AWB Limited - 2003 Annual Report

AWB Limited - 2003 Annual Report

AWB Limited - 2003 Annual Report

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

NOTES TO AND FORMING PART OF THE FINANCIAL STATEMENTS<br />

FOR THE YEAR ENDED 30 SEPTEMBER <strong>2003</strong><br />

31. EMPLOYEE BENEFITS AND SUPERANNUATION COMMITMENTS (continued)<br />

Equity share plan<br />

The equity share plan was established during the year. It provides<br />

the company with the flexibility to provide selected employees with<br />

part of any short term incentive in the form of B class shares in the<br />

company. Selected senior employees were invited to participate in<br />

the equity share plan and acquire a fixed proportion of their short<br />

term incentive in B class shares in the company.<br />

The number of shares allocated under the equity share plan was<br />

based on the weighted average of the prices at which B class<br />

shares in the company were traded on the ASX in the 20 trading<br />

days prior to the issue date, and the value of the remuneration or<br />

short term incentive to be provided.<br />

Under the equity share plan offer made on 31 January <strong>2003</strong>,<br />

51,034 shares were offered to eligible senior employees.<br />

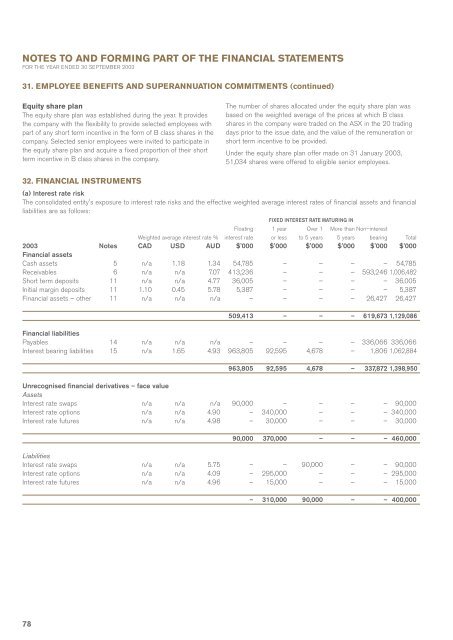

32. FINANCIAL INSTRUMENTS<br />

(a) Interest rate risk<br />

The consolidated entity's exposure to interest rate risks and the effective weighted average interest rates of financial assets and financial<br />

liabilities are as follows:<br />

FIXED INTEREST RATE MATURING IN<br />

Floating 1 year Over 1 More than Non–interest<br />

Weighted average interest rate % interest rate or less to 5 years 5 years bearing Total<br />

Notes CAD USD AUD $'000 $'000 $'000 $'000 $'000 $'000<br />

<strong>2003</strong><br />

Financial assets<br />

Cash assets 5 n/a 1.18<br />

Receivables 6 n/a n/a<br />

Short term deposits 11 n/a n/a<br />

Initial margin deposits 11 1.10 0.45<br />

Financial assets – other 11 n/a n/a<br />

1.34 54,785 – – – – 54,785<br />

7.07 413,236 – – – 593,246 1,006,482<br />

4.77 36,005 – – – – 36,005<br />

5.78 5,387 – – – – 5,387<br />

n/a – – – – 26,427 26,427<br />

509,413 – – – 619,673 1,129,086<br />

Financial liabilities<br />

Payables 14 n/a n/a n/a – – – – 336,066 336,066<br />

Interest bearing liabilities 15 n/a 1.65 4.93 963,805 92,595 4,678 – 1,806 1,062,884<br />

963,805 92,595 4,678 – 337,872 1,398,950<br />

Unrecognised financial derivatives – face value<br />

Assets<br />

Interest rate swaps n/a n/a<br />

Interest rate options n/a n/a<br />

Interest rate futures n/a n/a<br />

n/a 90,000 – – – – 90,000<br />

4.90 – 340,000 – – – 340,000<br />

4.98 – 30,000 – – – 30,000<br />

90,000 370,000 – – – 460,000<br />

Liabilities<br />

Interest rate swaps n/a n/a<br />

Interest rate options n/a n/a<br />

Interest rate futures n/a n/a<br />

5.75 – – 90,000 – – 90,000<br />

4.09 – 295,000 – – – 295,000<br />

4.96 – 15,000 – – – 15,000<br />

– 310,000 90,000 – – 400,000<br />

78