omc: no mention; hence safe - BMA Capital Management

omc: no mention; hence safe - BMA Capital Management

omc: no mention; hence safe - BMA Capital Management

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

OMC<br />

OVERWEIGHT<br />

Budget Impact<br />

Neutral<br />

Muhammad Ali Taufiq<br />

OMC Analyst<br />

19<br />

OMC: NO MENTION; HENCE SAFE<br />

June 7, 2010<br />

While <strong>no</strong> direct budgetary measures were expected for the Oil Marketing<br />

Companies (OMCs), the industry was largely expecting concretre<br />

an<strong>no</strong>uncements from the Finance Ministry to resolve the circular debt menace<br />

in the system. Promises recently made by GoP to inject PKR116bn have been<br />

delayed and the uproar by the entire value chain managed to bring merely<br />

PKR20bn into PEPCO during the month of May10.<br />

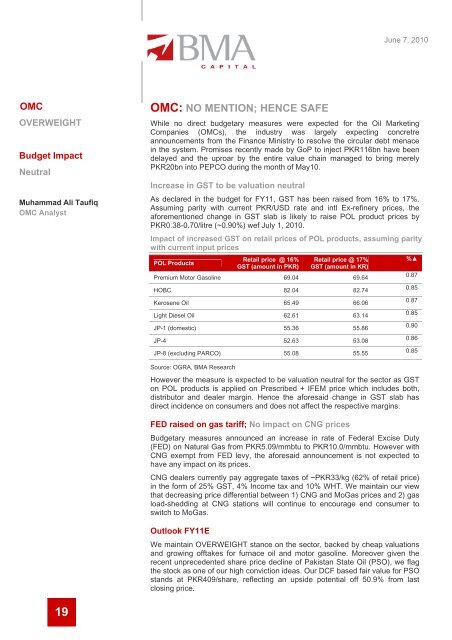

Increase in GST to be valuation neutral<br />

As declared in the budget for FY11, GST has been raised from 16% to 17%.<br />

Assuming parity with current PKR/USD rate and intl Ex-refinery prices, the<br />

afore<strong>mention</strong>ed change in GST slab is likely to raise POL product prices by<br />

PKR0.38-0.70/litre (~0.90%) wef July 1, 2010.<br />

Impact of increased GST on retail prices of POL products, assuming parity<br />

with current input prices<br />

POL Products<br />

Source: OGRA, <strong>BMA</strong> Research<br />

However the measure is expected to be valuation neutral for the sector as GST<br />

on POL products is applied on Prescribed + IFEM price which includes both,<br />

distributor and dealer margin. Hence the aforesaid change in GST slab has<br />

direct incidence on consumers and does <strong>no</strong>t affect the respective margins.<br />

FED raised on gas tariff; No impact on CNG prices<br />

Budgetary measures an<strong>no</strong>unced an increase in rate of Federal Excise Duty<br />

(FED) on Natural Gas from PKR5.09/mmbtu to PKR10.0/mmbtu. However with<br />

CNG exempt from FED levy, the aforesaid an<strong>no</strong>uncement is <strong>no</strong>t expected to<br />

have any impact on its prices.<br />

CNG dealers currently pay aggregate taxes of ~PKR33/kg (62% of retail price)<br />

in the form of 25% GST, 4% Income tax and 10% WHT. We maintain our view<br />

that decreasing price differential between 1) CNG and MoGas prices and 2) gas<br />

load-shedding at CNG stations will continue to encourage end consumer to<br />

switch to MoGas.<br />

Outlook FY11E<br />

Retail price @ 16%<br />

GST (amount in PKR)<br />

Retail price @ 17%<br />

GST (amount in KR)<br />

Premium Motor Gasoline 69.04 69.64<br />

HOBC 82.04 82.74<br />

Kerosene Oil 65.49 66.06<br />

Light Diesel Oil 62.61 63.14<br />

JP-1 (domestic) 55.36 55.86<br />

JP-4 52.63 53.08<br />

JP-8 (excluding PARCO) 55.08 55.55<br />

We maintain OVERWEIGHT stance on the sector, backed by cheap valuations<br />

and growing offtakes for furnace oil and motor gasoline. Moreover given the<br />

recent unprecedented share price decline of Pakistan State Oil (PSO), we flag<br />

the stock as one of our high conviction ideas. Our DCF based fair value for PSO<br />

stands at PKR409/share, reflecting an upside potential off 50.9% from last<br />

closing price.<br />

%▲<br />

0.87<br />

0.85<br />

0.87<br />

0.85<br />

0.90<br />

0.86<br />

0.85