />

4<br />

2<br />

0<br />

-2<br />

-4<br />

-6<br />

Fly 4.0<br />

Fly 4.5<br />

Fly 6.0<br />

-8<br />

Cheap<br />

-10<br />

Oct-10 Nov-10 Dec-10 Jan-11<br />

Source: <strong>BNP</strong> Paribas<br />

Table 1: …and Offer the Best Carry<br />

Drop<br />

Curve<br />

Hedge<br />

Convexity<br />

Cost<br />

Total Hedged<br />

Carry<br />

FNMA 3.5 9.1 9.9 0.9 -1.7<br />

FNMA 4.0 10.3 9.2 2.6 -1.6<br />

FNMA 4.5 10.8 7.9 4.7 -1.8<br />

FNMA 5.0 10.0 6.6 4.2 -0.8<br />

FNMA 5.5 8.0 5.5 2.2 0.3<br />

FNMA 6.0 7.8 5.4 1.7 0.7<br />

FNMA 6.5 8.3 5.4 1.8 1.1<br />

Source: <strong>BNP</strong> Paribas<br />

300<br />

250<br />

200<br />

150<br />

100<br />

50<br />

Chart 6: 10y TIPS BEs Back to Typical<br />

Pre-Crisis Levels<br />

10y TIPS Breakeven (bp) Current Value<br />

0<br />

Jan-06 May-07 Sep-08 Feb-10<br />

Rich<br />

Source: <strong>BNP</strong> Paribas<br />

Bulent Baygun / Mary- Beth Fisher / Timi Ajibola 13 January 2011<br />

<strong>Market</strong> Mover, Non-Objective Research Section<br />

26<br />

www.Global<strong>Market</strong>s.bnpparibas.com