regulatory and compliance issues and considerations

regulatory and compliance issues and considerations

regulatory and compliance issues and considerations

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

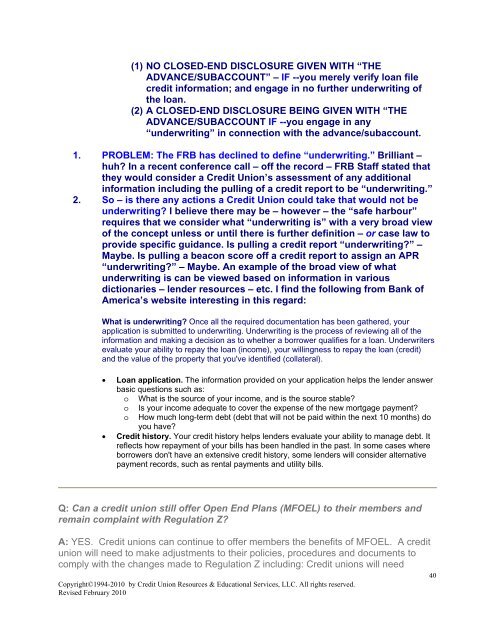

(1) NO CLOSED-END DISCLOSURE GIVEN WITH “THE<br />

ADVANCE/SUBACCOUNT” – IF --you merely verify loan file<br />

credit information; <strong>and</strong> engage in no further underwriting of<br />

the loan.<br />

(2) A CLOSED-END DISCLOSURE BEING GIVEN WITH “THE<br />

ADVANCE/SUBACCOUNT IF --you engage in any<br />

“underwriting” in connection with the advance/subaccount.<br />

1. PROBLEM: The FRB has declined to define “underwriting.” Brilliant –<br />

huh? In a recent conference call – off the record – FRB Staff stated that<br />

they would consider a Credit Union’s assessment of any additional<br />

information including the pulling of a credit report to be “underwriting.”<br />

2. So – is there any actions a Credit Union could take that would not be<br />

underwriting? I believe there may be – however – the “safe harbour”<br />

requires that we consider what “underwriting is” with a very broad view<br />

of the concept unless or until there is further definition – or case law to<br />

provide specific guidance. Is pulling a credit report “underwriting?” –<br />

Maybe. Is pulling a beacon score off a credit report to assign an APR<br />

“underwriting?” – Maybe. An example of the broad view of what<br />

underwriting is can be viewed based on information in various<br />

dictionaries – lender resources – etc. I find the following from Bank of<br />

America’s website interesting in this regard:<br />

What is underwriting? Once all the required documentation has been gathered, your<br />

application is submitted to underwriting. Underwriting is the process of reviewing all of the<br />

information <strong>and</strong> making a decision as to whether a borrower qualifies for a loan. Underwriters<br />

evaluate your ability to repay the loan (income), your willingness to repay the loan (credit)<br />

<strong>and</strong> the value of the property that you've identified (collateral).<br />

• Loan application. The information provided on your application helps the lender answer<br />

basic questions such as:<br />

o What is the source of your income, <strong>and</strong> is the source stable?<br />

o Is your income adequate to cover the expense of the new mortgage payment?<br />

o How much long-term debt (debt that will not be paid within the next 10 months) do<br />

you have?<br />

• Credit history. Your credit history helps lenders evaluate your ability to manage debt. It<br />

reflects how repayment of your bills has been h<strong>and</strong>led in the past. In some cases where<br />

borrowers don't have an extensive credit history, some lenders will consider alternative<br />

payment records, such as rental payments <strong>and</strong> utility bills.<br />

Q: Can a credit union still offer Open End Plans (MFOEL) to their members <strong>and</strong><br />

remain complaint with Regulation Z?<br />

A: YES. Credit unions can continue to offer members the benefits of MFOEL. A credit<br />

union will need to make adjustments to their policies, procedures <strong>and</strong> documents to<br />

comply with the changes made to Regulation Z including: Credit unions will need<br />

Copyright©1994-2010 by Credit Union Resources & Educational Services, LLC. All rights reserved.<br />

Revised February 2010<br />

40