regulatory and compliance issues and considerations

regulatory and compliance issues and considerations

regulatory and compliance issues and considerations

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

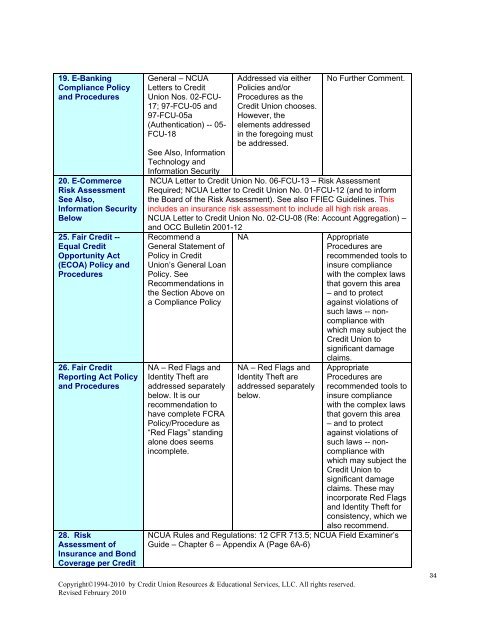

19. E-Banking<br />

Compliance Policy<br />

<strong>and</strong> Procedures<br />

20. E-Commerce<br />

Risk Assessment<br />

See Also,<br />

Information Security<br />

Below<br />

25. Fair Credit --<br />

Equal Credit<br />

Opportunity Act<br />

(ECOA) Policy <strong>and</strong><br />

Procedures<br />

26. Fair Credit<br />

Reporting Act Policy<br />

<strong>and</strong> Procedures<br />

28. Risk<br />

Assessment of<br />

Insurance <strong>and</strong> Bond<br />

Coverage per Credit<br />

General – NCUA<br />

Letters to Credit<br />

Union Nos. 02-FCU-<br />

17; 97-FCU-05 <strong>and</strong><br />

97-FCU-05a<br />

(Authentication) -- 05-<br />

FCU-18<br />

See Also, Information<br />

Technology <strong>and</strong><br />

Information Security<br />

Addressed via either<br />

Policies <strong>and</strong>/or<br />

Procedures as the<br />

Credit Union chooses.<br />

However, the<br />

elements addressed<br />

in the foregoing must<br />

be addressed.<br />

Copyright©1994-2010 by Credit Union Resources & Educational Services, LLC. All rights reserved.<br />

Revised February 2010<br />

No Further Comment.<br />

NCUA Letter to Credit Union No. 06-FCU-13 – Risk Assessment<br />

Required; NCUA Letter to Credit Union No. 01-FCU-12 (<strong>and</strong> to inform<br />

the Board of the Risk Assessment). See also FFIEC Guidelines. This<br />

includes an insurance risk assessment to include all high risk areas.<br />

NCUA Letter to Credit Union No. 02-CU-08 (Re: Account Aggregation) –<br />

<strong>and</strong> OCC Bulletin 2001-12<br />

Recommend a<br />

General Statement of<br />

Policy in Credit<br />

Union’s General Loan<br />

Policy. See<br />

Recommendations in<br />

the Section Above on<br />

a Compliance Policy<br />

NA – Red Flags <strong>and</strong><br />

Identity Theft are<br />

addressed separately<br />

below. It is our<br />

recommendation to<br />

have complete FCRA<br />

Policy/Procedure as<br />

“Red Flags” st<strong>and</strong>ing<br />

alone does seems<br />

incomplete.<br />

NA<br />

NA – Red Flags <strong>and</strong><br />

Identity Theft are<br />

addressed separately<br />

below.<br />

Appropriate<br />

Procedures are<br />

recommended tools to<br />

insure <strong>compliance</strong><br />

with the complex laws<br />

that govern this area<br />

– <strong>and</strong> to protect<br />

against violations of<br />

such laws -- non<strong>compliance</strong><br />

with<br />

which may subject the<br />

Credit Union to<br />

significant damage<br />

claims.<br />

Appropriate<br />

Procedures are<br />

recommended tools to<br />

insure <strong>compliance</strong><br />

with the complex laws<br />

that govern this area<br />

– <strong>and</strong> to protect<br />

against violations of<br />

such laws -- non<strong>compliance</strong><br />

with<br />

which may subject the<br />

Credit Union to<br />

significant damage<br />

claims. These may<br />

incorporate Red Flags<br />

<strong>and</strong> Identity Theft for<br />

consistency, which we<br />

also recommend.<br />

NCUA Rules <strong>and</strong> Regulations: 12 CFR 713.5; NCUA Field Examiner’s<br />

Guide – Chapter 6 – Appendix A (Page 6A-6)<br />

34