AWB Limited - 2003 Annual Report

AWB Limited - 2003 Annual Report

AWB Limited - 2003 Annual Report

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

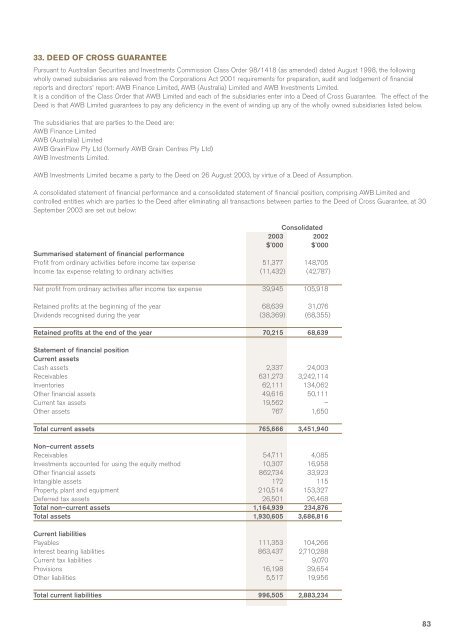

33. DEED OF CROSS GUARANTEE<br />

Pursuant to Australian Securities and Investments Commission Class Order 98/1418 (as amended) dated August 1998, the following<br />

wholly owned subsidiaries are relieved from the Corporations Act 2001 requirements for preparation, audit and lodgement of financial<br />

reports and directors’ report: <strong>AWB</strong> Finance <strong>Limited</strong>, <strong>AWB</strong> (Australia) <strong>Limited</strong> and <strong>AWB</strong> Investments <strong>Limited</strong>.<br />

It is a condition of the Class Order that <strong>AWB</strong> <strong>Limited</strong> and each of the subsidiaries enter into a Deed of Cross Guarantee. The effect of the<br />

Deed is that <strong>AWB</strong> <strong>Limited</strong> guarantees to pay any deficiency in the event of winding up any of the wholly owned subsidiaries listed below.<br />

The subsidiaries that are parties to the Deed are:<br />

<strong>AWB</strong> Finance <strong>Limited</strong> <br />

<strong>AWB</strong> (Australia) <strong>Limited</strong> <br />

<strong>AWB</strong> GrainFlow Pty Ltd (formerly <strong>AWB</strong> Grain Centres Pty Ltd)<br />

<strong>AWB</strong> Investments <strong>Limited</strong>. <br />

<strong>AWB</strong> Investments <strong>Limited</strong> became a party to the Deed on 26 August <strong>2003</strong>, by virtue of a Deed of Assumption.<br />

A consolidated statement of financial performance and a consolidated statement of financial position, comprising <strong>AWB</strong> <strong>Limited</strong> and<br />

controlled entities which are parties to the Deed after eliminating all transactions between parties to the Deed of Cross Guarantee, at 30<br />

September <strong>2003</strong> are set out below:<br />

Consolidated<br />

<strong>2003</strong> 2002<br />

$'000 $'000<br />

Summarised statement of financial performance<br />

Profit from ordinary activities before income tax expense 51,377 148,705<br />

Income tax expense relating to ordinary activities (11,432) (42,787)<br />

Net profit from ordinary activities after income tax expense 39,945 105,918<br />

Retained profits at the beginning of the year 68,639 31,076<br />

Dividends recognised during the year (38,369) (68,355)<br />

Retained profits at the end of the year 70,215 68,639<br />

Statement of financial position<br />

Current assets<br />

Cash assets 2,337 24,003<br />

Receivables 631,273 3,242,114<br />

Inventories 62,111 134,062<br />

Other financial assets 49,616 50,111<br />

Current tax assets 19,562 –<br />

Other assets 767 1,650<br />

Total current assets 765,666 3,451,940<br />

Non–current assets<br />

Receivables 54,711 4,085<br />

Investments accounted for using the equity method 10,307 16,958<br />

Other financial assets 862,734 33,923<br />

Intangible assets 172 115<br />

Property, plant and equipment 210,514 153,327<br />

Deferred tax assets 26,501 26,468<br />

Total non–current assets 1,164,939 234,876<br />

Total assets 1,930,605 3,686,816<br />

Current liabilities<br />

Payables 111,353 104,266<br />

Interest bearing liabilities 863,437 2,710,288<br />

Current tax liabilities – 9,070<br />

Provisions 16,198 39,654<br />

Other liabilities 5,517 19,956<br />

Total current liabilities 996,505 2,883,234<br />

83