omc: no mention; hence safe - BMA Capital Management

omc: no mention; hence safe - BMA Capital Management

omc: no mention; hence safe - BMA Capital Management

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

13<br />

June 7, 2010<br />

an<strong>no</strong>unced in the budget. The circular debt <strong>no</strong>t only caused partial outlays from<br />

PSDP but also caused 2% decline in GDP growth for FY10.<br />

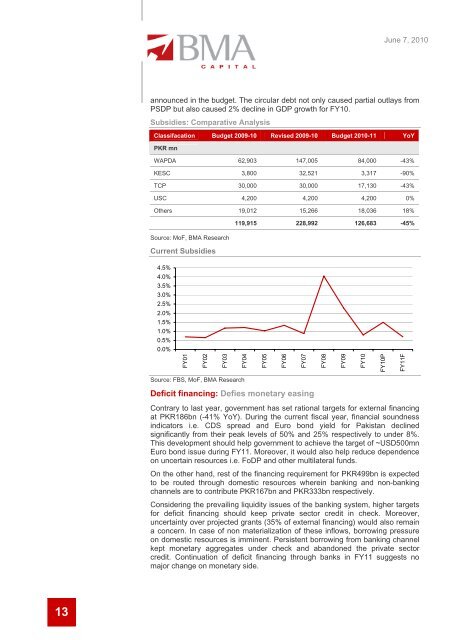

Subsidies: Comparative Analysis<br />

Classifacation Budget 2009-10 Revised 2009-10 Budget 2010-11 YoY<br />

PKR mn<br />

WAPDA 62,903 147,005 84,000 -43%<br />

KESC 3,800 32,521 3,317 -90%<br />

TCP 30,000 30,000 17,130 -43%<br />

USC 4,200 4,200 4,200 0%<br />

Others 19,012 15,266 18,036 18%<br />

Source: MoF, <strong>BMA</strong> Research<br />

Current Subsidies<br />

4.5%<br />

4.0%<br />

3.5%<br />

3.0%<br />

2.5%<br />

2.0%<br />

1.5%<br />

1.0%<br />

0.5%<br />

0.0%<br />

FY01<br />

FY02<br />

FY03<br />

Source: FBS, MoF, <strong>BMA</strong> Research<br />

Deficit financing: Defies monetary easing<br />

119,915 228,992 126,683 -45%<br />

FY04<br />

FY05<br />

FY06<br />

Contrary to last year, government has set rational targets for external financing<br />

at PKR186bn (-41% YoY). During the current fiscal year, financial soundness<br />

indicators i.e. CDS spread and Euro bond yield for Pakistan declined<br />

significantly from their peak levels of 50% and 25% respectively to under 8%.<br />

This development should help government to achieve the target of ~USD500mn<br />

Euro bond issue during FY11. Moreover, it would also help reduce dependence<br />

on uncertain resources i.e. FoDP and other multilateral funds.<br />

On the other hand, rest of the financing requirement for PKR499bn is expected<br />

to be routed through domestic resources wherein banking and <strong>no</strong>n-banking<br />

channels are to contribute PKR167bn and PKR333bn respectively.<br />

Considering the prevailing liquidity issues of the banking system, higher targets<br />

for deficit financing should keep private sector credit in check. Moreover,<br />

uncertainty over projected grants (35% of external financing) would also remain<br />

a concern. In case of <strong>no</strong>n materialization of these inflows, borrowing pressure<br />

on domestic resources is imminent. Persistent borrowing from banking channel<br />

kept monetary aggregates under check and abandoned the private sector<br />

credit. Continuation of deficit financing through banks in FY11 suggests <strong>no</strong><br />

major change on monetary side.<br />

FY07<br />

FY08<br />

FY09<br />

FY10<br />

FY10P<br />

FY11F