omc: no mention; hence safe - BMA Capital Management

omc: no mention; hence safe - BMA Capital Management

omc: no mention; hence safe - BMA Capital Management

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

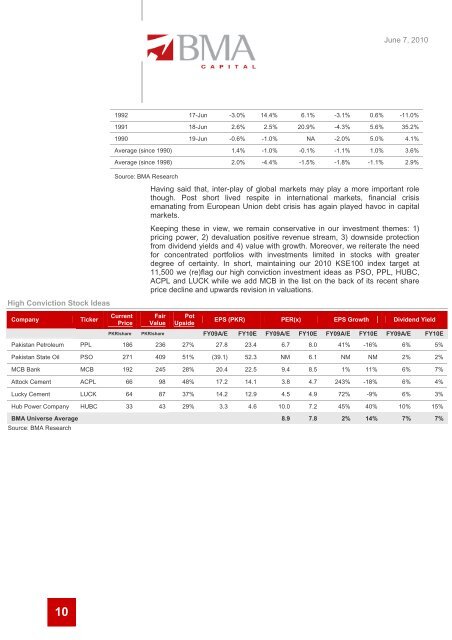

High Conviction Stock Ideas<br />

Company Ticker<br />

10<br />

June 7, 2010<br />

1992 17-Jun -3.0% 14.4% 6.1% -3.1% 0.6% -11.0%<br />

1991 18-Jun 2.6% 2.5% 20.9% -4.3% 5.6% 35.2%<br />

1990 19-Jun -0.6% -1.0% NA -2.0% 5.0% 4.1%<br />

Average (since 1990) 1.4% -1.0% -0.1% -1.1% 1.0% 3.6%<br />

Average (since 1998) 2.0% -4.4% -1.5% -1.8% -1.1% 2.9%<br />

Source: <strong>BMA</strong> Research<br />

Current<br />

Price<br />

Having said that, inter-play of global markets may play a more important role<br />

though. Post short lived respite in international markets, financial crisis<br />

emanating from European Union debt crisis has again played havoc in capital<br />

markets.<br />

Keeping these in view, we remain conservative in our investment themes: 1)<br />

pricing power, 2) devaluation positive revenue stream, 3) downside protection<br />

from dividend yields and 4) value with growth. Moreover, we reiterate the need<br />

for concentrated portfolios with investments limited in stocks with greater<br />

degree of certainty. In short, maintaining our 2010 KSE100 index target at<br />

11,500 we (re)flag our high conviction investment ideas as PSO, PPL, HUBC,<br />

ACPL and LUCK while we add MCB in the list on the back of its recent share<br />

price decline and upwards revision in valuations.<br />

Fair<br />

Value<br />

Pot<br />

Upside<br />

EPS (PKR) PER(x) EPS Growth Dividend Yield<br />

PKR/share PKR/share FY09A/E FY10E FY09A/E FY10E FY09A/E FY10E FY09A/E FY10E<br />

Pakistan Petroleum PPL 186 236 27% 27.8 23.4 6.7 8.0 41% -16% 6% 5%<br />

Pakistan State Oil PSO 271 409 51% (39.1) 52.3 NM 6.1 NM NM 2% 2%<br />

MCB Bank MCB 192 245 28% 20.4 22.5 9.4 8.5 1% 11% 6% 7%<br />

Attock Cement ACPL 66 98 48% 17.2 14.1 3.8 4.7 243% -18% 6% 4%<br />

Lucky Cement LUCK 64 87 37% 14.2 12.9 4.5 4.9 72% -9% 6% 3%<br />

Hub Power Company HUBC 33 43 29% 3.3 4.6 10.0 7.2 45% 40% 10% 15%<br />

<strong>BMA</strong> Universe Average<br />

Source: <strong>BMA</strong> Research<br />

8.9 7.8 2% 14% 7% 7%