AWB Limited - 2003 Annual Report

AWB Limited - 2003 Annual Report

AWB Limited - 2003 Annual Report

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

DIRECTORS' REPORT<br />

Your directors submit their report for the year ended 30 September<br />

<strong>2003</strong>.<br />

DIRECTORS<br />

The directors of the company in office at the date of this report are:<br />

Brendan Stewart (Chairman) <br />

Robert Barry (Deputy Chairman)<br />

Andrew Lindberg (Managing Director)<br />

Brendan Fitzgerald (elected at <strong>2003</strong> <strong>Annual</strong> General Meeting)<br />

Laurie Marshall<br />

Xavier Martin (elected at <strong>2003</strong> <strong>Annual</strong> General Meeting)<br />

Warrick McClelland <br />

Christopher Moffet <br />

Peter Polson (appointed 31 March <strong>2003</strong>)<br />

Kerry Sanderson<br />

John Simpson <br />

John Thame.<br />

Except where noted, the directors held their position as director for<br />

the financial year and up to the date of this report. A summary of<br />

the experience, qualifications and special responsibilities of each<br />

director is provided on page 38 and 39.<br />

PRINCIPAL ACTIVITIES<br />

The <strong>AWB</strong> Group is Australia's leading rural services provider and<br />

one of the world's largest wheat managers and marketers. Refer<br />

to Note 34(a) to the Financial Statements for details of entities<br />

within the Group.<br />

<strong>AWB</strong> Group's operations can be categorised into six key business<br />

areas:<br />

Pool Management Services – managing the aggregation and<br />

global marketing of Australian wheat to maximise net pool<br />

returns; and providing commodity price and currency risk<br />

management;<br />

Rural Services (Landmark) – Landmark is Australia's largest<br />

supplier of agribusiness products and services. It provides<br />

clients with rural merchandise, fertiliser, livestock, wool<br />

marketing, agronomy, insurance, real estate and rural financial<br />

services;<br />

Finance and Risk Management Products – the provision of<br />

finance and risk management products to grain growers;<br />

Grain Acquisition and Trading – the trading, as principal, of<br />

grains and the provision of marketing products to Australian<br />

grain growers;<br />

Grain Technology – the development and Australian application<br />

of leading edge grain related technologies; and<br />

Supply Chain and Other Investments – the development of,<br />

and direct investment in, supply chain infrastructure and end<br />

user grain businesses, along with the management and trading<br />

of shipping capacity.<br />

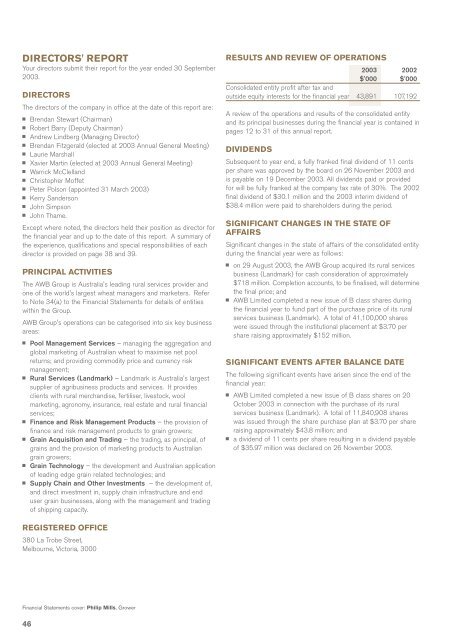

RESULTS AND REVIEW OF OPERATIONS<br />

<strong>2003</strong> 2002<br />

$'000 $'000<br />

Consolidated entity profit after tax and<br />

outside equity interests for the financial year 43,891 107,192<br />

A review of the operations and results of the consolidated entity<br />

and its principal businesses during the financial year is contained in<br />

pages 12 to 31 of this annual report.<br />

DIVIDENDS<br />

Subsequent to year end, a fully franked final dividend of 11 cents<br />

per share was approved by the board on 26 November <strong>2003</strong> and<br />

is payable on 19 December <strong>2003</strong>. All dividends paid or provided<br />

for will be fully franked at the company tax rate of 30%. The 2002<br />

final dividend of $30.1 million and the <strong>2003</strong> interim dividend of<br />

$38.4 million were paid to shareholders during the period.<br />

SIGNIFICANT CHANGES IN THE STATE OF<br />

AFFAIRS<br />

Significant changes in the state of affairs of the consolidated entity<br />

during the financial year were as follows:<br />

on 29 August <strong>2003</strong>, the <strong>AWB</strong> Group acquired its rural services<br />

business (Landmark) for cash consideration of approximately<br />

$718 million. Completion accounts, to be finalised, will determine<br />

the final price; and<br />

<strong>AWB</strong> <strong>Limited</strong> completed a new issue of B class shares during<br />

the financial year to fund part of the purchase price of its rural<br />

services business (Landmark). A total of 41,100,000 shares<br />

were issued through the institutional placement at $3.70 per<br />

share raising approximately $152 million.<br />

SIGNIFICANT EVENTS AFTER BALANCE DATE<br />

The following significant events have arisen since the end of the<br />

financial year:<br />

<strong>AWB</strong> <strong>Limited</strong> completed a new issue of B class shares on 20<br />

October <strong>2003</strong> in connection with the purchase of its rural<br />

services business (Landmark). A total of 11,840,908 shares<br />

was issued through the share purchase plan at $3.70 per share<br />

raising approximately $43.8 million; and<br />

a dividend of 11 cents per share resulting in a dividend payable<br />

of $35.97 million was declared on 26 November <strong>2003</strong>.<br />

REGISTERED OFFICE<br />

380 La Trobe Street,<br />

Melbourne, Victoria, 3000<br />

Financial Statements cover: Philip Mills, Grower<br />

46