omc: no mention; hence safe - BMA Capital Management

omc: no mention; hence safe - BMA Capital Management

omc: no mention; hence safe - BMA Capital Management

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

E&P<br />

MARKETWEIGHT<br />

Budget Impact<br />

Neutral<br />

Hamad Aslam<br />

Head of Research<br />

17<br />

E&P: VALUATIONS WITH CONVICTION<br />

June 7, 2010<br />

With the E&P sector being governed under Petroleum Policies, the federal<br />

budget <strong>no</strong>rmally has limited implications on the sector. However through its<br />

an<strong>no</strong>uncement on allowance of decommissioning cost as a tax deductible<br />

expense, the budget has resolved a long pending tax issue between FBR and<br />

E&P companies.<br />

Decommissioning cost: Deduction allowed over a period of ten<br />

years but one-off expense to be incurred by E&P companies<br />

It was an<strong>no</strong>unced that ‘Decommission Cost’ incurred by E&P companies shall<br />

be allowed as a tax deductible expense to be depleted over a period of ten<br />

years or the life of the development and production lease, whichever is less.<br />

Based on our preliminary understanding, the E&P companies currently<br />

expense out the afore<strong>mention</strong>ed cost at the time of actual decommissioning of<br />

respective wells. However FBR had up till <strong>no</strong>w <strong>no</strong>t allowed the expense to be<br />

tax deductible, as a result of which a total amount of PKR6bn is estimated to be<br />

pending against the sector. Based on latest financial reports, Pakistan<br />

Petroleum (PPL) and Pakistan Oilfield (POL) have respective amounts of<br />

PKR578mn and PKR447mn pending against this head.<br />

For OGDC, recall that the company booked an additional tax amount of<br />

PKR11.6bn in FY08 (and ~PKR3bn in FY09), thereby clearing off its pending<br />

dues against the tax liability.<br />

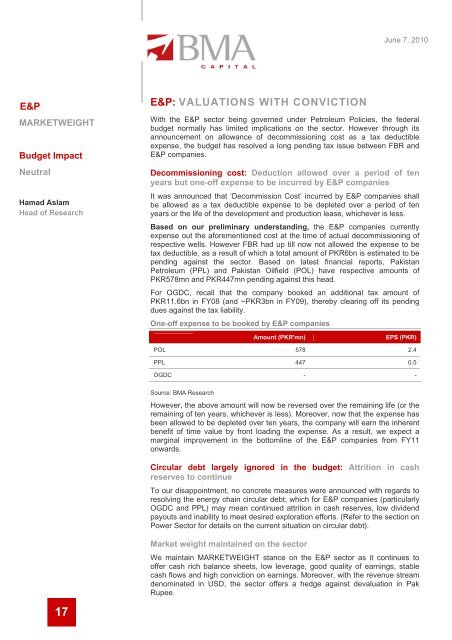

One-off expense to be booked by E&P companies<br />

Source: <strong>BMA</strong> Research<br />

However, the above amount will <strong>no</strong>w be reversed over the remaining life (or the<br />

remaining of ten years, whichever is less). Moreover, <strong>no</strong>w that the expense has<br />

been allowed to be depleted over ten years, the company will earn the inherent<br />

benefit of time value by front loading the expense. As a result, we expect a<br />

marginal improvement in the bottomline of the E&P companies from FY11<br />

onwards.<br />

Circular debt largely ig<strong>no</strong>red in the budget: Attrition in cash<br />

reserves to continue<br />

To our disappointment, <strong>no</strong> concrete measures were an<strong>no</strong>unced with regards to<br />

resolving the energy chain circular debt; which for E&P companies (particularly<br />

OGDC and PPL) may mean continued attrition in cash reserves, low dividend<br />

payouts and inability to meet desired exploration efforts. (Refer to the section on<br />

Power Sector for details on the current situation on circular debt).<br />

Market weight maintained on the sector<br />

Amount (PKR'mn) EPS (PKR)<br />

POL 578 2.4<br />

PPL 447 0.5<br />

OGDC - -<br />

We maintain MARKETWEIGHT stance on the E&P sector as it continues to<br />

offer cash rich balance sheets, low leverage, good quality of earnings, stable<br />

cash flows and high conviction on earnings. Moreover, with the revenue stream<br />

de<strong>no</strong>minated in USD, the sector offers a hedge against devaluation in Pak<br />

Rupee.