AWB Limited - 2003 Annual Report

AWB Limited - 2003 Annual Report

AWB Limited - 2003 Annual Report

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

NOTES TO AND FORMING PART OF THE FINANCIAL STATEMENTS<br />

FOR THE YEAR ENDED 30 SEPTEMBER <strong>2003</strong><br />

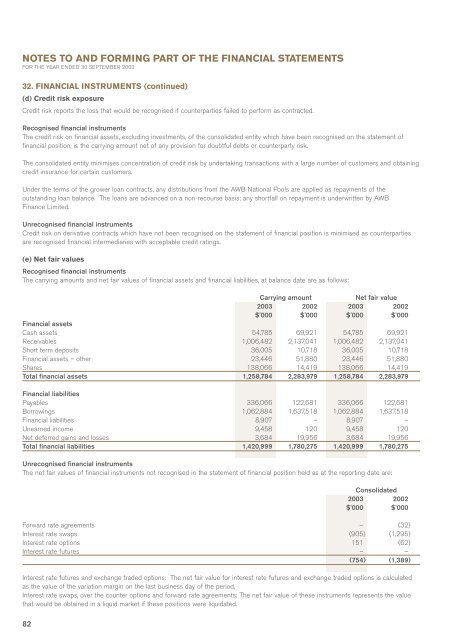

32. FINANCIAL INSTRUMENTS (continued)<br />

(d) Credit risk exposure<br />

Credit risk reports the loss that would be recognised if counterparties failed to perform as contracted.<br />

Recognised financial instruments<br />

The credit risk on financial assets, excluding investments, of the consolidated entity which have been recognised on the statement of<br />

financial position, is the carrying amount net of any provision for doubtful debts or counterparty risk.<br />

The consolidated entity minimises concentration of credit risk by undertaking transactions with a large number of customers and obtaining<br />

credit insurance for certain customers.<br />

Under the terms of the grower loan contracts, any distributions from the <strong>AWB</strong> National Pools are applied as repayments of the<br />

outstanding loan balance. The loans are advanced on a non-recourse basis; any shortfall on repayment is underwritten by <strong>AWB</strong><br />

Finance <strong>Limited</strong>.<br />

Unrecognised financial instruments<br />

Credit risk on derivative contracts which have not been recognised on the statement of financial position is minimised as counterparties<br />

are recognised financial intermediaries with acceptable credit ratings.<br />

(e) Net fair values<br />

Recognised financial instruments<br />

The carrying amounts and net fair values of financial assets and financial liabilities, at balance date are as follows:<br />

Carrying amount<br />

Net fair value<br />

<strong>2003</strong> 2002 <strong>2003</strong> 2002<br />

$'000 $'000 $'000 $'000<br />

Financial assets<br />

Cash assets 54,785 69,921 54,785 69,921<br />

Receivables 1,006,482 2,137,041 1,006,482 2,137,041<br />

Short term deposits 36,005 10,718 36,005 10,718<br />

Financial assets – other 23,446 51,880 23,446 51,880<br />

Shares 138,066 14,419 138,066 14,419<br />

Total financial assets 1,258,784 2,283,979 1,258,784 2,283,979<br />

Financial liabilities<br />

Payables 336,066 122,681 336,066 122,681<br />

Borrowings 1,062,884 1,637,518 1,062,884 1,637,518<br />

Financial liabilities 8,907 – 8,907 –<br />

Unearned income 9,458 120 9,458 120<br />

Net deferred gains and losses 3,684 19,956 3,684 19,956<br />

Total financial liabilities 1,420,999 1,780,275 1,420,999 1,780,275<br />

Unrecognised financial instruments<br />

The net fair values of financial instruments not recognised in the statement of financial position held as at the reporting date are:<br />

Consolidated<br />

<strong>2003</strong> 2002<br />

$'000 $'000<br />

Forward rate agreements – (32)<br />

Interest rate swaps (905) (1,295)<br />

Interest rate options 151 (62)<br />

Interest rate futures – –<br />

(754) (1,389)<br />

Interest rate futures and exchange traded options: The net fair value for interest rate futures and exchange traded options is calculated<br />

as the value of the variation margin on the last business day of the period.<br />

Interest rate swaps, over the counter options and forward rate agreements: The net fair value of these instruments represents the value<br />

that would be obtained in a liquid market if these positions were liquidated.<br />

82