regulatory and compliance issues and considerations

regulatory and compliance issues and considerations

regulatory and compliance issues and considerations

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

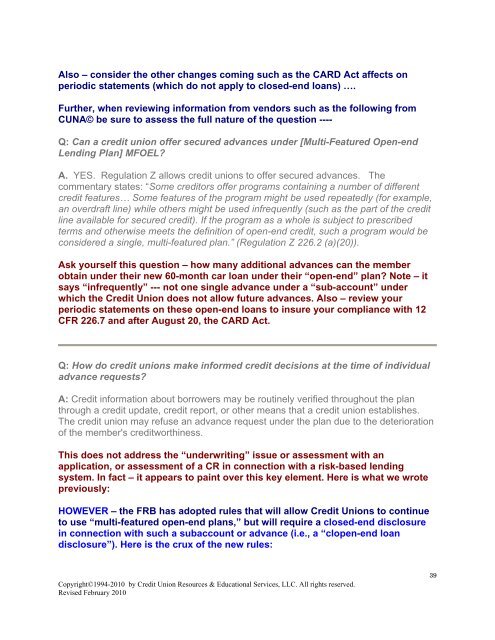

Also – consider the other changes coming such as the CARD Act affects on<br />

periodic statements (which do not apply to closed-end loans) ….<br />

Further, when reviewing information from vendors such as the following from<br />

CUNA© be sure to assess the full nature of the question ----<br />

Q: Can a credit union offer secured advances under [Multi-Featured Open-end<br />

Lending Plan] MFOEL?<br />

A. YES. Regulation Z allows credit unions to offer secured advances. The<br />

commentary states: “Some creditors offer programs containing a number of different<br />

credit features… Some features of the program might be used repeatedly (for example,<br />

an overdraft line) while others might be used infrequently (such as the part of the credit<br />

line available for secured credit). If the program as a whole is subject to prescribed<br />

terms <strong>and</strong> otherwise meets the definition of open-end credit, such a program would be<br />

considered a single, multi-featured plan.” (Regulation Z 226.2 (a)(20)).<br />

Ask yourself this question – how many additional advances can the member<br />

obtain under their new 60-month car loan under their “open-end” plan? Note – it<br />

says “infrequently” --- not one single advance under a “sub-account” under<br />

which the Credit Union does not allow future advances. Also – review your<br />

periodic statements on these open-end loans to insure your <strong>compliance</strong> with 12<br />

CFR 226.7 <strong>and</strong> after August 20, the CARD Act.<br />

Q: How do credit unions make informed credit decisions at the time of individual<br />

advance requests?<br />

A: Credit information about borrowers may be routinely verified throughout the plan<br />

through a credit update, credit report, or other means that a credit union establishes.<br />

The credit union may refuse an advance request under the plan due to the deterioration<br />

of the member's creditworthiness.<br />

This does not address the “underwriting” issue or assessment with an<br />

application, or assessment of a CR in connection with a risk-based lending<br />

system. In fact – it appears to paint over this key element. Here is what we wrote<br />

previously:<br />

HOWEVER – the FRB has adopted rules that will allow Credit Unions to continue<br />

to use “multi-featured open-end plans,” but will require a closed-end disclosure<br />

in connection with such a subaccount or advance (i.e., a “clopen-end loan<br />

disclosure”). Here is the crux of the new rules:<br />

Copyright©1994-2010 by Credit Union Resources & Educational Services, LLC. All rights reserved.<br />

Revised February 2010<br />

39