regulatory and compliance issues and considerations

regulatory and compliance issues and considerations

regulatory and compliance issues and considerations

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

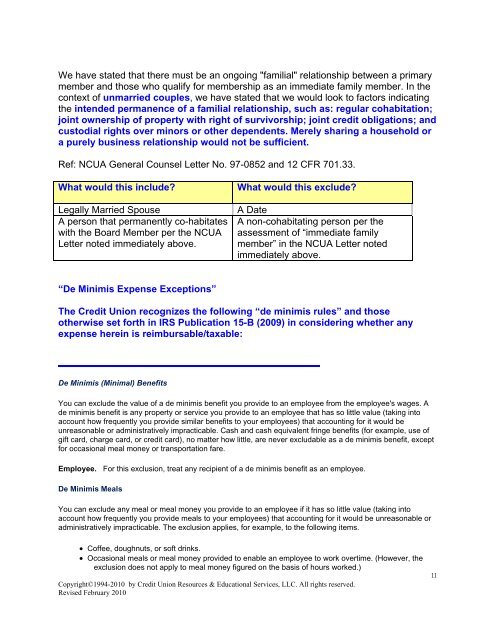

We have stated that there must be an ongoing "familial" relationship between a primary<br />

member <strong>and</strong> those who qualify for membership as an immediate family member. In the<br />

context of unmarried couples, we have stated that we would look to factors indicating<br />

the intended permanence of a familial relationship, such as: regular cohabitation;<br />

joint ownership of property with right of survivorship; joint credit obligations; <strong>and</strong><br />

custodial rights over minors or other dependents. Merely sharing a household or<br />

a purely business relationship would not be sufficient.<br />

Ref: NCUA General Counsel Letter No. 97-0852 <strong>and</strong> 12 CFR 701.33.<br />

What would this include?<br />

Legally Married Spouse<br />

A person that permanently co-habitates<br />

with the Board Member per the NCUA<br />

Letter noted immediately above.<br />

What would this exclude?<br />

A Date<br />

A non-cohabitating person per the<br />

assessment of “immediate family<br />

member” in the NCUA Letter noted<br />

immediately above.<br />

“De Minimis Expense Exceptions”<br />

The Credit Union recognizes the following “de minimis rules” <strong>and</strong> those<br />

otherwise set forth in IRS Publication 15-B (2009) in considering whether any<br />

expense herein is reimbursable/taxable:<br />

De Minimis (Minimal) Benefits<br />

You can exclude the value of a de minimis benefit you provide to an employee from the employee's wages. A<br />

de minimis benefit is any property or service you provide to an employee that has so little value (taking into<br />

account how frequently you provide similar benefits to your employees) that accounting for it would be<br />

unreasonable or administratively impracticable. Cash <strong>and</strong> cash equivalent fringe benefits (for example, use of<br />

gift card, charge card, or credit card), no matter how little, are never excludable as a de minimis benefit, except<br />

for occasional meal money or transportation fare.<br />

Employee. For this exclusion, treat any recipient of a de minimis benefit as an employee.<br />

De Minimis Meals<br />

You can exclude any meal or meal money you provide to an employee if it has so little value (taking into<br />

account how frequently you provide meals to your employees) that accounting for it would be unreasonable or<br />

administratively impracticable. The exclusion applies, for example, to the following items.<br />

• Coffee, doughnuts, or soft drinks.<br />

• Occasional meals or meal money provided to enable an employee to work overtime. (However, the<br />

exclusion does not apply to meal money figured on the basis of hours worked.)<br />

Copyright©1994-2010 by Credit Union Resources & Educational Services, LLC. All rights reserved.<br />

Revised February 2010<br />

11