omc: no mention; hence safe - BMA Capital Management

omc: no mention; hence safe - BMA Capital Management

omc: no mention; hence safe - BMA Capital Management

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

ECONOMY<br />

Budget Impact<br />

Positive<br />

Abdul Shakur<br />

Eco<strong>no</strong>mist<br />

11<br />

BUDGET FY11: A CAUTIONED APPROACH!<br />

June 7, 2010<br />

Considering the political and administrative issues for the implementation of<br />

Value Added Tax (VAT), government postponed VAT implementation till Oct10.<br />

The important factor of the budget an<strong>no</strong>uncement is to incentivise the lower<br />

income class by salary enhancement and trimming direct tax for narrow tax<br />

slabs. Although these measures encourage improvement in disposable income<br />

of the masses, revenue generation will also remain a prime objective of the<br />

government to meet the fiscal requirements.<br />

Being a populist, imposition of additional taxes would remain a challenging act<br />

for the incumbent government. However, persistently low tax revenues require<br />

strong footholds to produce resources for welfare and development. To manage<br />

fiscal space for development and sustainable growth, all components of tax<br />

machinery are projected to be channelized with the target of 18% YoY growth in<br />

tax revenue for FY11. Most important revenue measures includes 1) the<br />

increase of 100bps rate for sales tax to 17%, 2) upward revision of 5% income<br />

tax rate for small companies and 3) increased tax slab for high income class<br />

under salaried head.<br />

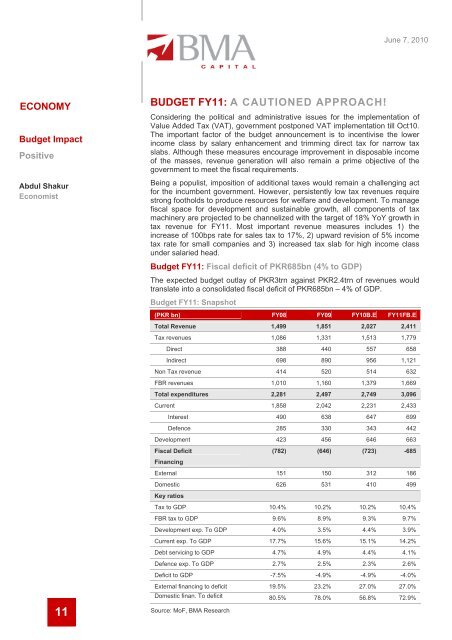

Budget FY11: Fiscal deficit of PKR685bn (4% to GDP)<br />

The expected budget outlay of PKR3trn against PKR2.4trn of revenues would<br />

translate into a consolidated fiscal deficit of PKR685bn – 4% of GDP.<br />

Budget FY11: Snapshot<br />

(PKR bn) FY08 FY09 FY10B.E FY11FB.E<br />

Total Revenue 1,499 1,851 2,027 2,411<br />

Tax revenues 1,086 1,331 1,513 1,779<br />

Direct 388 440 557 658<br />

Indirect 698 890 956 1,121<br />

Non Tax revenue 414 520 514 632<br />

FBR revenues 1,010 1,160 1,379 1,669<br />

Total expenditures 2,281 2,497 2,749 3,096<br />

Current 1,858 2,042 2,231 2,433<br />

Interest 490 638 647 699<br />

Defence 285 330 343 442<br />

Development 423 456 646 663<br />

Fiscal Deficit<br />

Financing<br />

(782) (646) (723) -685<br />

External 151 150 312 186<br />

Domestic<br />

Key ratios<br />

626 531 410 499<br />

Tax to GDP 10.4% 10.2% 10.2% 10.4%<br />

FBR tax to GDP 9.6% 8.9% 9.3% 9.7%<br />

Development exp. To GDP 4.0% 3.5% 4.4% 3.9%<br />

Current exp. To GDP 17.7% 15.6% 15.1% 14.2%<br />

Debt servicing to GDP 4.7% 4.9% 4.4% 4.1%<br />

Defence exp. To GDP 2.7% 2.5% 2.3% 2.6%<br />

Deficit to GDP -7.5% -4.9% -4.9% -4.0%<br />

External financing to deficit 19.5% 23.2% 27.0% 27.0%<br />

Domestic finan. To deficit 80.5% 78.0% 56.8% 72.9%<br />

Source: MoF, <strong>BMA</strong> Research