regulatory and compliance issues and considerations

regulatory and compliance issues and considerations

regulatory and compliance issues and considerations

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

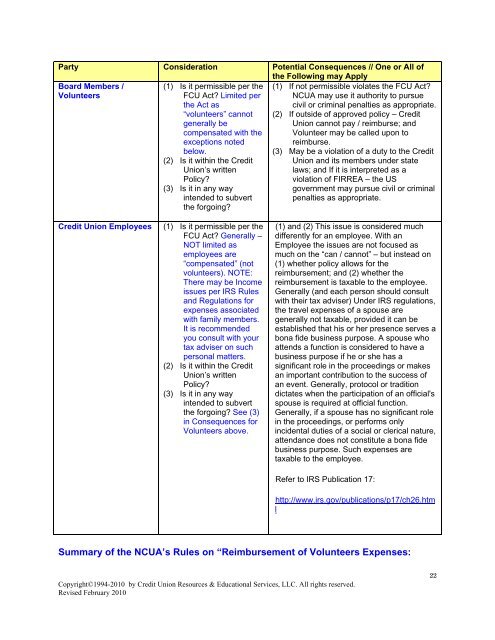

Party Consideration Potential Consequences // One or All of<br />

the Following may Apply<br />

Board Members /<br />

Volunteers<br />

(1) Is it permissible per the<br />

FCU Act? Limited per<br />

the Act as<br />

“volunteers” cannot<br />

generally be<br />

compensated with the<br />

exceptions noted<br />

below.<br />

(2) Is it within the Credit<br />

Union’s written<br />

Policy?<br />

(3) Is it in any way<br />

intended to subvert<br />

the forgoing?<br />

(1) If not permissible violates the FCU Act?<br />

NCUA may use it authority to pursue<br />

civil or criminal penalties as appropriate.<br />

(2) If outside of approved policy – Credit<br />

Union cannot pay / reimburse; <strong>and</strong><br />

Volunteer may be called upon to<br />

reimburse.<br />

(3) May be a violation of a duty to the Credit<br />

Union <strong>and</strong> its members under state<br />

laws; <strong>and</strong> If it is interpreted as a<br />

violation of FIRREA – the US<br />

government may pursue civil or criminal<br />

penalties as appropriate.<br />

Credit Union Employees<br />

(1) Is it permissible per the<br />

FCU Act? Generally –<br />

NOT limited as<br />

employees are<br />

“compensated” (not<br />

volunteers). NOTE:<br />

There may be Income<br />

<strong>issues</strong> per IRS Rules<br />

<strong>and</strong> Regulations for<br />

expenses associated<br />

with family members.<br />

It is recommended<br />

you consult with your<br />

tax adviser on such<br />

personal matters.<br />

(2) Is it within the Credit<br />

Union’s written<br />

Policy?<br />

(3) Is it in any way<br />

intended to subvert<br />

the forgoing? See (3)<br />

in Consequences for<br />

Volunteers above.<br />

(1) <strong>and</strong> (2) This issue is considered much<br />

differently for an employee. With an<br />

Employee the <strong>issues</strong> are not focused as<br />

much on the “can / cannot” – but instead on<br />

(1) whether policy allows for the<br />

reimbursement; <strong>and</strong> (2) whether the<br />

reimbursement is taxable to the employee.<br />

Generally (<strong>and</strong> each person should consult<br />

with their tax adviser) Under IRS regulations,<br />

the travel expenses of a spouse are<br />

generally not taxable, provided it can be<br />

established that his or her presence serves a<br />

bona fide business purpose. A spouse who<br />

attends a function is considered to have a<br />

business purpose if he or she has a<br />

significant role in the proceedings or makes<br />

an important contribution to the success of<br />

an event. Generally, protocol or tradition<br />

dictates when the participation of an official's<br />

spouse is required at official function.<br />

Generally, if a spouse has no significant role<br />

in the proceedings, or performs only<br />

incidental duties of a social or clerical nature,<br />

attendance does not constitute a bona fide<br />

business purpose. Such expenses are<br />

taxable to the employee.<br />

Refer to IRS Publication 17:<br />

http://www.irs.gov/publications/p17/ch26.htm<br />

l<br />

Summary of the NCUA’s Rules on “Reimbursement of Volunteers Expenses:<br />

Copyright©1994-2010 by Credit Union Resources & Educational Services, LLC. All rights reserved.<br />

Revised February 2010<br />

22