AWB Limited - 2003 Annual Report

AWB Limited - 2003 Annual Report

AWB Limited - 2003 Annual Report

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

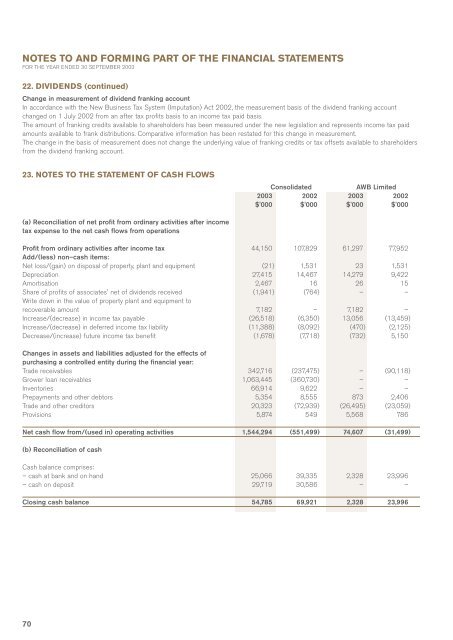

NOTES TO AND FORMING PART OF THE FINANCIAL STATEMENTS<br />

FOR THE YEAR ENDED 30 SEPTEMBER <strong>2003</strong><br />

22. DIVIDENDS (continued)<br />

Change in measurement of dividend franking account<br />

In accordance with the New Business Tax System (Imputation) Act 2002, the measurement basis of the dividend franking account<br />

changed on 1 July 2002 from an after tax profits basis to an income tax paid basis.<br />

The amount of franking credits available to shareholders has been measured under the new legislation and represents income tax paid<br />

amounts available to frank distributions. Comparative information has been restated for this change in measurement.<br />

The change in the basis of measurement does not change the underlying value of franking credits or tax offsets available to shareholders<br />

from the dividend franking account.<br />

23. NOTES TO THE STATEMENT OF CASH FLOWS<br />

Consolidated<br />

<strong>AWB</strong> <strong>Limited</strong><br />

<strong>2003</strong> 2002 <strong>2003</strong> 2002<br />

$'000 $'000 $'000 $'000<br />

(a) Reconciliation of net profit from ordinary activities after income<br />

tax expense to the net cash flows from operations<br />

Profit from ordinary activities after income tax 44,150 107,829 61,297 77,952<br />

Add/(less) non–cash items:<br />

Net loss/(gain) on disposal of property, plant and equipment (21) 1,531 23 1,531<br />

Depreciation 27,415 14,467 14,279 9,422<br />

Amortisation 2,467 16 26 15<br />

Share of profits of associates' net of dividends received (1,941) (764) – –<br />

Write down in the value of property plant and equipment to<br />

recoverable amount 7,182 – 7,182 –<br />

Increase/(decrease) in income tax payable (26,518) (6,350) 13,056 (13,459)<br />

Increase/(decrease) in deferred income tax liability (11,388) (8,092) (470) (2,125)<br />

Decrease/(increase) future income tax benefit (1,678) (7,718) (732) 5,150<br />

Changes in assets and liabilities adjusted for the effects of<br />

purchasing a controlled entity during the financial year:<br />

Trade receivables 342,716 (237,475) – (90,118)<br />

Grower loan receivables 1,063,445 (360,730) – –<br />

Inventories 66,914 9,622 – –<br />

Prepayments and other debtors 5,354 8,555 873 2,406<br />

Trade and other creditors 20,323 (72,939) (26,495) (23,059)<br />

Provisions 5,874 549 5,568 786<br />

Net cash flow from/(used in) operating activities 1,544,294 (551,499) 74,607 (31,499)<br />

(b) Reconciliation of cash<br />

Cash balance comprises:<br />

– cash at bank and on hand 25,066 39,335 2,328 23,996<br />

– cash on deposit 29,719 30,586 – –<br />

Closing cash balance 54,785 69,921 2,328 23,996<br />

70