regulatory and compliance issues and considerations

regulatory and compliance issues and considerations

regulatory and compliance issues and considerations

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

135-2009 Community Notice // OE/CE Loan Assessment <strong>and</strong> Comparison <strong>and</strong><br />

Underst<strong>and</strong>ing Common Security Interest Documentation Issues Credit Union’s<br />

Face; <strong>and</strong> comparing OE versus CE Systems<br />

Assessing Fairly <strong>and</strong> Honestly OE vs. Closed End: To Determine which is the<br />

Better Compliance Solution for the Credit Union for July 2010 AND Thereafter?<br />

Closed-end versus Open-end – Signatures Required for Secured Loans are also<br />

required for Secured Advances under an LOC where a New Collateral Interest is<br />

Pledged. Misleading Sales Programs on the Simplicity of OE Lending Plan<br />

without a Discussion of the Risks of failing to property perfect such loans --<br />

This is intended to dispel the somewhat misleading statement that MFOE Lending<br />

Plans are Better due to the fact that a Credit Union is required to obtain new<br />

signatures on each Closed-End loan it makes (with it being considered a given<br />

that this is not the case with OE Lending). This is not necessarily true as to<br />

collateralized OE loans. In fact, a MFOE Lending Plan is not based on one set of<br />

signatures. It is based on one set to establish the plan; <strong>and</strong> then may require<br />

follow up – additional signatures as time goes on in connection with collateral<br />

pledged to secure each loan/sub-account under the MFOE Plan. It is here that a<br />

Credit Union may face greater concerns that it may necessarily underst<strong>and</strong>; <strong>and</strong><br />

in considering the following – a simpler CE option may actually lead to lesser<br />

exposure to the Credit Union. Regardless of whether the Credit Union ultimately<br />

chooses OE or CE lending (as both will work “IF” properly used) – a Credit Union<br />

must assess <strong>and</strong> underst<strong>and</strong> the following <strong>issues</strong>.<br />

Why does not one signature cover all loans/sub-accounts?<br />

It is a state law issue governed by laws that establish lien rights such as Article<br />

Nine of the Uniform Commercial Code (“UCC”). These laws require that a<br />

borrower give a lien at a time that is “proximate” to the time the lien is created<br />

(<strong>and</strong> thus a signature on a MFOE Plan months or even years before is likely not<br />

considered “proximate” to the time a car loan sub-account is opened on a five<br />

year old plan). Ref. Articles 9-203 <strong>and</strong> 9-204 of the Uniform Commercial Code.<br />

What is the Risk?<br />

The Credit Union may be using a MFOE Plan with one set of signatures to open a<br />

plan; <strong>and</strong> then the Credit Union uses a separate disbursement voucher <strong>and</strong>/or<br />

security agreement or a restrictive endorsement on the back of the OE Loan<br />

Disbursement Check to address the need for a signature for the pledge of the<br />

collateral intended to secure the loan. In assessing this compare:<br />

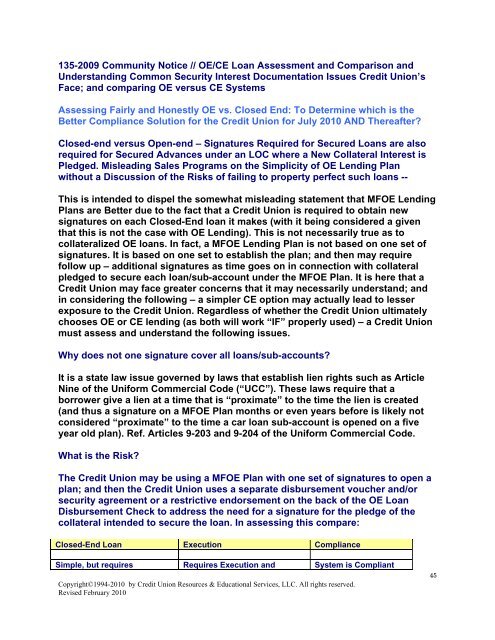

Closed-End Loan Execution Compliance<br />

Simple, but requires Requires Execution <strong>and</strong> System is Compliant<br />

Copyright©1994-2010 by Credit Union Resources & Educational Services, LLC. All rights reserved.<br />

Revised February 2010<br />

45