AWB Limited - 2003 Annual Report

AWB Limited - 2003 Annual Report

AWB Limited - 2003 Annual Report

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

NOTES TO AND FORMING PART OF THE FINANCIAL STATEMENTS<br />

FOR THE YEAR ENDED 30 SEPTEMBER <strong>2003</strong><br />

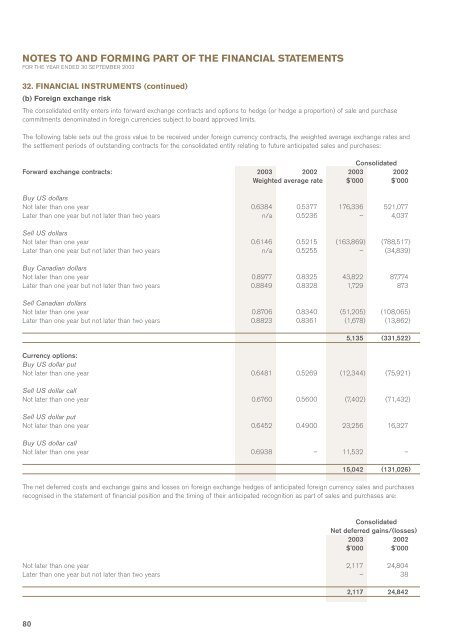

32. FINANCIAL INSTRUMENTS (continued)<br />

(b) Foreign exchange risk<br />

The consolidated entity enters into forward exchange contracts and options to hedge (or hedge a proportion) of sale and purchase<br />

commitments denominated in foreign currencies subject to board approved limits.<br />

The following table sets out the gross value to be received under foreign currency contracts, the weighted average exchange rates and<br />

the settlement periods of outstanding contracts for the consolidated entity relating to future anticipated sales and purchases:<br />

Forward exchange contracts:<br />

Consolidated<br />

<strong>2003</strong> 2002 <strong>2003</strong> 2002<br />

Weighted average rate $'000 $'000<br />

Buy US dollars<br />

Not later than one year<br />

Later than one year but not later than two years<br />

Sell US dollars<br />

Not later than one year<br />

Later than one year but not later than two years<br />

Buy Canadian dollars<br />

Not later than one year<br />

Later than one year but not later than two years<br />

Sell Canadian dollars<br />

Not later than one year<br />

Later than one year but not later than two years<br />

0.6384 0.5377<br />

n/a 0.5236<br />

0.6146 0.5215<br />

n/a 0.5255<br />

0.8977 0.8325<br />

0.8849 0.8328<br />

0.8706 0.8340<br />

0.8823 0.8361<br />

176,336 521,077<br />

– 4,037<br />

(163,869) (788,517)<br />

– (34,839)<br />

43,822 87,774<br />

1,729 873<br />

(51,205) (108,065)<br />

(1,678) (13,862)<br />

5,135 (331,522)<br />

Currency options:<br />

Buy US dollar put<br />

Not later than one year<br />

Sell US dollar call<br />

Not later than one year<br />

Sell US dollar put<br />

Not later than one year<br />

Buy US dollar call<br />

Not later than one year<br />

0.6481 0.5269 (12,344) (75,921)<br />

0.6760 0.5600 (7,402) (71,432)<br />

0.6452 0.4900 23,256 16,327<br />

0.6938 – 11,532 –<br />

15,042 (131,026)<br />

The net deferred costs and exchange gains and losses on foreign exchange hedges of anticipated foreign currency sales and purchases<br />

recognised in the statement of financial position and the timing of their anticipated recognition as part of sales and purchases are:<br />

Consolidated<br />

Net deferred gains/(losses)<br />

<strong>2003</strong> 2002<br />

$'000 $'000<br />

Not later than one year 2,117 24,804<br />

Later than one year but not later than two years – 38<br />

2,117 24,842<br />

80