regulatory and compliance issues and considerations

regulatory and compliance issues and considerations

regulatory and compliance issues and considerations

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

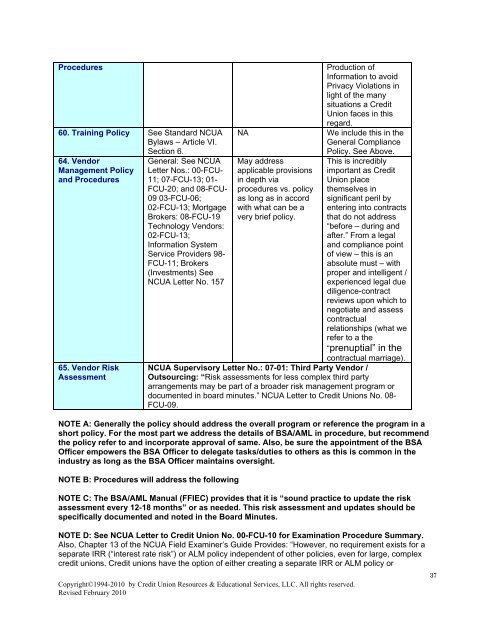

Procedures<br />

60. Training Policy See St<strong>and</strong>ard NCUA<br />

Bylaws – Article VI.<br />

Section 6.<br />

64. Vendor<br />

Management Policy<br />

<strong>and</strong> Procedures<br />

65. Vendor Risk<br />

Assessment<br />

General: See NCUA<br />

Letter Nos.: 00-FCU-<br />

11; 07-FCU-13; 01-<br />

FCU-20; <strong>and</strong> 08-FCU-<br />

09 03-FCU-06;<br />

02-FCU-13; Mortgage<br />

Brokers: 08-FCU-19<br />

Technology Vendors:<br />

02-FCU-13;<br />

Information System<br />

Service Providers 98-<br />

FCU-11; Brokers<br />

(Investments) See<br />

NCUA Letter No. 157<br />

Copyright©1994-2010 by Credit Union Resources & Educational Services, LLC. All rights reserved.<br />

Revised February 2010<br />

NA<br />

May address<br />

applicable provisions<br />

in depth via<br />

procedures vs. policy<br />

as long as in accord<br />

with what can be a<br />

very brief policy.<br />

Production of<br />

Information to avoid<br />

Privacy Violations in<br />

light of the many<br />

situations a Credit<br />

Union faces in this<br />

regard.<br />

We include this in the<br />

General Compliance<br />

Policy. See Above.<br />

This is incredibly<br />

important as Credit<br />

Union place<br />

themselves in<br />

significant peril by<br />

entering into contracts<br />

that do not address<br />

“before – during <strong>and</strong><br />

after.” From a legal<br />

<strong>and</strong> <strong>compliance</strong> point<br />

of view – this is an<br />

absolute must – with<br />

proper <strong>and</strong> intelligent /<br />

experienced legal due<br />

diligence-contract<br />

reviews upon which to<br />

negotiate <strong>and</strong> assess<br />

contractual<br />

relationships (what we<br />

refer to a the<br />

“prenuptial” in the<br />

contractual marriage).<br />

NCUA Supervisory Letter No.: 07-01: Third Party Vendor /<br />

Outsourcing: “Risk assessments for less complex third party<br />

arrangements may be part of a broader risk management program or<br />

documented in board minutes.” NCUA Letter to Credit Unions No. 08-<br />

FCU-09.<br />

NOTE A: Generally the policy should address the overall program or reference the program in a<br />

short policy. For the most part we address the details of BSA/AML in procedure, but recommend<br />

the policy refer to <strong>and</strong> incorporate approval of same. Also, be sure the appointment of the BSA<br />

Officer empowers the BSA Officer to delegate tasks/duties to others as this is common in the<br />

industry as long as the BSA Officer maintains oversight.<br />

NOTE B: Procedures will address the following<br />

NOTE C: The BSA/AML Manual (FFIEC) provides that it is “sound practice to update the risk<br />

assessment every 12-18 months” or as needed. This risk assessment <strong>and</strong> updates should be<br />

specifically documented <strong>and</strong> noted in the Board Minutes.<br />

NOTE D: See NCUA Letter to Credit Union No. 00-FCU-10 for Examination Procedure Summary.<br />

Also, Chapter 13 of the NCUA Field Examiner’s Guide Provides: “However, no requirement exists for a<br />

separate IRR (“interest rate risk”) or ALM policy independent of other policies, even for large, complex<br />

credit unions. Credit unions have the option of either creating a separate IRR or ALM policy or<br />

37