AWB Limited - 2003 Annual Report

AWB Limited - 2003 Annual Report

AWB Limited - 2003 Annual Report

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

LIKELY DEVELOPMENTS AND EXPECTED<br />

RESULTS<br />

The consolidated entity will continue to pursue its policy of<br />

increasing the profitability and market share of its major business<br />

areas during the next financial year. Further information about<br />

likely developments in the operations of the consolidated entity and<br />

the expected results of those operations in future financial years<br />

has not been included in this report because disclosure of the<br />

information would be likely to result in unreasonable prejudice to<br />

the consolidated entity.<br />

ENVIRONMENTAL REGULATION AND<br />

PERFORMANCE<br />

The consolidated entity's operations are subject to various<br />

Commonwealth, State and Territory environmental legislation and<br />

regulation. There is no environmental regulation specific to the<br />

consolidated entity. The board is not aware of any significant<br />

environmental breaches during the financial year.<br />

INDEMNIFICATION AND INSURANCE<br />

The constitution of <strong>AWB</strong> <strong>Limited</strong> provides an indemnity for all<br />

current and previous company directors, secretaries and executive<br />

officers. The company indemnifies these people to the maximum<br />

extent permitted by law for any liabilities or expenses incurred in<br />

defending any proceedings where judgement is given in the<br />

person's favour. The indemnity does not however, cover conduct<br />

involving a lack of good faith.<br />

A Deed of Access, Indemnity and Insurance was entered into<br />

between the company and each director during the period which<br />

provides that the company will maintain a directors' and officers'<br />

insurance policy. The Deed also provides an indemnity to the<br />

maximum extent permissible by law to the director for any liabilities<br />

incurred as a director, other than liabilities to the company or a<br />

related body corporate, or liabilities arising out of conduct involving<br />

lack of good faith.<br />

A directors' and officers' insurance policy is maintained; however,<br />

the terms of the contract prohibit disclosure of the amount of the<br />

premium. During or since the end of the financial year, no director,<br />

officer or auditor had recourse to the indemnity or insurance.<br />

DIRECTORS' AND OTHER OFFICERS'<br />

EMOLUMENTS<br />

Remuneration policy<br />

The Remuneration Committee of the board of directors is<br />

responsible for reviewing and recommending remuneration and<br />

performance of the Managing Director, the Performance Appraisal<br />

Policy and any Employee Share Plans and superannuation policies.<br />

The remuneration and performance of the executive team is<br />

assessed by the Managing Director on a periodic basis by<br />

reference to relevant employment market conditions with the<br />

overall objective of ensuring maximum shareholder benefit from the<br />

retention of a high quality executive team.<br />

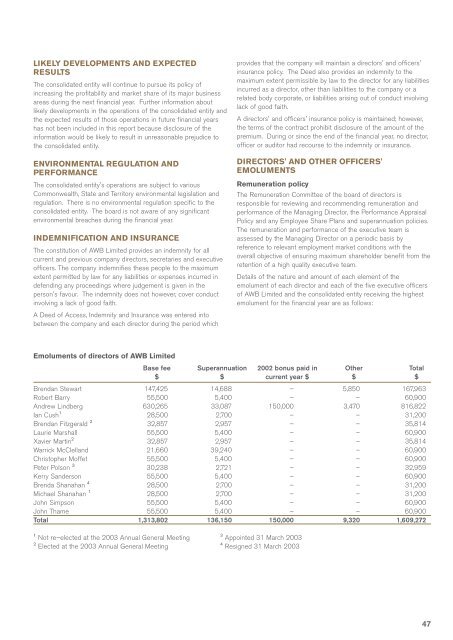

Details of the nature and amount of each element of the<br />

emolument of each director and each of the five executive officers<br />

of <strong>AWB</strong> <strong>Limited</strong> and the consolidated entity receiving the highest<br />

emolument for the financial year are as follows:<br />

Emoluments of directors of <strong>AWB</strong> <strong>Limited</strong><br />

Base fee<br />

$<br />

Superannuation<br />

$<br />

2002 bonus paid in<br />

current year $<br />

Brendan Stewart 147,425 14,688 – 5,850 167,963<br />

Robert Barry 55,500 5,400 – – 60,900<br />

Andrew Lindberg 630,265 33,087 150,000 3,470 816,822<br />

Ian Cush 1 28,500 2,700 – – 31,200<br />

Brendan Fitzgerald 2 32,857 2,957 – – 35,814<br />

Laurie Marshall 55,500 5,400 – – 60,900<br />

Xavier Martin 2 32,857 2,957 – – 35,814<br />

Warrick McClelland 21,660 39,240 – – 60,900<br />

Christopher Moffet 55,500 5,400 – – 60,900<br />

Peter Polson 3 30,238 2,721 – – 32,959<br />

Kerry Sanderson 55,500 5,400 – – 60,900<br />

Brenda Shanahan 4 28,500 2,700 – – 31,200<br />

Michael Shanahan 1 28,500 2,700 – – 31,200<br />

John Simpson 55,500 5,400 – – 60,900<br />

John Thame 55,500 5,400 – – 60,900<br />

Total 1,313,802 136,150 150,000 9,320 1,609,272<br />

Other<br />

$<br />

Total<br />

$<br />

1<br />

Not re–elected at the <strong>2003</strong> <strong>Annual</strong> General Meeting<br />

2<br />

Elected at the <strong>2003</strong> <strong>Annual</strong> General Meeting<br />

3<br />

Appointed 31 March <strong>2003</strong><br />

4<br />

Resigned 31 March <strong>2003</strong><br />

47